How Investors Are Reacting To Amphenol (APH) Removal From Major Russell Value Indices

Reviewed by Simply Wall St

- In late June 2025, Amphenol Corporation (NYSE: APH) was dropped from several major Russell value indices, including the Russell 1000 Value and Russell 3000 Value indices. This removal from broad market benchmarks can influence the trading activity of passive funds and institutional investors that track these indices.

- Such a change in index inclusion status highlights how passive investment flows and index eligibility can directly affect liquidity and investor composition for a company.

- We'll explore how Amphenol's removal from major value indices may impact its investment thesis and long-term market positioning.

Amphenol Investment Narrative Recap

The case for owning Amphenol stock often centers on strong exposure to high-growth markets like AI-driven data centers and the potential benefits of recent acquisitions. The company's recent removal from several Russell value indices is unlikely to materially affect its core catalysts, such as integration of Andrew, but could shift short-term trading activity; the biggest immediate risk remains financial leverage from acquisition debt, rather than index exclusion.

Among Amphenol’s recent developments, the June 2025 debt financing, raising US$750,000,000 and €600,000,000 in senior notes, directly relates to the company’s acquisition-driven growth. This step supports ongoing expansion, but it also amplifies the importance of maintaining strong cash flow and successfully integrating new businesses to manage increased debt and execution risk.

In contrast, investors should be aware that beyond passive outflows, the company’s rising net debt position poses risks if cash generation stumbles or integration challenges mount…

Read the full narrative on Amphenol (it's free!)

Amphenol's outlook forecasts $23.9 billion in revenue and $4.1 billion in earnings by 2028. This implies annual revenue growth of 12.5% and a $1.5 billion increase in earnings from the current $2.6 billion.

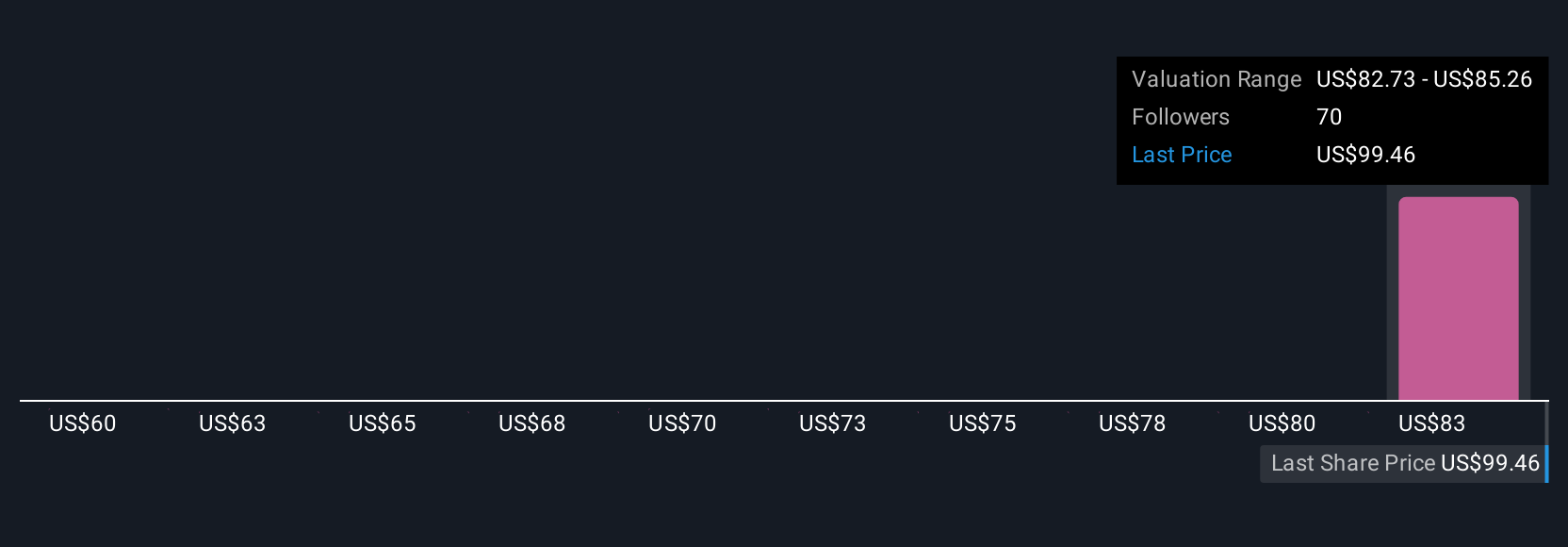

Uncover how Amphenol's forecasts yield a $85.26 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Amphenol range between US$60 and US$85.26, reflecting wide opinions on the stock’s potential. Consider how acquisition-related debt and market positioning could influence future outcomes, and check out multiple viewpoints to inform your own stance.

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives