Arrow Electronics (ARW): Fresh Analysis Puts Spotlight on Valuation and Growth Potential

Reviewed by Kshitija Bhandaru

Recent analysis has brought Arrow Electronics (ARW) into focus, pointing out the company’s solid value ranking and positive earnings outlook. With valuation metrics that compare well with industry peers, ARW is catching the attention of investors seeking growth and value potential.

See our latest analysis for Arrow Electronics.

Arrow Electronics’ share price has seen limited movement in recent months. However, the stock’s three-year total shareholder return of 25.6% hints at meaningful long-term value creation. This steady performance, combined with strong earnings and valuation credentials, is keeping momentum intact for patient investors.

If you want more ideas like this, now's the ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With Arrow Electronics trading at a discount compared to industry peers and earnings growth on the horizon, the key question for investors is whether this signals an overlooked buying opportunity or if the market has already accounted for its future growth.

Most Popular Narrative: 4.9% Overvalued

The current consensus calls Arrow Electronics slightly overvalued, with a fair value of $116.75 compared to its last close of $122.45. This valuation highlights the narrative's expectations for growth and margin expansion, pointing to key trends shaping the company's future.

Ongoing investments in supply chain management services, engineering and design, and integration solutions are driving a greater mix of value-added offerings. This strategy is expected to gradually enhance gross and operating margins while improving long-term earnings resilience.

Want to know the numbers fueling this higher price target? The answer lies in surprisingly strong earnings projections and a future profit multiple below industry norms. Dive in to discover the hidden assumptions and bold bets that underpin this fair value.

Result: Fair Value of $116.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain automation or an extended downturn in key end markets could derail Arrow’s expected earnings growth and margin expansion.

Find out about the key risks to this Arrow Electronics narrative.

Another View: Look to the Numbers

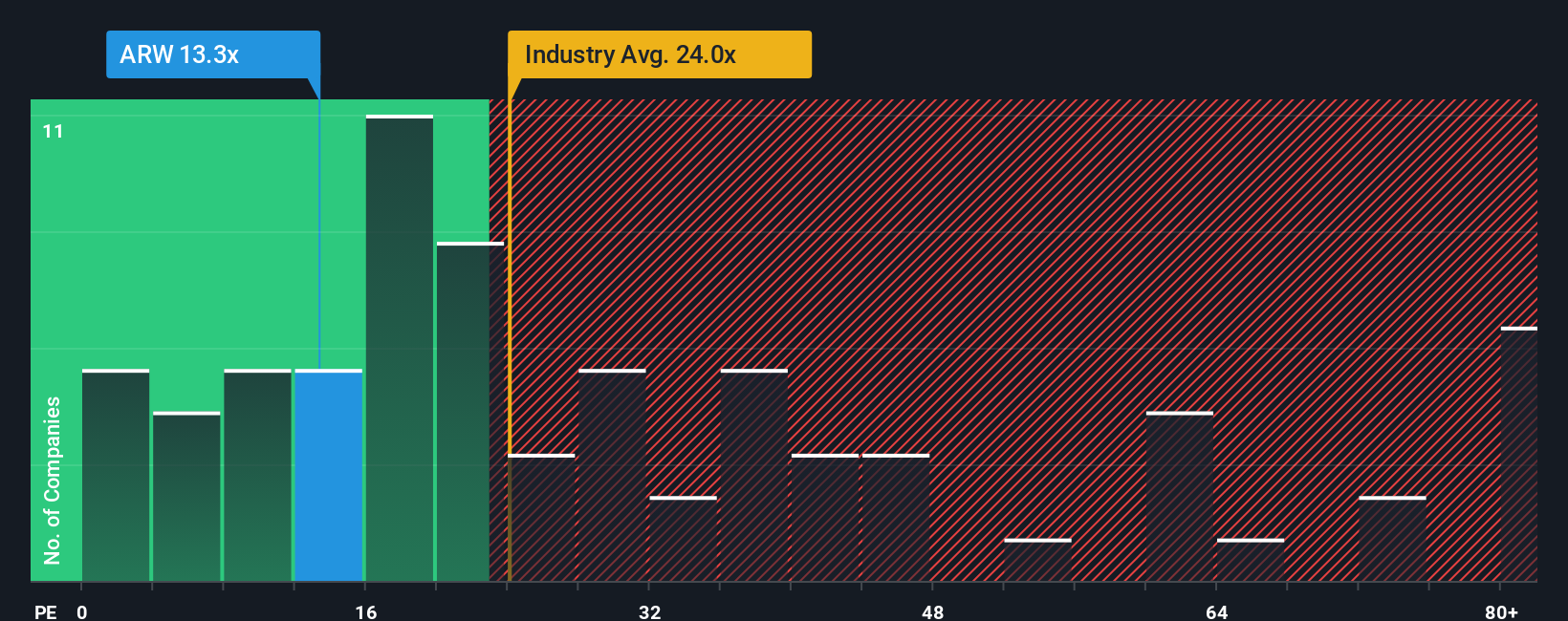

Let’s take a step back and look at Arrow Electronics through the lens of price-to-earnings. Right now, its ratio stands at 13.5x, which is below both the US Electronic industry average of 24.3x and the peer average of 19.6x. That is still far away from its fair ratio of 27x, suggesting the market could be undervaluing ARW’s potential. But if that is the case, why aren’t investors bidding the stock higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrow Electronics Narrative

If you see the story differently or want to dig into the data on your own, you can shape your own view in just a few minutes as well. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your next big opportunity could be just a click away. Don’t let today’s momentum pass you by. See what other smart investors are tracking right now with these tailored stock ideas:

- Secure steady income as you check out these 19 dividend stocks with yields > 3%, delivering yields above 3 percent and proven resilience through market cycles.

- Ride the AI boom by targeting growth with these 24 AI penny stocks, which are turning cutting-edge technology into profit and reshaping entire industries.

- Catch the undervalued gems early by reviewing these 909 undervalued stocks based on cash flows, trading below their cash flow potential before the broader market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives