Badger Meter (BMI): Margin Expansion Reinforces Premium Valuation Narrative

Reviewed by Simply Wall St

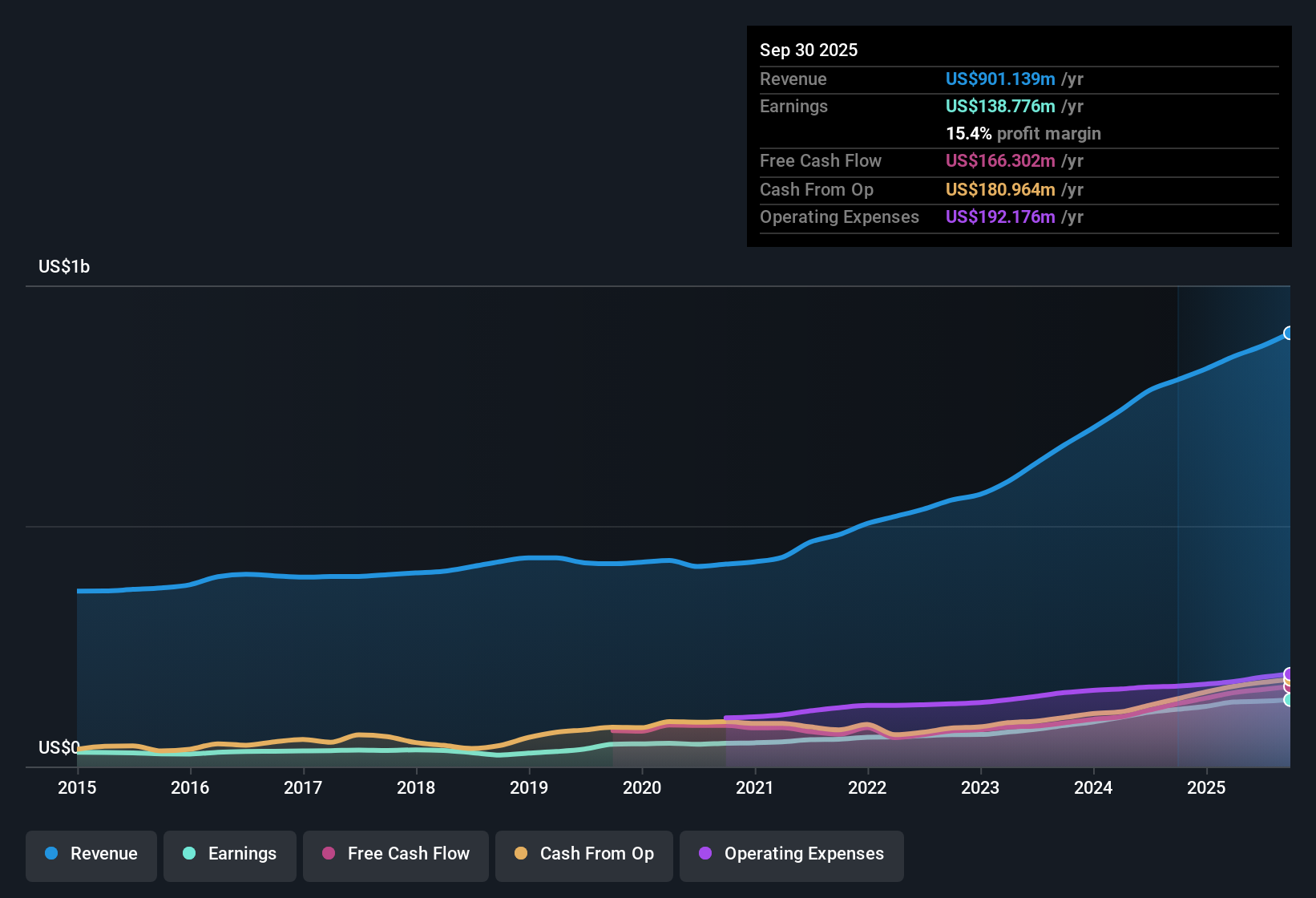

Badger Meter (BMI) posted a net profit margin of 15.4%, up from 14.8% last year, reflecting expanding profitability. Over the past five years, earnings have grown at an impressive annualized rate of 23.1%, while the most recent annual growth came in at 16.7%. Revenue is forecast to grow 7.7% per year, trailing the US market's expected 10.1% rate, and annual earnings growth is projected at 9.9%, also below the market's 15.5% pace. With shares trading at $177.35, well above the estimated fair value of $145.77, the results point to sustained business health and operational efficiency, even as growth forecasts lag broader market averages.

See our full analysis for Badger Meter.Next, we will put the latest earnings side by side with the market narratives that drive sentiment. Some expectations will be confirmed, while others might get shaken up.

See what the community is saying about Badger Meter

Premium Price-to-Earnings Ratio Stands Out

- Badger Meter’s price-to-earnings ratio sits at 37.7x, putting it well above the US Electronic industry average of 26.4x and its peer group at 33.6x. Investors are clearly paying a premium versus sector benchmarks.

- According to the analysts' consensus, ongoing investments in IoT-enabled water solutions like BEACON and product innovation are expected to drive high single-digit revenue growth over the long run.

- This ability to maintain margins while expanding into new tech-heavy segments is seen as a key reason investors are comfortable paying up versus industry averages.

- Consensus narrative notes that the regular reinvestment in recurring software and SaaS offerings could translate to durable, higher-quality earnings and cushion the premium against market volatility.

See how the latest tech push and investor optimism shape the consensus outlook for Badger Meter: 📊 Read the full Badger Meter Consensus Narrative.

Analyst Target 30% Above Current Share Price

- The current share price of $177.35 still sits 30.6% below the analyst consensus target of $231.71, highlighting upside if optimistic growth forecasts play out.

- Analysts' consensus view balances strong expected earnings growth (to $182.2 million by 2028) against the tension of needing to justify a much higher PE ratio of 47.8x five years out.

- Bulls argue the premium can persist if recurring software revenues and gross margin expansion materialize, especially as water infrastructure spending remains robust.

- Even so, some analysts highlight that reaching those growth and margin targets is critical to close the current share price gap.

Net Margin Expansion Outpaces Peers

- Margins have advanced to 15.4% after rising from 14.8% last year. By comparison, industry profit growth is projected to remain below Badger Meter’s recent five-year annualized earnings growth of 23.1%.

- Consensus narrative highlights that margin durability is supported by investments in digital metering platforms and the smoothing effect of high-value recurring service contracts.

- However, risks like higher SG&A from new acquisitions and reliance on large municipal contracts could create margin volatility, especially if project rollouts stall or cost controls lag.

- Analysts are watching closely to see if margin improvements continue to outpace sector trends in the face of competitive and regulatory pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Badger Meter on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? You can shape your own story in just a few minutes and share your perspective: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Badger Meter.

See What Else Is Out There

Badger Meter’s premium valuation and lagging growth forecasts compared to the broader market could limit future upside if expectations are not met.

If you want to target better value for money, use our these 872 undervalued stocks based on cash flows to spot stocks trading at a discount with stronger growth potential than Badger Meter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Meter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMI

Badger Meter

Manufactures and markets flow measurement, quality, control, and communication solutions worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives