- United States

- /

- Communications

- /

- NYSE:ANET

Arista Networks (NYSE:ANET) Announces Q1 2025 Earnings Call For May 6

Reviewed by Simply Wall St

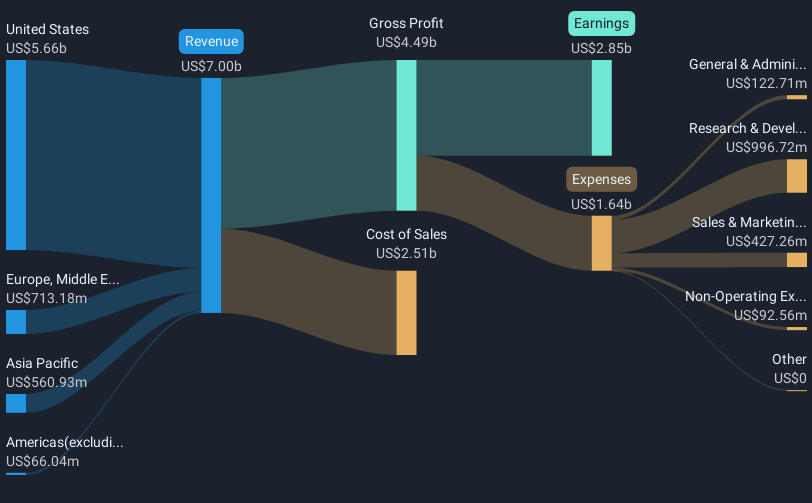

Arista Networks (NYSE:ANET) recently announced its upcoming Q1 2025 earnings release and earnings call scheduled for May 6, 2025. Over the past month, the company's shares have surged 40%, significantly outperforming the broader market, which saw a modest decline amid concerns over tariffs and the Federal Reserve's anticipated meeting outcomes. This substantial increase suggests a notable investor interest in Arista Networks ahead of its earnings report, potentially due to expectations of strong performance. This positive movement within an otherwise tepid market underscores investor confidence in Arista Networks amidst broader economic uncertainties.

We've identified 1 warning sign for Arista Networks that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Arista Networks' recent announcement of its upcoming Q1 2025 earnings call has spurred a sharp share price increase of 40% over the past month. This surge reflects strong investor interest and heightened expectations of performance, which contrasts with broader market declines due to economic uncertainties such as tariffs and Federal Reserve meetings. This price movement ahead of the earnings release could signal positive investor sentiment about Arista's focus on AI networking and proprietary software, potentially influencing future revenue and earnings forecasts.

Over the longer term, Arista has delivered a substantial total return of over 540% over the last five years, underscoring its success compared to both the market and industry peers. While the company's 1-year performance exceeded the US Communications industry's 28.1% return, it is worth noting that the forecasted revenue growth, driven by AI initiatives and subscription services, is expected to enhance financial stability.

The recent share price movement towards the consensus price target of US$107.05, albeit at a discount, underscores the anticipation surrounding Arista's projected growth. Analyst projections, which consider revenues reaching $1.5 billion from AI networking by 2025, alongside a bullish price target of US$145, imply that the current price offers room for appreciation. However, the dependency on major clients, evolving regulatory landscapes, and competitive pressures remain key factors that could influence these expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives