Assessing Benchmark Electronics (BHE) Valuation After The Appointment Of A New CTO

Reviewed by Simply Wall St

Why Benchmark Electronics is in Focus After a CTO Change

Benchmark Electronics (BHE) is back on investor radars after appointing Josh Hollin as Senior Vice President and Chief Technology Officer, following the planned retirement of long serving engineering leader Jan Janick.

See our latest analysis for Benchmark Electronics.

The CTO transition comes after a stretch of firm price momentum, with a 7 day share price return of 9.86% and a 90 day share price return of 15.71%. The 5 year total shareholder return of 103.99% points to meaningful longer term value creation from dividends and price gains combined.

If this leadership change has you thinking about where technology and electronics manufacturing could head next, it might be worth scanning fast growing stocks with high insider ownership as a starting point for fresh ideas beyond Benchmark Electronics.

With the stock recently near US$49.49 and only a small gap to the US$50.00 analyst price target, together with solid recent share returns, it is reasonable to ask whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 4.6% Overvalued

With Benchmark Electronics last closing at US$49.49 against a widely followed fair value estimate of US$47.33, the narrative leans slightly cautious on upside.

The analysts have a consensus price target of $44.667 for Benchmark Electronics based on their expectations of its future earnings growth, profit margins and other risk factors.

Given the current share price of $39.02, the analyst price target of $44.67 is 12.6% higher.

Curious how modest revenue assumptions, rising margins and a lower future P/E are combined into that fair value line? The full narrative lays out the earnings roadmap behind that view and the valuation hinge points that keep the estimate where it is.

Result: Fair Value of $47.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if semi cap demand stays weak or if industrial and medical orders flatten, which would challenge those earnings and margin assumptions.

Find out about the key risks to this Benchmark Electronics narrative.

Another Angle on Valuation

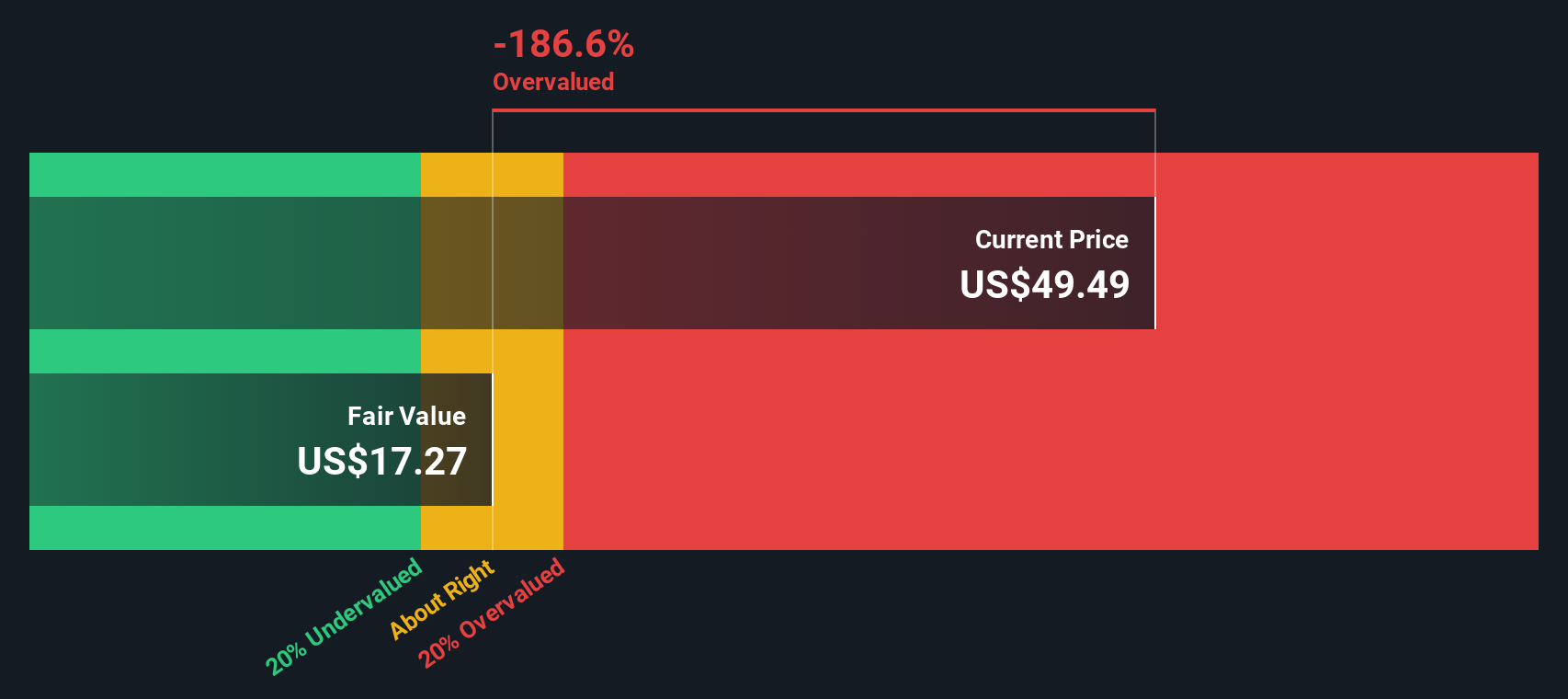

Our SWS DCF model presents a sharper contrast. On that approach, Benchmark Electronics at US$49.49 is trading well above an estimated fair value of US$17.28. This indicates a wide gap between the price implied by cash flow assumptions and the analyst target. Which interpretation do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Benchmark Electronics Narrative

If you see the numbers differently or prefer to piece together your own view from the raw data, you can shape a custom thesis in just a few minutes: Do it your way.

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Benchmark Electronics has sharpened your thinking, do not stop there. Use the Simply Wall St Screener to quickly uncover fresh, data driven opportunities that match your style.

- Target potential turnaround stories by scanning these 3529 penny stocks with strong financials that still back their businesses with solid financials rather than hype alone.

- Explore the growth of smarter software and automation by checking out these 24 AI penny stocks that are aligned with artificial intelligence themes.

- Hunt for value by reviewing these 873 undervalued stocks based on cash flows that our models flag as trading below estimated cash flow based assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Is Global Payments (NYSE:GPN) The Undervalued Cash Cow Your Portfolio Needs?

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026