Assessing Arrow Electronics (ARW) Valuation Following Leadership Shake-Up and CEO Transition

Reviewed by Kshitija Bhandaru

Arrow Electronics (ARW) grabbed investors' attention this week following a shake-up at the top. The company named William Austen as Interim President and CEO after Sean Kerins stepped down from both roles. Arrow says this move is unrelated to its financial reporting. With the board now searching for a permanent successor, leadership transitions of this scope can have ripple effects on confidence and expectations, especially for a company with Arrow’s scale and reach.

The news did coincide with softness in the share price, which has drifted lower in the past month and is now down roughly 7% over the last year. Despite this pullback, Arrow Electronics still boasts a strong track record over longer time frames, building up more than 56% in total returns over five years. Recent initiatives like expanding its IP&E portfolio continue to shape its industry position. The key question now is whether sentiment toward the stock resets as the management transition unfolds, or if uncertainty dampens enthusiasm in the short run.

So after a challenging year for the shares and with new leadership at the helm, is Arrow Electronics trading at a bargain, or are markets already pricing in what is next?

Most Popular Narrative: 4.3% Overvalued

According to the most followed narrative, Arrow Electronics is currently viewed as slightly overvalued, trading above the fair value estimate based on a detailed discounted cash flow approach and future earnings assumptions.

Accelerating adoption of cloud, infrastructure software, cybersecurity, and mid-market as-a-service offerings (notably through ArrowSphere) is increasing Arrow's exposure to higher-margin, recurring revenue streams. This is expected to support both revenue growth and margin stability in future quarters.

Can Arrow’s future growth ambitions really justify its current price? Analysts are betting on recurring revenue and margin stability to fuel a profit surge. The narrative’s valuation is built on bold projections for top and bottom line growth that most investors won’t want to miss. Want to see which financial drivers are at the heart of this fair value calculation? The full narrative reveals all.

Result: Fair Value of $116.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing supply chain shifts and direct sourcing by customers could threaten Arrow's margins and long-term growth if industry dynamics change.

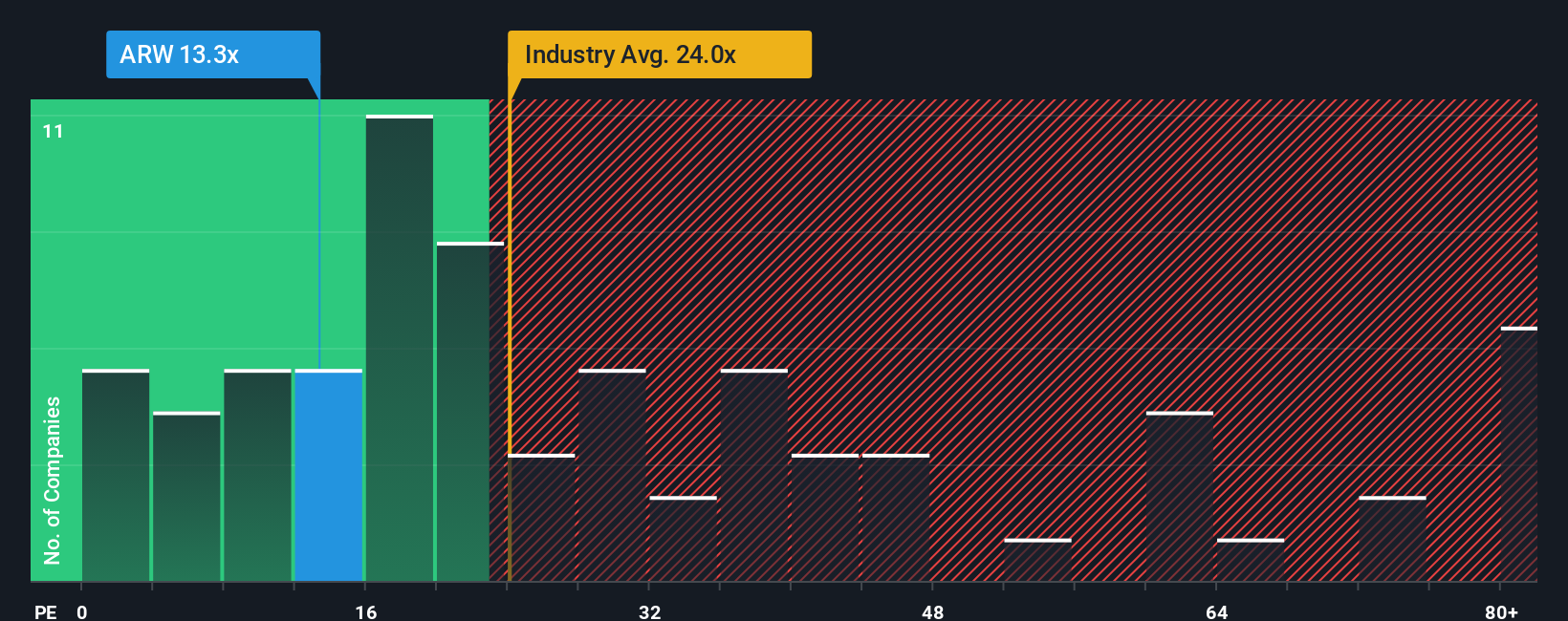

Find out about the key risks to this Arrow Electronics narrative.Another View: Market Multiples Tell a Different Story

While analyst fair value models give Arrow Electronics a slightly overvalued tag, looking at how shares trade compared to industry peers paints a more optimistic picture. The company’s valuation is actually lower than most in its sector. Could the market be undervaluing Arrow's future earnings potential, or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrow Electronics Narrative

If you have a different perspective or want to dig into the numbers yourself, you can quickly build and share your own story in just a few minutes. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your edge in today’s fast-moving market by checking out stocks you might otherwise overlook. The next big opportunity could be a click away. Don’t miss your chance to stay ahead with tailored investment lists from Simply Wall Street.

- Unlock ultra-high yield potential by tapping into dividend stocks with yields > 3%. Discover companies rewarding shareholders with impressive income streams.

- Spot up-and-coming tech disruptors by browsing AI penny stocks. Explore innovators powering the next wave of artificial intelligence breakthroughs.

- Target deep value finds and under-the-radar bargains by starting with undervalued stocks based on cash flows. Get ahead before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives