- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Investors Aren't Entirely Convinced By Western Digital Corporation's (NASDAQ:WDC) Revenues

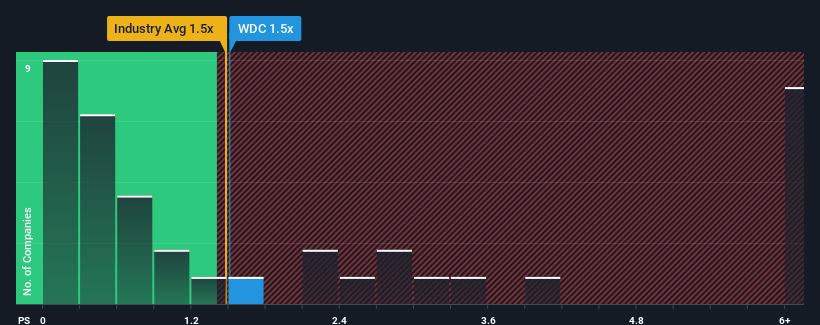

It's not a stretch to say that Western Digital Corporation's (NASDAQ:WDC) price-to-sales (or "P/S") ratio of 1.5x seems quite "middle-of-the-road" for Tech companies in the United States, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Western Digital

How Western Digital Has Been Performing

With revenue that's retreating more than the industry's average of late, Western Digital has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Western Digital will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Western Digital?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Western Digital's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's top line. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 16% each year over the next three years. With the industry only predicted to deliver 5.8% each year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Western Digital is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Western Digital's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Western Digital's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Western Digital (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Western Digital, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions in the United States, China, Hong Kong, Europe, the Middle East, Africa, rest of Asia, and internationally.

Adequate balance sheet slight.