- United States

- /

- Communications

- /

- NYSE:ANET

What Arista Networks (ANET)'s Executive Shakeup and AI Focus Mean for Shareholders

Reviewed by Simply Wall St

- Earlier this month, Arista Networks announced major executive changes with Kenneth Duda becoming President and CTO, and Tyson Lamoreaux joining as Senior Vice President of Cloud and AI Networking, coinciding with amendments to company bylaws enabling multiple presidents and updated Delaware forum selections.

- These moves highlight Arista Networks’ effort to prioritize AI and cloud systems engineering, reflecting its increased ambition in next-generation networking technologies.

- We’ll explore how the expanded leadership team and AI focus may influence Arista’s investment narrative and future business outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Arista Networks Investment Narrative Recap

To be a shareholder in Arista Networks, you need to believe in the long-term potential of AI and cloud networking, confident that Arista can maintain product leadership as these sectors expand. The recent executive and bylaw changes underscore its growing commitment to AI innovation but do not meaningfully affect the most immediate catalyst: capturing hyperscale cloud and AI data center buildouts. The biggest risk remains Arista’s heavy reliance on a small group of hyperscale customers for outsized revenue contributions, which makes results vulnerable to shifts in their spending or demand, and these recent leadership changes do not materially reduce this exposure.

Among recent announcements, Arista’s raised 2025 revenue target to US$8.75 billion is highly relevant. This upward guidance closely follows appointments focused on cloud and AI, providing context for short-term investor enthusiasm and linking current leadership updates to the company’s most important revenue growth driver.

Yet, investors should keep in mind that despite the buzz around new appointments, concentrated customer risk remains a critical factor to watch...

Read the full narrative on Arista Networks (it's free!)

Arista Networks' outlook points to $13.6 billion in revenue and $5.4 billion in earnings by 2028. This is based on a 19.5% annual revenue growth rate and a $2.1 billion earnings increase from the current $3.3 billion.

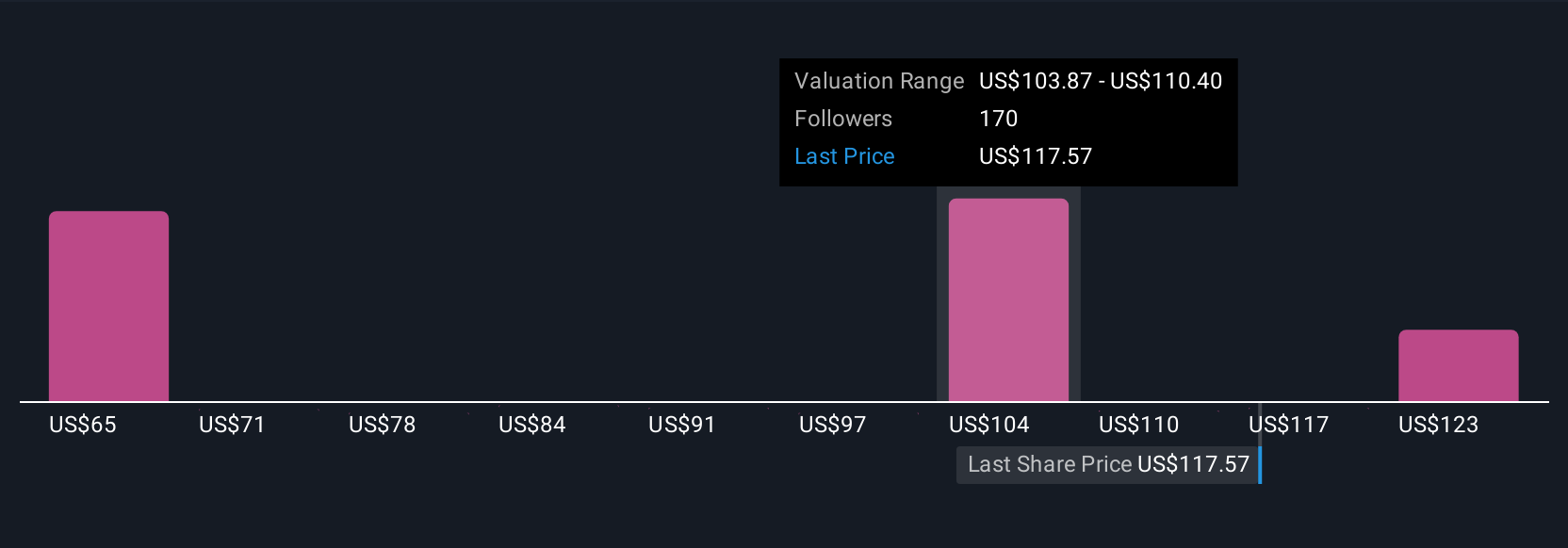

Uncover how Arista Networks' forecasts yield a $142.63 fair value, in line with its current price.

Exploring Other Perspectives

Compared to consensus, the most optimistic analysts see revenue hitting US$15,400 million by 2028, emphasizing AI-driven growth. If you believe Arista can overcome concentrated customer risk and win bigger deals, these projections may look achievable. Your view could shift quickly following recent executive moves, so consider multiple perspectives as forecasts may shift from here.

Explore 19 other fair value estimates on Arista Networks - why the stock might be worth as much as $142.63!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives