Arrow Electronics (ARW): Valuation Insights Following Eased U.S. Trade Restrictions on China Operations

Reviewed by Kshitija Bhandaru

Arrow Electronics has revealed that the U.S. Commerce Department will remove trade restrictions on its China-based affiliates, a reversal connected to past concerns over U.S. component sales. Six of Arrow’s Hong Kong entities are set to come off the Entity List. This change could ease regulatory challenges and support future business development in the region.

See our latest analysis for Arrow Electronics.

Following this regulatory relief, Arrow Electronics has seen its 7-day share price return jump by nearly 5 percent, which may indicate renewed investor optimism after a challenging stretch. While cumulative shareholder returns over the past year remain negative, the company’s three and five-year total returns still reflect solid long-term growth. This suggests momentum could be building again if business conditions continue to improve.

If Arrow’s rebound has you thinking bigger, it might be interesting to broaden your search and discover fast growing stocks with high insider ownership

With Arrow’s regulatory headwinds easing, is this renewed optimism signaling an undervalued opportunity for investors, or is the recent share price jump already accounting for potential future growth?

Most Popular Narrative: 2% Overvalued

Compared to Arrow Electronics’ last close price, the most popular narrative suggests the stock is priced a bit above fair value. This perspective weighs near-term optimism alongside the company’s actual potential for earnings and revenue growth.

Ongoing investments in supply chain management services, engineering and design, and integration solutions are driving a greater mix of value-added offerings. These efforts are expected to incrementally enhance gross and operating margins and improve long-term earnings resilience. Productivity and cost-saving initiatives, along with improving inventory turns and a focus on matching inventory to real demand, are projected to further stabilize and potentially expand net margins. This positions Arrow to translate topline growth into robust earnings performance as secular growth drivers take hold.

Want to see what’s behind this “almost fair” value? The narrative centers on steady growth in key segments and a crucial shift in margins. Ready to find out if those financial targets are game-changers or just wishful thinking? Click to read the full breakdown and uncover the forecast details that could drive Arrow’s next big move.

Result: Fair Value of $116.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in customer sourcing and unpredictable global demand could undermine Arrow’s recovery narrative. This may make current growth trends less sustainable than they appear.

Find out about the key risks to this Arrow Electronics narrative.

Another View: Peer Comparison Puts Price in Perspective

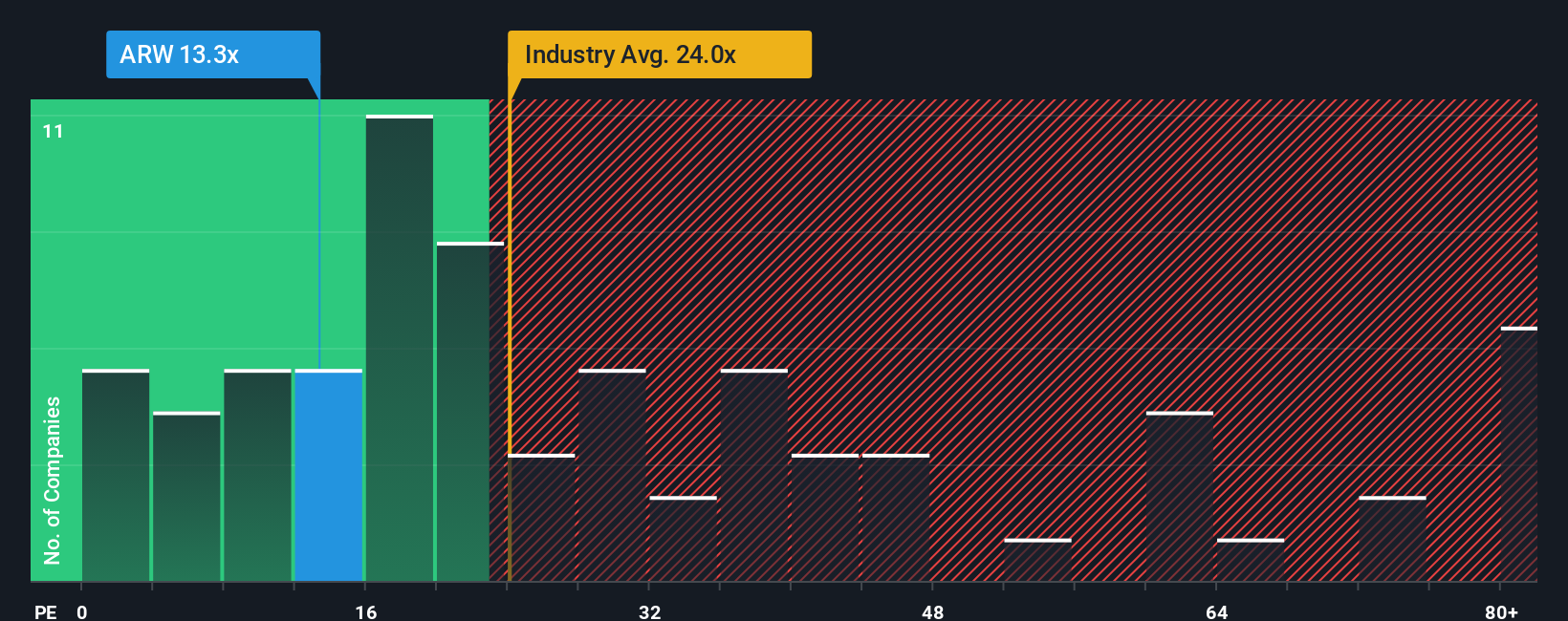

Looking at Arrow Electronics’ price-to-earnings ratio of 13.1x, there appears to be value relative to both the US Electronic industry average (26.2x) and its peer group (18.9x). The fair ratio, pegged at 27x, is also much higher than today’s level. Does this suggest investors are missing latent opportunity, or could risks still justify the discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrow Electronics Narrative

If you have a different perspective or want to analyze the numbers for yourself, you can quickly assemble your own outlook in just a few minutes. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Even More Smart Investing?

Don’t let great opportunities pass you by. Use Simply Wall Street’s powerful Screeners to spot untapped markets and companies you might otherwise miss out on.

- Unlock the potential of the digital economy and access future-focused companies by reviewing these 79 cryptocurrency and blockchain stocks as it transforms payments and blockchain.

- Capture growth moments by targeting reliable income streams and exploring these 18 dividend stocks with yields > 3% with dividends above 3 percent.

- Get ahead in tomorrow’s technology revolution by tracking these 26 quantum computing stocks as it advances in quantum computing and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives