Does Amphenol's (APH) Removal From Russell Value Indexes Change the Bull Case?

Reviewed by Simply Wall St

- On June 30, 2025, Amphenol Corporation (NYSE: APH) was removed as a constituent from several Russell value indexes, including the Russell 1000 Value Index and the Russell 3000 Value Index.

- This index removal highlights a shift in the company’s classification, while analyst ratings and operational strengths continue to support its positive investment outlook.

- We’ll explore how Amphenol’s removal from multiple value indexes could influence its investment narrative and future market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Amphenol Investment Narrative Recap

Owning Amphenol is about believing in the continued demand for its connectivity solutions, driven by growth in the IT datacom and AI markets. While the company’s recent removal from several Russell value indexes marks a shift in how it may be categorized by some institutional investors, this index change does not materially alter the primary catalyst, AI-fueled demand, nor does it affect the short-term risk linked to global trade tensions and tariffs.

Among recent developments, the announcement of new debt offerings in June 2025 stands out, with Amphenol issuing €600 million and $750 million in senior notes to further support acquisitions and growth initiatives. This aligns with its ongoing expansion strategy, reflecting both the opportunities and heightened financial risks associated with raising additional capital as the business looks to capitalize on high-growth segments.

However, despite strong operational momentum, there is a risk investors should be aware of, especially around how trade tensions with China could…

Read the full narrative on Amphenol (it's free!)

Amphenol's narrative projects $23.9 billion in revenue and $4.1 billion in earnings by 2028. This requires 12.5% yearly revenue growth and a $1.5 billion increase in earnings from the current $2.6 billion.

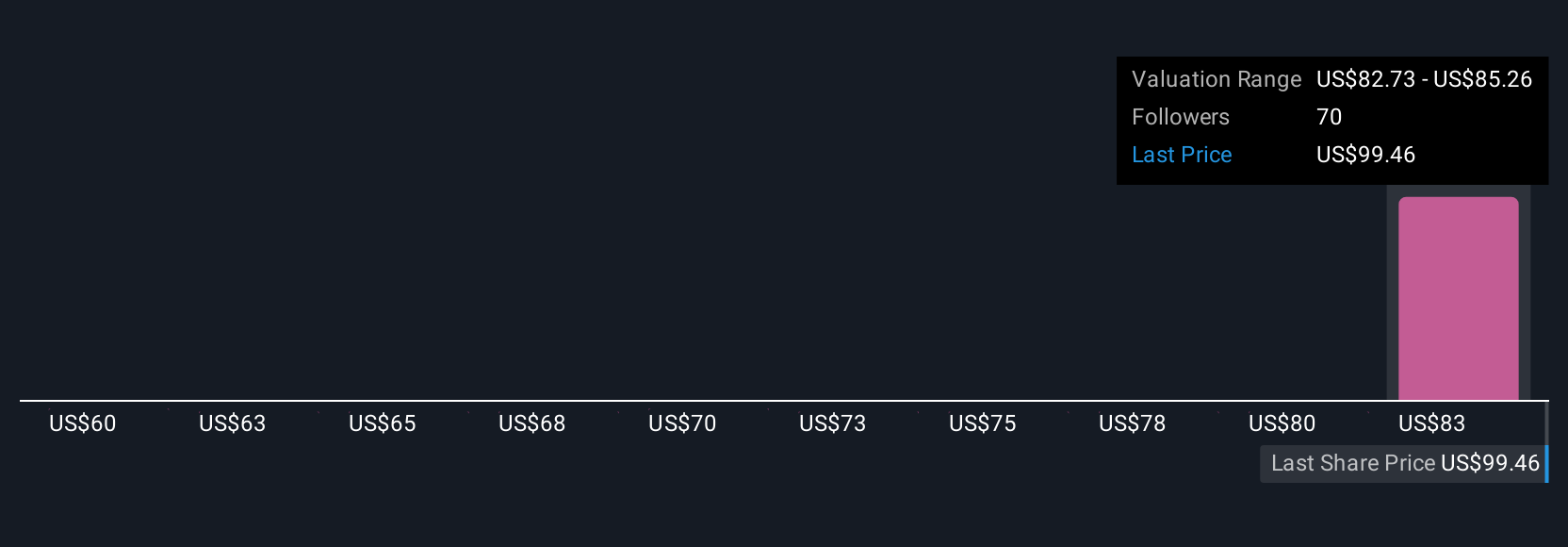

Uncover how Amphenol's forecasts yield a $85.26 fair value, a 14% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided four fair value estimates for Amphenol, spanning US$60 to US$85.26 per share. While views vary, many are watching global trade policy as a critical variable for future business stability and returns.

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives