A Fresh Look at Amphenol (APH) Valuation After Recent Share Price Rally

Reviewed by Kshitija Bhandaru

Amphenol (APH) shares have attracted interest recently, with the stock advancing about 13% in the past month and up 24% over the past 3 months. Investors appear to be weighing current performance in relation to broader market shifts.

See our latest analysis for Amphenol.

Amphenol’s share price has steadily built momentum, not just in the last month but throughout 2024. This suggests that investors are beginning to recognize the company’s consistent execution and growth potential. Its 1-year total shareholder return above 100% stands out, reflecting both recent optimism and longer-term gains.

If you’re curious about what other technology leaders are gaining steam, this is a great moment to explore the latest movers with our See the full list for free.

With shares nearing their price targets after a strong rally, investors are left to wonder whether Amphenol is still trading below its true value or if the market has already priced in all of its expected future growth.

Most Popular Narrative: 5% Overvalued

Amphenol’s last close price of $123.58 stands just above the narrative fair value of $117.44, prompting fresh debate on whether investors have pushed the stock too far or are simply pricing in robust future growth. The tension between current momentum and future expectations is at the heart of the most popular narrative among analysts.

Accelerating global deployment of AI-driven data centers and adoption of next-generation IT architecture is driving strong, sustained demand for Amphenol's high-speed, high-value interconnect solutions, as evidenced by exceptional growth in IT datacom revenue and continued multi-quarter customer engagement; this is expected to support further top-line growth and maintain higher incremental margins.

How do analysts arrive at such a bold valuation? Their thesis leans on relentless earnings upgrades, rapid market expansion, and ambitious margin assumptions that separate this expectation from the pack. The specific growth rates and profitability goals propelling this narrative will surprise those who expect business as usual. Want to see the underlying metrics turning heads? Dive into the full narrative for the real wow factor.

Result: Fair Value of $117.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid shifts in AI hardware demand or acquisition missteps could quickly stall Amphenol’s momentum and challenge these bullish growth assumptions.

Find out about the key risks to this Amphenol narrative.

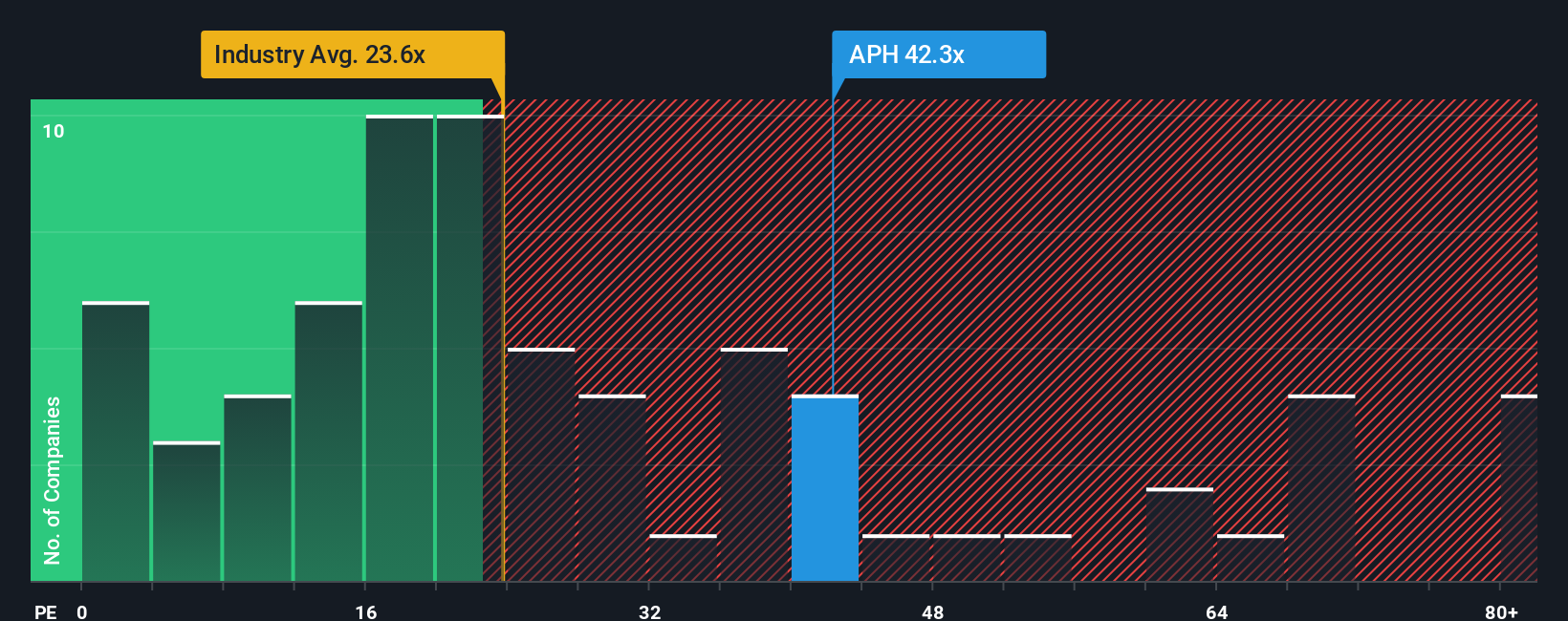

Another View: What Do the Multiples Say?

Looking beyond analyst projections, Amphenol currently trades at a price-to-earnings ratio of 47.5 times, which is well above both the US Electronic industry average of 24.4 and its fair ratio of 35.5. This suggests the market may be paying a significant premium and raises the question: could expectations be too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amphenol Narrative

If you have a different perspective or want to dive into the numbers yourself, it takes just a few minutes to put together your own story. Do it your way

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with Amphenol when so many other opportunities could boost your portfolio? Get ahead of market trends and expand your watchlist with hand-picked stocks designed for real growth potential.

- Supercharge your returns by exploring these 916 undervalued stocks based on cash flows that have the numbers to back up their bargain price tags.

- Capture income and stability by choosing from these 19 dividend stocks with yields > 3% delivering reliable yields above 3%.

- Tap into explosive innovation through these 23 AI penny stocks that are at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives