- United States

- /

- Communications

- /

- NYSE:CIEN

A Look at Ciena (CIEN) Valuation After Major Wins Power New Global Network Infrastructure

Reviewed by Simply Wall St

Several major global network operators are turning to Ciena (NYSE:CIEN) to power new high-capacity fiber networks. Trans Americas Fiber System, FLAG, and EXA Infrastructure are each deploying Ciena's cutting-edge optical solutions to support major infrastructure projects.

See our latest analysis for Ciena.

Those infrastructure wins haven’t gone unnoticed as Ciena’s share price has surged, with a 1-month return of 26.2% and a stunning 115.1% year-to-date gain. This momentum echoes in the numbers, as investors have enjoyed a 179% total shareholder return over the past year, underscoring strong confidence in Ciena’s long-term growth and relevance as advanced networking projects accelerate worldwide.

If Ciena's rise has you thinking about emerging trends, it’s a great moment to broaden your investing perspective and discover fast growing stocks with high insider ownership.

With the stock surging on the back of major network wins and rapid revenue growth, the key question emerges: is Ciena trading at a bargain with more upside ahead, or is the market already factoring in all future gains?

Most Popular Narrative: 26% Overvalued

Ciena's widely followed narrative price target stands well below the recent share price, highlighting a double-digit valuation gap that has investors talking. This sets up a major tension around whether growing momentum can keep up with current expectations.

Ciena's industry-leading solutions (WaveLogic 6, RLS platform, pluggables, DCOM) are rapidly becoming de facto standards for AI network infrastructure, resulting in sizable multi-hundred-million-dollar orders, a record order book, and strong visibility into 2026 growth. This suggests consensus revenue estimates may be too conservative.

Want to peek behind the curtain at the catalysts pushing analyst optimism sky-high? The foundation is built on relentless revenue expansion, blockbuster orders, and soaring profitability assumptions. What does this narrative say about Ciena's future margins or share count? Discover which metrics could make or break this ambitious target. Dive into the details to see what justifies this price!

Result: Fair Value of $142.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as Ciena's reliance on a handful of large clients and the rapid pace of technology shifts could quickly overturn current optimism.

Find out about the key risks to this Ciena narrative.

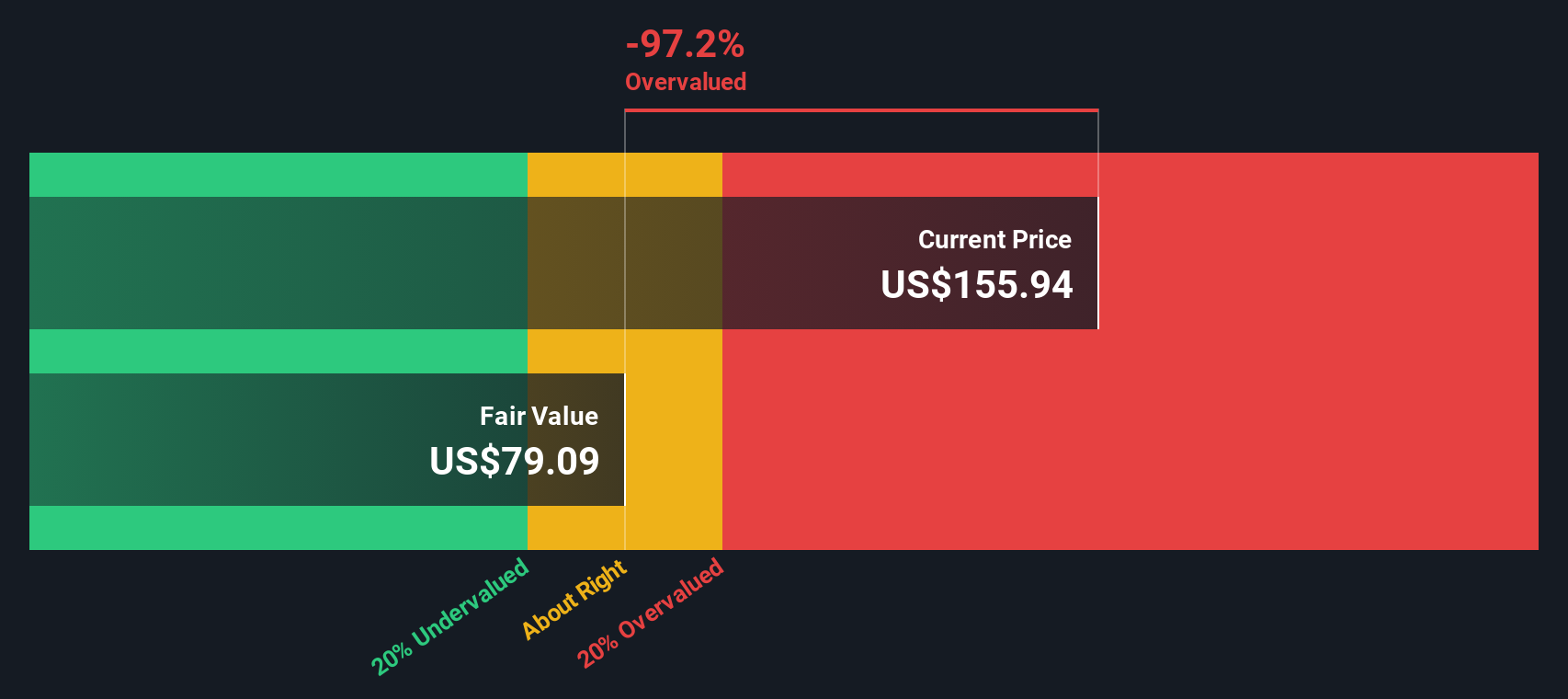

Another View: Discounted Cash Flow Model Diverges Sharply

For a different angle on Ciena’s valuation, our SWS DCF model draws a stark contrast. While the market’s multiples highlight significant momentum, the DCF model arrives at a much more conservative fair value of $73.84. This implies that shares are trading significantly above estimated future cash flows. Could this point to risk for overenthusiastic investors, or is the market still ahead of the curve?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ciena Narrative

If these perspectives don’t fully align with your view or you’re ready to dig deeper, it’s quick and easy to build your own take in just a few minutes. Do it your way.

A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your chance to stay ahead and power up your watchlist with bold, strategic opportunities you won’t see in the headlines. Let Simply Wall Street’s screeners help you move instantly on the kind of stocks that could transform your portfolio, before everyone else catches on.

- Capture tech’s explosive growth and ride the momentum of innovation when you tap into these 27 AI penny stocks setting new standards in artificial intelligence.

- Fuel your search for undervalued gems ready for a breakout and make your next smart move by scanning these 877 undervalued stocks based on cash flows.

- Build a resilient income stream by zeroing in on strong companies yielding more than 3%, all through these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives