- United States

- /

- Communications

- /

- NasdaqGS:VSAT

Viasat (VSAT): Valuation in Focus After U.S. Space Force Contract Win Spurs Investor Interest

Reviewed by Kshitija Bhandaru

Viasat, Inc. (VSAT) shares jumped after the company revealed it was chosen as a prime contractor for the U.S. Space Force’s Protected Tactical SATCOM-Global program. This represents a major step for its defense communications portfolio.

See our latest analysis for Viasat.

The Space Force contract news has supercharged Viasat’s momentum, adding to buzz from its InRange telemetry launch and the completed Inmarsat merger earlier this year. The stock’s 119% share price return over the last three months is remarkable, and its 199% total shareholder return in the past year hints at surging optimism around long-term growth, even after a slight pullback today.

If you’re interested in the broader aerospace and defense opportunity set, take the next step and explore See the full list for free..

Yet with shares soaring and optimism running high, the real question is whether today’s price fully reflects Viasat’s turnaround potential, or if the current rally still leaves room for investors to buy into future growth.

Most Popular Narrative: 25% Overvalued

With Viasat’s last close at $32.62 but the most widely followed narrative setting fair value at $26.14, the stock’s recent surge puts it above consensus. This sets the stage for a closer look at what is driving the current analyst perspective on future prospects.

Viasat is poised to benefit from growing global demand for secure connectivity and resilient communications, driven by heightened geopolitical instability and increased threats to network and data center security. This is fueling double-digit growth in its Defense and Advanced Technologies segment and is expected to drive sustained revenue expansion.

Want to know what powers this bold price target? There is a high-stakes blend of segment growth, global rollout, and shifting profit assumptions hiding behind the scenes. The future value calculation might surprise you. Find out which market dynamics tip the scales in this narrative.

Result: Fair Value of $26.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant capital spending needs or further subscriber losses could quickly challenge the current outlook and cause analysts to reconsider the valuation case.

Find out about the key risks to this Viasat narrative.

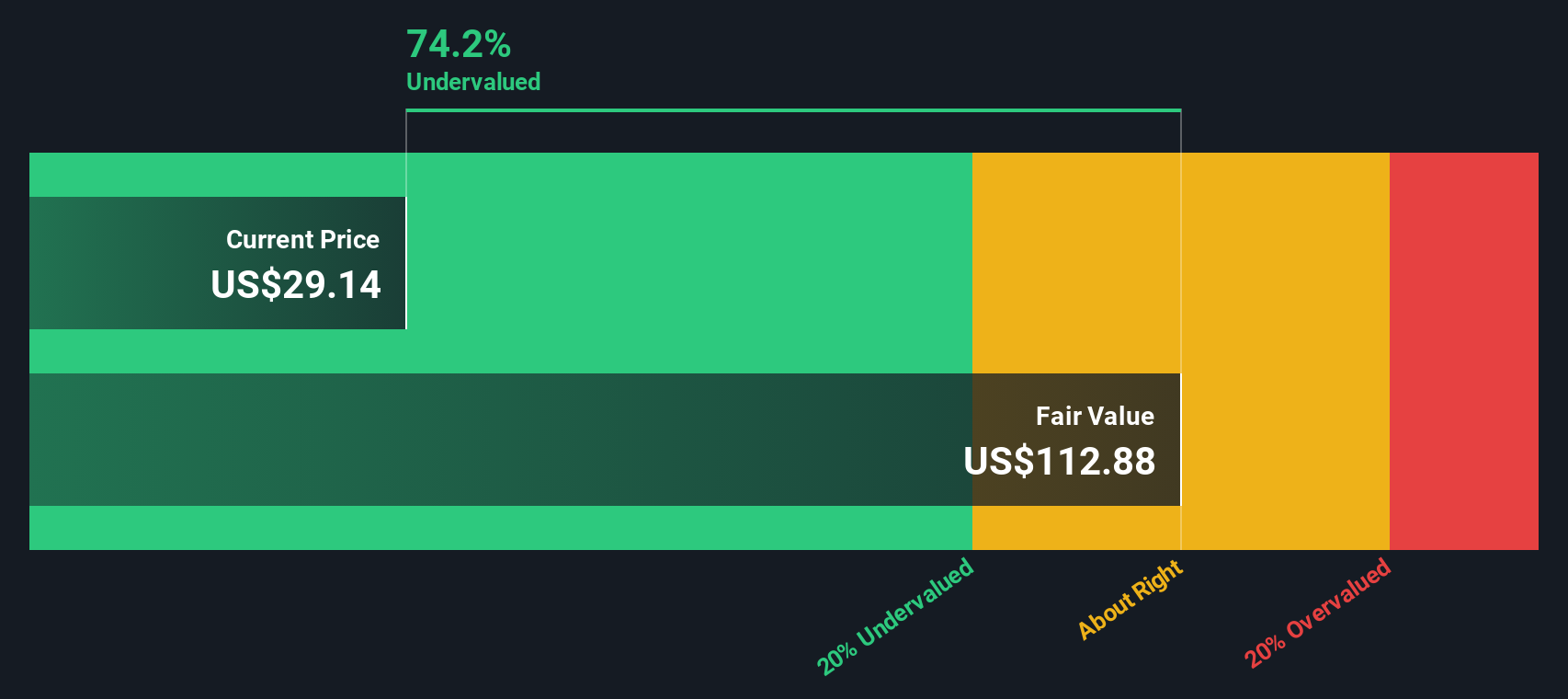

Another View: The SWS DCF Model Signals Undervaluation

While the analyst consensus suggests Viasat is overvalued based on future earnings estimates, our DCF model paints a very different picture. According to this method, Viasat shares are trading well below estimated fair value. This could highlight a unique opportunity for investors who trust in longer-term cash flow predictions. Which approach deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viasat Narrative

If you want to put these perspectives to the test or see how your ideas stack up, you can build your own analysis in just a few minutes. Do it your way.

A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t settle for one opportunity when you could broaden your portfolio with stocks that match your goals. Check out these strong starting points to boost your edge before the next rally passes you by:

- Unleash your search for growth by targeting these 892 undervalued stocks based on cash flows with healthy cash flows and opportunities that might be hiding in plain sight.

- Tap into tech’s next wave by identifying these 24 AI penny stocks powering innovation in artificial intelligence and machine learning.

- Get ahead of Wall Street by tracking these 3585 penny stocks with strong financials with sturdy financials that could be tomorrow’s big surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives