Badger Meter (BMI): Reassessing Valuation After Q2 Earnings Miss and Guidance Revision

Reviewed by Simply Wall St

Badger Meter (BMI) just posted its second-quarter results, and for many investors, the headline numbers sparked a double-take. While revenue ticked higher thanks to steady water utility sales and the integration of SmartCover, profits did not quite meet Wall Street’s projections. Management maintained an optimistic tone regarding ongoing demand and operational progress, but their updated guidance seemed to catch analysts off guard, leading to downward revisions and a more cautious outlook for the near term.

This earnings miss occurred amid growing nerves across the tech sector, with Badger Meter’s shares declining alongside the broader market ahead of a closely watched Federal Reserve speech. The stock is down about 7% over the past year, and recent months have seen that decline accelerate, despite the company’s strong multi-year performance. An 18% dividend increase, driven by resilient earnings and prudent payout management, was a recent bright spot; however, it has not been enough to spark a clear turnaround in investor sentiment.

With Badger Meter’s long-term track record contrasted against its recent stumble, investors are left to consider whether the current market presents a compelling entry point, or if the business’s growth prospects are already reflected in today’s price.

Most Popular Narrative: 21.2% Undervalued

According to community narrative, Badger Meter is currently considered undervalued, with its fair value estimated to be notably higher than the present share price. This perspective is built on anticipated growth, increasing margins, and industry momentum supporting digital water infrastructure.

The increasing emphasis on water conservation and sustainable infrastructure is driving elevated demand from utilities for advanced metering and monitoring solutions. Badger Meter's continued success with its BEACON SaaS platform, BlueEdge suite, and recent SmartCover acquisition positions the company to capture a larger share of this growing market, which supports high single-digit revenue growth targets over the long run.

What is fueling analysts' bold price target? Imagine a scenario where recurring revenue increases and margins improve, driven by innovations and software. There are crucial growth projections and profit assumptions behind this valuation. Want to know how these stack up against the market? The answers might surprise you.

Result: Fair Value of $240.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain pressures or delays in utility project rollouts could quickly challenge Badger Meter’s positive long-term narrative.

Find out about the key risks to this Badger Meter narrative.Another View: High Valuation Signals Caution

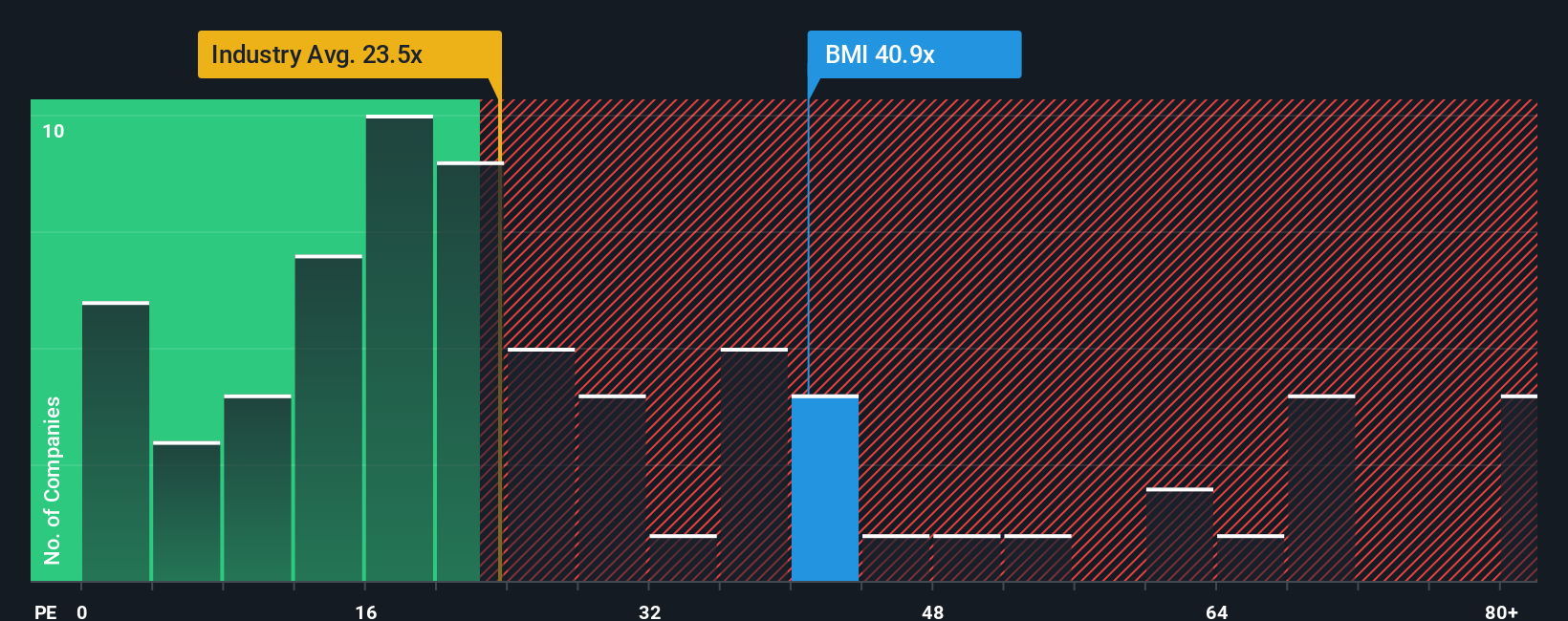

While analysts argue Badger Meter offers value based on growth forecasts, another method—comparing its price tag in the market to the industry average—actually finds the shares are much more expensive than similar companies. Could this mean future gains are already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Badger Meter Narrative

If the above perspectives do not align with your own, or if you would rather draw your own conclusions, you have the tools to examine the numbers directly and create your unique take in under three minutes. So why not do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Badger Meter.

Looking for More Smart Stock Ideas?

Seize fresh opportunities beyond Badger Meter and unlock your next advantage. The market is filled with standout companies with strong fundamentals, and the best ideas often come from looking beyond what's in the headlines. If you want to stay ahead of the curve, these handpicked investment themes are worth your attention:

- Uncover stable cash-generators by checking out dividend stocks with yields > 3%. Target reliable yields for your portfolio.

- Spot tomorrow’s winners with AI penny stocks. Discover exciting new businesses harnessing artificial intelligence to disrupt entire industries.

- Boost your search for resilient value by exploring undervalued stocks based on cash flows. Pinpoint stocks the crowd has overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Meter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMI

Badger Meter

Manufactures and markets flow measurement, quality, control, and communication solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives