Amphenol's (APH) Removal From Value Indices Might Change Its Investment Case

- Amphenol Corporation has been removed from several major Russell value indices, signaling a shift away from value stock classifications due to recent index rebalancing.

- This change occurs as Amphenol continues to expand through acquisitions in communications and medical sectors, drawing increased attention from growth-oriented investors and analysts.

- Next, we'll consider how Amphenol's removal from value indices may impact its investment narrative and investor appeal going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Amphenol Investment Narrative Recap

To be an Amphenol shareholder, you typically need confidence in its ability to harness growth through acquisitions and innovation, particularly in communications and medical sectors. Amphenol's removal from several Russell value indices does not materially alter the company’s strongest near-term catalyst, growth from AI-driven datacom demand, nor does it significantly address pressing risks like expanding net debt and acquisition integration. The shift may influence how certain investors perceive the stock, but core business fundamentals and operational drivers remain unchanged.

Among recent announcements, the acquisition of CommScope’s Andrew wireless infrastructure business stands out. This deal is particularly relevant, projected to add US$1.3 billion in sales and strengthen Amphenol’s exposure to high-growth, application-specific markets. While this expands the company’s reach in sectors benefiting from strong demand, it also adds to the short-term catalyst of accelerating revenue and margin expansion tied to ongoing technology investments.

However, it’s important for investors to be aware that, unlike index changes, financial risks could arise if debt levels grow faster than cash flow, the kind of scenario that could...

Read the full narrative on Amphenol (it's free!)

Amphenol's narrative projects $23.9 billion in revenue and $4.1 billion in earnings by 2028. This requires a yearly revenue growth of 12.5% and an earnings increase of 58% from the current earnings of $2.6 billion.

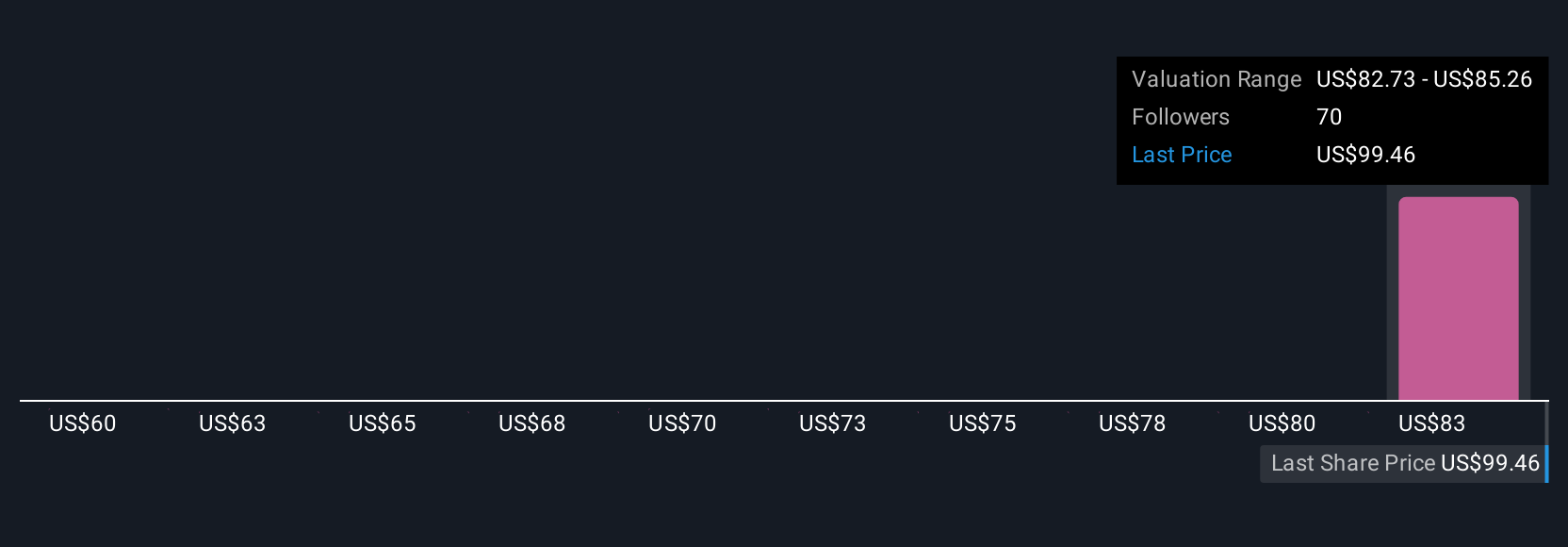

Uncover how Amphenol's forecasts yield a $85.26 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$60 to US$85.26 per share, reflecting diverse forecasts. Keep in mind the pace of acquisition-driven growth can affect future stability, and consider a variety of opinions as you assess the company’s outlook.

Explore 4 other fair value estimates on Amphenol - why the stock might be worth as much as $85.26!

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives