Is Trade War Threat Reshaping the Investment Case for Arlo Technologies (ARLO)?

Reviewed by Sasha Jovanovic

- In early October 2025, President Trump threatened a substantial increase in tariffs on Chinese imports, heightening concerns about a renewed US-China trade war and resulting in worries over supply chain disruptions for technology companies such as Arlo Technologies.

- This development underscored Arlo’s exposure to potential cost pressures and sourcing uncertainties related to Chinese manufacturing and electronic components.

- We'll explore how these revived trade war fears and supply chain risks could influence the company's outlook and future growth assumptions.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Arlo Technologies Investment Narrative Recap

If you own Arlo Technologies stock, you need to believe in the ongoing adoption of smart home security and the company’s ability to transition hardware buyers into high-margin service subscribers. The recent tariff threats from President Trump highlight the risk of higher manufacturing costs and possible supply chain disruption, which could pressure margins, materially impacting near-term outlook and reinforcing cost structure as the most important short-term catalyst and risk right now.

Amid these trade concerns, Arlo’s August launch of new AI-powered security cameras and enhanced subscription services stands out. This product refresh, driving users to higher-value service plans while unlocking new hardware at price points from $34.99 to $59.99, reinforces the company’s push to grow recurring revenue, a key catalyst for future profitability and margin resilience in the face of global supply chain uncertainty.

But while demand drivers remain appealing, investors should be especially mindful that, unlike product cycles, the risk of abrupt cost spikes from tariffs or sourcing bottlenecks is not always...

Read the full narrative on Arlo Technologies (it's free!)

Arlo Technologies is projected to reach $632.0 million in revenue and $103.1 million in earnings by 2028. This outlook requires 7.6% annual revenue growth and a $110.1 million increase in earnings from the current level of -$7.0 million.

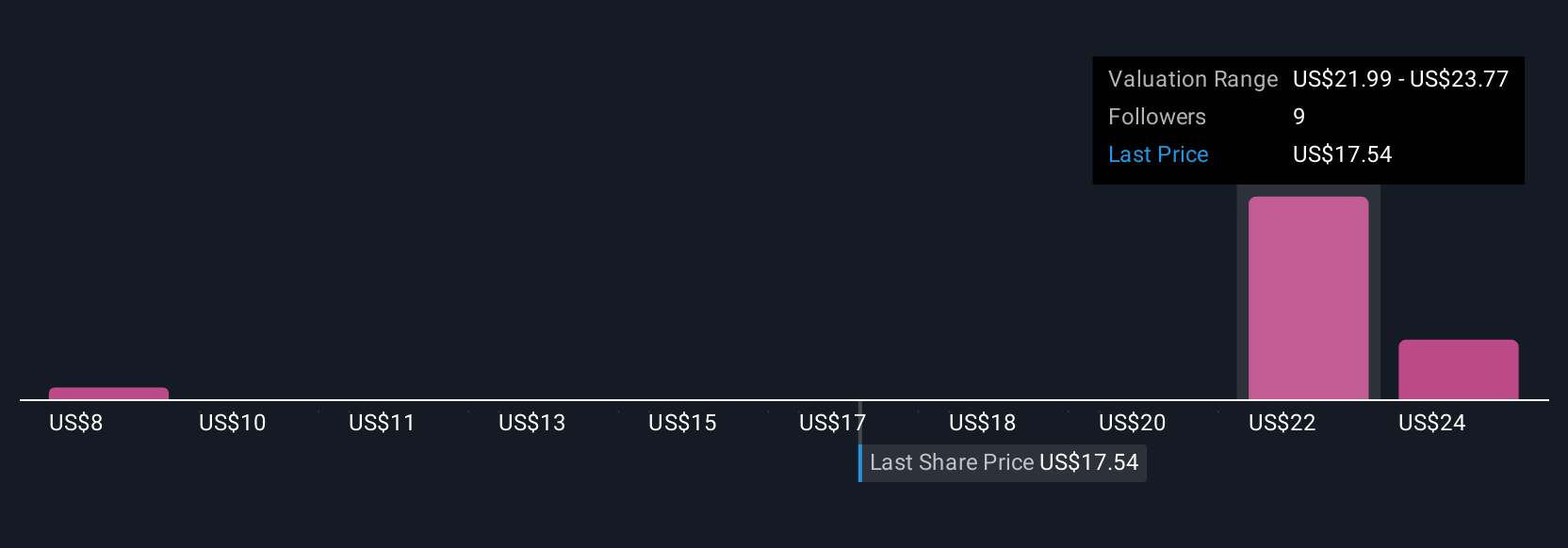

Uncover how Arlo Technologies' forecasts yield a $23.20 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Arlo run from US$7.79 to US$24.73 across 4 contributors. Many participants see expanding service margins as highly influential, but short-term cost risks could quickly shift sentiment and future assumptions.

Explore 4 other fair value estimates on Arlo Technologies - why the stock might be worth less than half the current price!

Build Your Own Arlo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arlo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arlo Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026