A Look at Amphenol (APH) Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Amphenol (APH) has been turning heads with a steady climb in its share price over the past 3 months, gaining 23%. This momentum comes alongside annual revenue and net income growth in the double digits, which gives investors plenty to talk about.

See our latest analysis for Amphenol.

While Amphenol’s recent surge has grabbed the spotlight, it is part of a year marked by strong momentum. The stock has delivered a remarkable year-to-date share price return of over 82%, and its one-year total shareholder return stands at an impressive 89% as steady growth and market optimism drive further gains.

If Amphenol’s strong run has you wondering what other stocks are on the move, consider this the perfect chance to discover fast growing stocks with high insider ownership.

Yet with shares now hovering just below analyst price targets after such rapid gains, the question is whether Amphenol still offers value to new investors or if the market has already priced in future growth.

Most Popular Narrative: Fairly Valued

With Amphenol’s last close price landing within 1% of the narrative’s fair value estimate, the consensus signals cautious alignment with the company’s current stock price. This sets up the stage for a closer look at what is driving this equilibrium.

Enhanced focus on high-technology, differentiated product mix, driven by customer demand for mission-critical, high-performance components, has strengthened pricing power and operating efficiency. This has resulted in structurally higher conversion and operating margins, with management now targeting 30% incremental margin conversion versus the historical 25%.

Curious which “structural shift” supports this disciplined valuation? The narrative revolves around ambitious margin targets and a blend of high-value products. There is a game-changing forecast hiding within—want to see what is driving the math behind the fair value?

Result: Fair Value of $122.88 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued heavy spending in AI datacenters and unpredictable tech demand could quickly test the durability of Amphenol’s prevailing growth story.

Find out about the key risks to this Amphenol narrative.

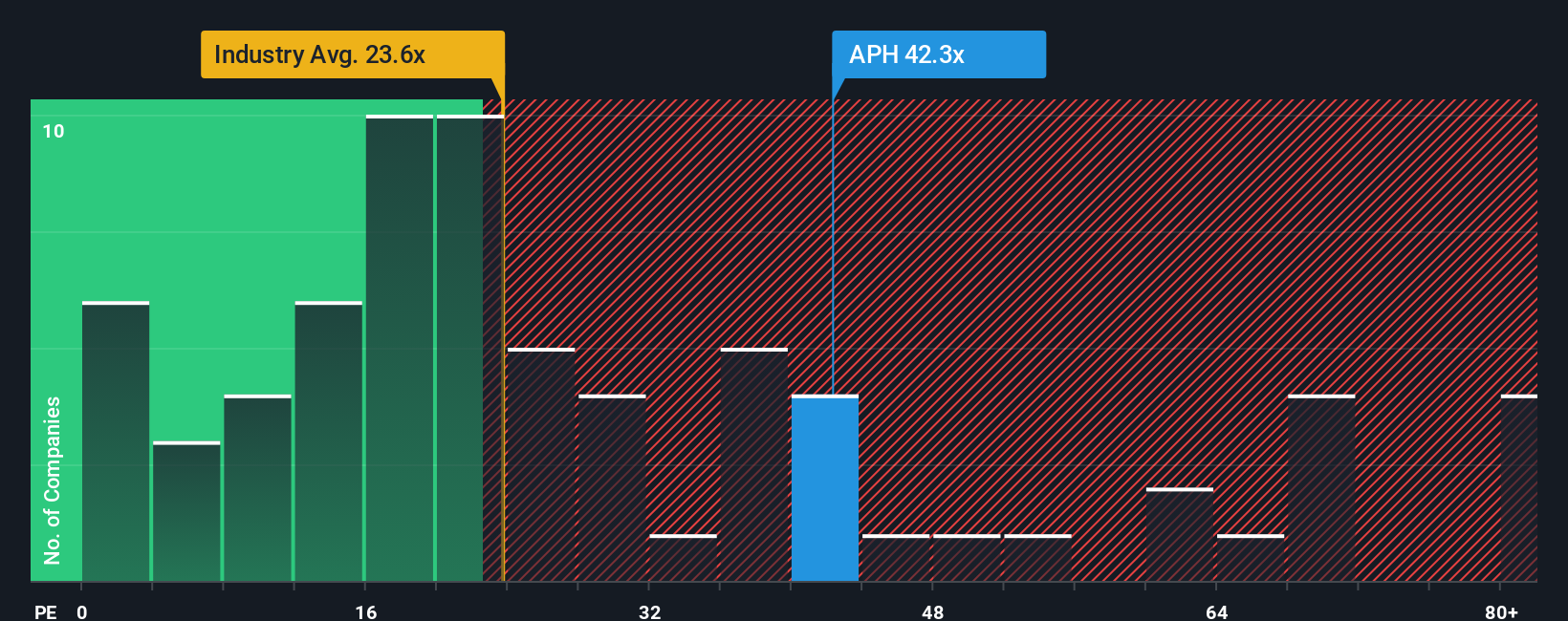

Another View: Multiples Raise the Bar

Looking through the lens of the price-to-earnings ratio, Amphenol is trading at 48.2x, which is well above both its industry average of 26.2x and the calculated fair ratio of 35.6x. This points to a more expensive valuation, suggesting the market is pricing in robust expectations. Could there be risk if the story changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amphenol Narrative

If you have your own analysis or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great opportunities do not wait. Power up your portfolio by targeting unique trends and breakthroughs to uncover stocks that might otherwise fly under the radar.

- Spot income potential and beat low rates when you tap into these 18 dividend stocks with yields > 3% offering yields above 3% for investors who want more from their money.

- Get ahead of the crowd by riding the wave of medical innovation through these 33 healthcare AI stocks, and see which healthcare companies are harnessing AI to shape tomorrow’s treatments.

- Unlock the competitive edge of next-gen computing by checking out these 26 quantum computing stocks, filled with companies at the forefront of quantum breakthroughs and advanced technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives