A Look at Belden’s Valuation as It Joins the Chicago Quantum Exchange for Quantum-Secure Future

Reviewed by Kshitija Bhandaru

Belden (NYSE:BDC) just made a move that is likely to get investors talking. The company announced it has joined the Chicago Quantum Exchange, signaling a clear focus on developing quantum-secure networking technologies for critical infrastructure. This event is significant because the quantum era brings both new opportunities and heightened risks, and Belden is positioning itself early to address the pressing need for cyber-secure communications as quantum computing moves closer to reality.

This partnership is the latest chapter in Belden’s ongoing strategic transformation, evolving from a classic connectivity product business to a provider of advanced, future-ready solutions. Over the past year, the stock has delivered a 16% total return, a sign of building momentum, especially considering the 15% gain year-to-date and a strong 118% three-year run. The affiliation with the Chicago Quantum Exchange could be viewed as the company strengthening its connectivity leadership just as industry demands shift toward quantum resilience.

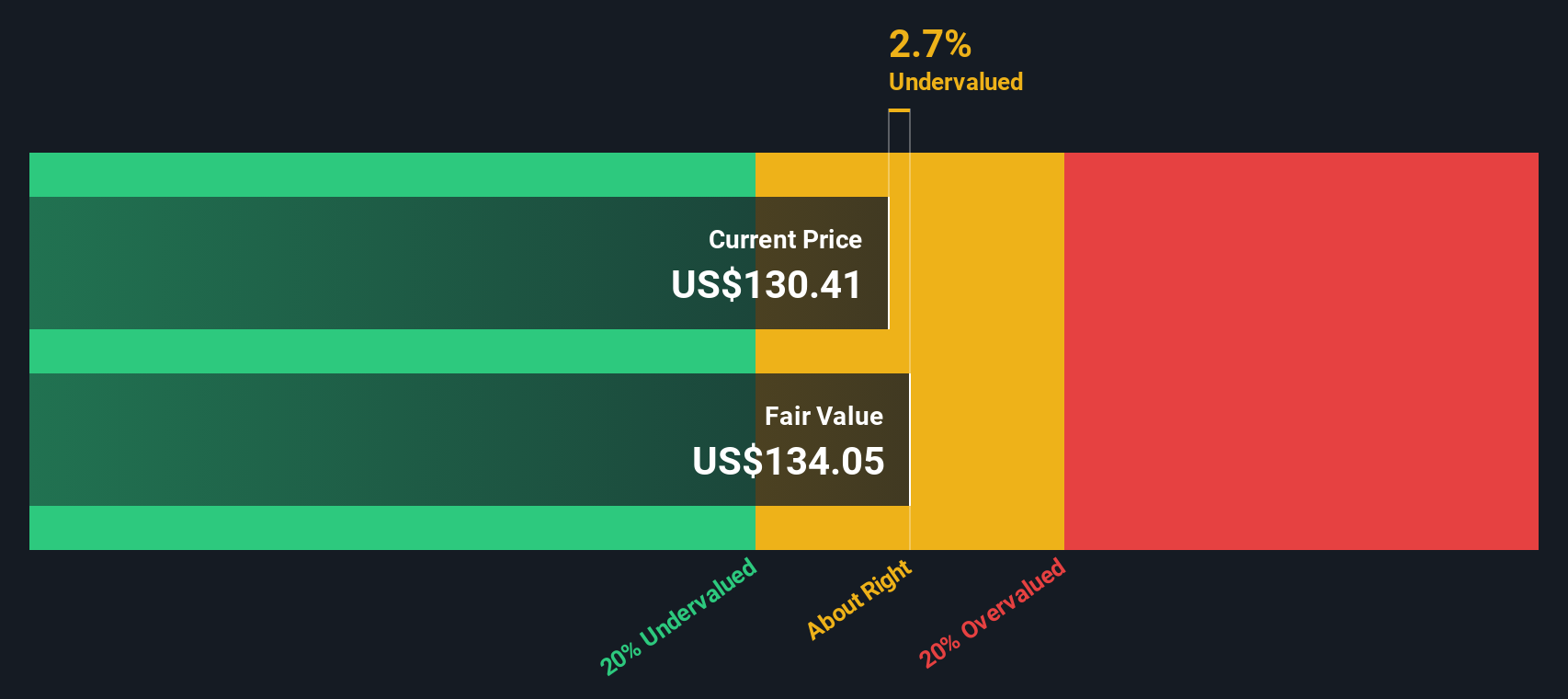

With the stock’s strong recent performance and a bold step into quantum security, is Belden undervalued relative to its long-term potential, or is the market already factoring in its next wave of growth?

Most Popular Narrative: 8.6% Undervalued

According to the most widely followed narrative, Belden shares are currently undervalued, with analysts pricing in more future growth than the market reflects today.

Persistent investments in high-margin, software-enabled and integrated solutions (with a goal to double the solutions revenue mix by 2028) are shifting Belden's product mix toward recurring revenue and improved overall net margins. This is enhancing long-term earnings power.

Want to see what’s fueling this lucrative outlook? The real driver behind this price target is an ambitious revenue plan and next-level profit expectations, backed by a future profit multiple rarely seen outside the biggest disruptors. Think you know which growth levers are in play? The answer might surprise you.

Result: Fair Value of $142.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic uncertainty and volatile input costs could dampen Belden's growth outlook and present challenges to its efforts for sustained margin gains.

Find out about the key risks to this Belden narrative.Another View: What Does the SWS DCF Model Say?

While analyst targets hint at undervaluation, our DCF model paints a similar picture by projecting fair value based on future cash flows. Does this agreement add conviction, or is there still room for debate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Belden Narrative

If these perspectives do not fully match your outlook, dive into the data to shape your own take on Belden’s story in just a few minutes. Do it your way.

A great starting point for your Belden research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Uncover unique opportunities beyond Belden and strengthen your portfolio with investment themes trusted by savvy investors. Start now and you could be among the first to spot the next breakout star.

- Tap into emerging tech trends as leading innovators unlock the power of artificial intelligence with AI penny stocks.

- Secure potential bargain buys by targeting quality companies trading below their true value using our undervalued stocks based on cash flows.

- Jump ahead of quantum advancements and ride the excitement as pioneers shape tomorrow’s digital world through quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDC

Belden

Provides connection solutions to bring data infrastructure into alignment to unlock new possibilities for its customers.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives