Benchmark Electronics (NYSE:BHE) Has Re-Affirmed Its Dividend Of US$0.17

Benchmark Electronics, Inc. (NYSE:BHE) will pay a dividend of US$0.17 on the 14th of April. Based on this payment, the dividend yield on the company's stock will be 2.5%, which is an attractive boost to shareholder returns.

See our latest analysis for Benchmark Electronics

Benchmark Electronics' Earnings Easily Cover the Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Benchmark Electronics' earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise by 25.6% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 60% by next year, which is in a pretty sustainable range.

Benchmark Electronics Doesn't Have A Long Payment History

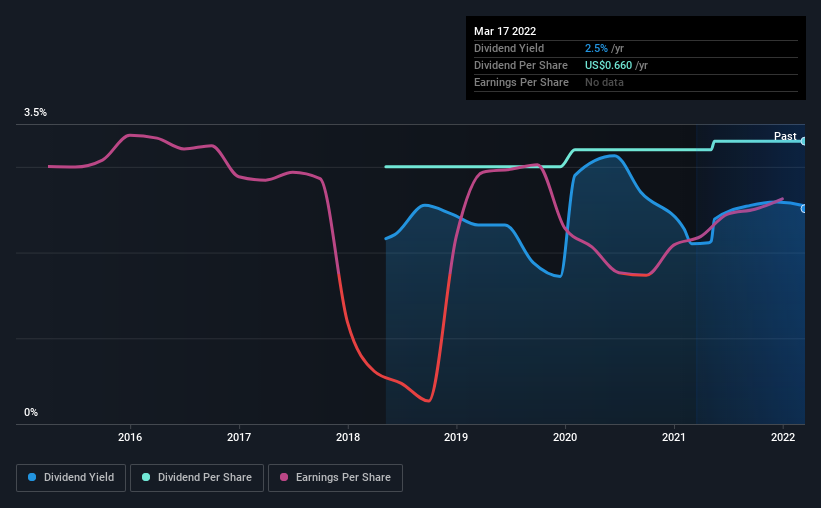

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 4 years, which isn't that long in the grand scheme of things. Since 2018, the first annual payment was US$0.60, compared to the most recent full-year payment of US$0.66. This implies that the company grew its distributions at a yearly rate of about 2.4% over that duration. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Benchmark Electronics May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. It's not great to see that Benchmark Electronics' earnings per share has fallen at approximately 4.8% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While Benchmark Electronics is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Benchmark Electronics that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks