- United States

- /

- Communications

- /

- NasdaqGS:VSAT

Can Viasat's (VSAT) New Space Partnership Reveal Its Edge in Satellite Communications Strategy?

Reviewed by Sasha Jovanovic

- Viasat announced it will provide its InRange launch telemetry service for Skyrora's upcoming sub-orbital rocket demonstrations, ensuring continuous space-to-ground connectivity using its geostationary satellite network.

- This development highlights Viasat’s ongoing efforts to expand its space communications solutions and strengthen collaborations with international space agencies and commercial partners.

- We'll examine how growing partnerships in the launch services sector could impact Viasat's broader investment narrative and future growth strategies.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Viasat Investment Narrative Recap

Being a Viasat shareholder today means believing that growing global demand for secure, resilient connectivity across defense, aviation, maritime, and space will outweigh the ongoing financial pressures from heavy capital investments and intense industry competition. While the Skyrora InRange partnership showcases Viasat's space communications capabilities and global reach, its near-term impact on the company's most important catalyst, the successful deployment and monetization of ViaSat-3, appears limited, with capital expenditure and execution risks still front and center for investors.

Among recent announcements, the upcoming launch of ViaSat-3 Flight 2 (F2) stands out as the closest tie-in to near-term catalysts. Continued progress here is likely to matter more for Viasat’s financial flexibility, recurring revenue, and ability to compete effectively across multiple segments than new product integrations alone.

Yet, despite this focus on growth, some investors may want to keep a close eye on rising legal and regulatory costs, since...

Read the full narrative on Viasat (it's free!)

Viasat's outlook anticipates $5.0 billion in revenue and $534.2 million in earnings by 2028. This projection assumes a 2.9% annual revenue growth rate and a $1.13 billion increase in earnings from the current level of -$598.5 million.

Uncover how Viasat's forecasts yield a $24.29 fair value, a 21% downside to its current price.

Exploring Other Perspectives

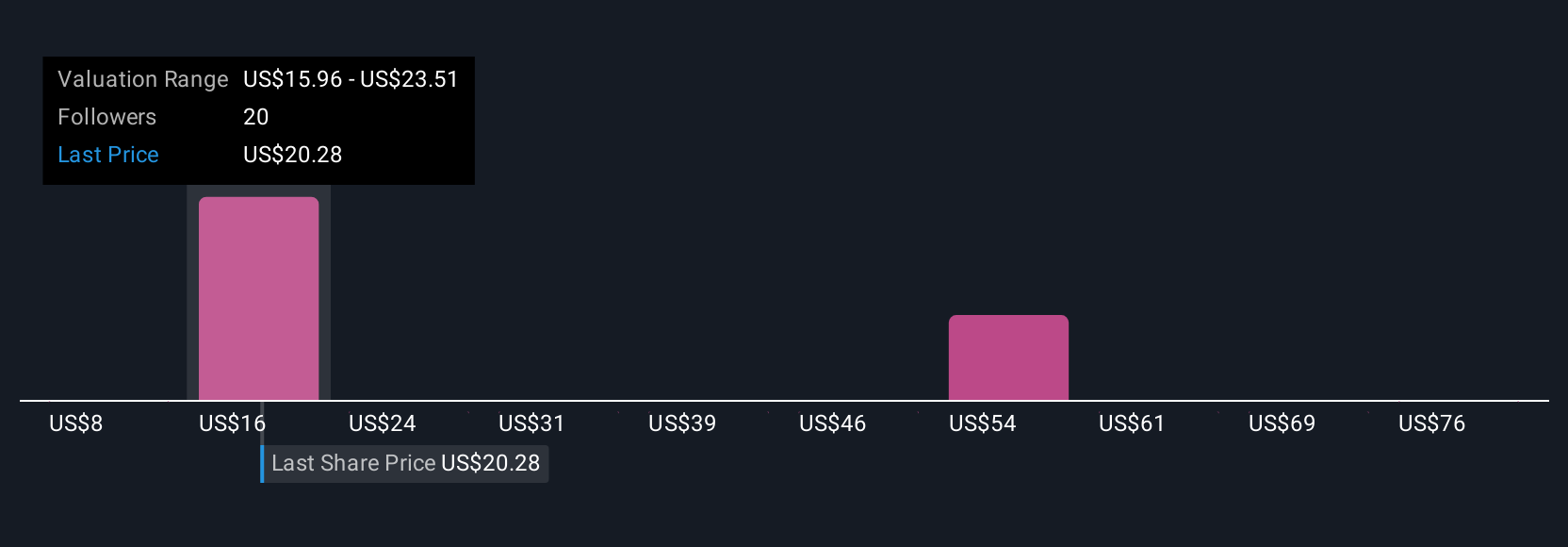

Ten community-generated fair value estimates for Viasat span from as low as US$8.40 to US$112.88 per share, signaling wide-ranging investor views within the Simply Wall St Community. As you weigh these differences, remember that heavy reliance on capital-intensive satellite projects still carries significant operational and cash flow risks.

Explore 10 other fair value estimates on Viasat - why the stock might be worth over 3x more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives