- United States

- /

- Communications

- /

- NasdaqGS:VSAT

A Look at Viasat (VSAT) Valuation Following New Space Partnerships and Evolving Analyst Views

Reviewed by Kshitija Bhandaru

Viasat (VSAT) is generating interest after announcing its InRange telemetry technology will be used for Skyrora’s Skylark L launch and other global space initiatives. These moves place Viasat at the center of evolving space communications.

See our latest analysis for Viasat.

Viasat's latest moves in space tech have come alongside a year of positive share price momentum, with a 2.4% year-to-date share price return underscoring renewed optimism around new launches and integration initiatives. Although the 1-year total shareholder return of 1.8% shows only modest gains, recent business wins and major analyst reassessments continue to shape an outlook that feels more constructive than just a few months ago.

If Viasat’s strategy in space communications has you looking for the next opportunity, consider exploring the aerospace and defense sector. See the full list for free.

With the share price steady and analysts divided on the outlook, is Viasat trading at a discount to its true potential? Or is the market already pricing in the company’s future growth story?

Most Popular Narrative: 22.6% Overvalued

Viasat's fair value, according to the most widely followed narrative, is $26.14. This is notably lower than the recent close of $32.06, prompting a closer look at what could be fueling this valuation gap, even as headline optimism persists.

"Expanding secure connectivity and advanced satellite networks positions Viasat for broader market access, higher pricing power, and sustained top-line growth. Strategic integration, operational efficiency, and heightened demand for digital inclusion support improved cash flow, reduced debt, and better earnings quality."

Curious about the bold bets behind this valuation? The narrative is built on a mix of future growth assumptions and improved earnings quality. But which financial levers truly drive the analyst outlook? Uncover the core calculations and explore the numbers that shape the fair value case.

Result: Fair Value of $26.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high capital spending and declining fixed broadband subscribers could quickly dampen Viasat’s growth narrative if these challenges persist or worsen.

Find out about the key risks to this Viasat narrative.

Another View: SWS DCF Model Suggests Undervaluation

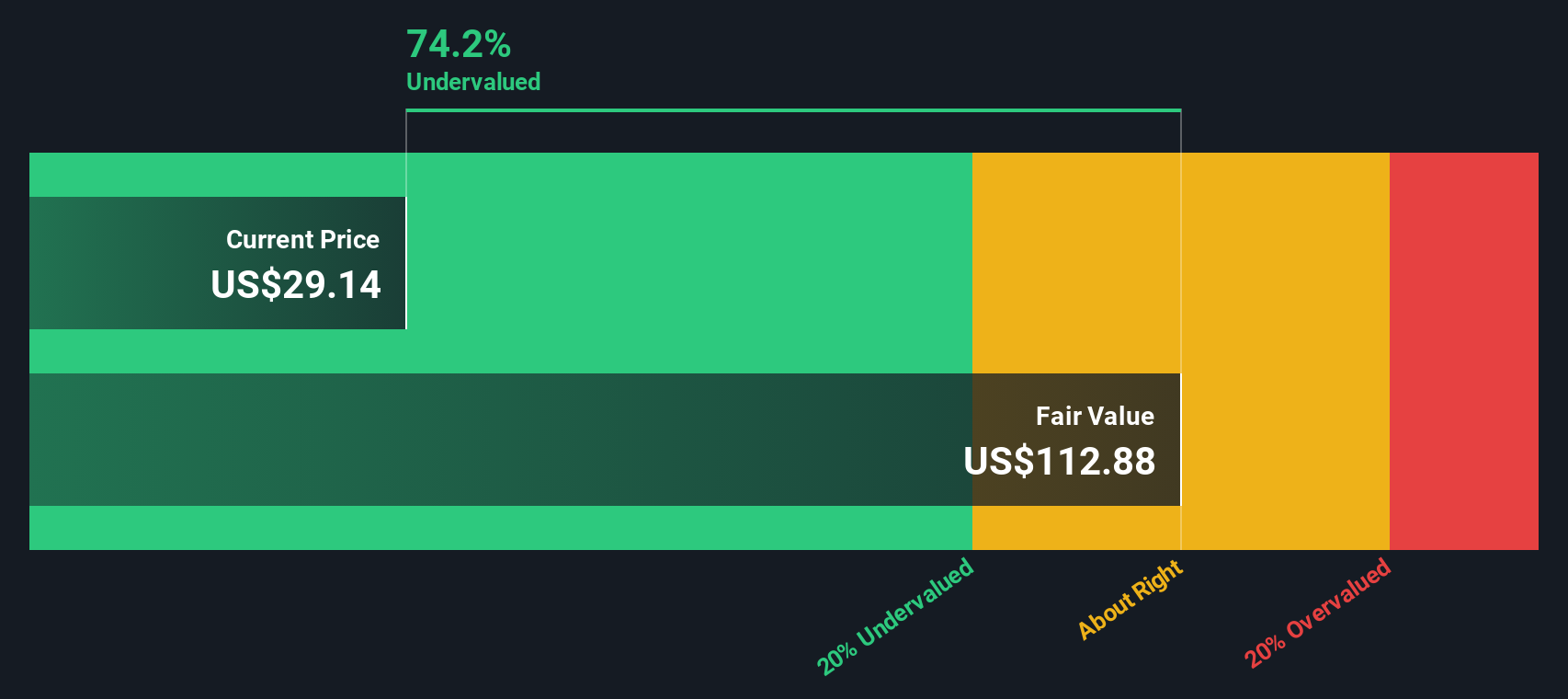

Taking a step back from consensus price targets, our DCF model offers a different perspective. It estimates Viasat's fair value at $112.88, which is much higher than the current market price. This signals substantial potential upside if the DCF assumptions hold true. However, is this optimism justified, or could the model be overlooking key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viasat Narrative

If you have a different perspective, or want to dive into the numbers yourself, you can craft your own view with just a few clicks. Do it your way

A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when some of the market’s smartest plays could be flying under the radar? Jump on these unique stock themes and never let an exciting potential win pass you by.

- Uncover overlooked value by scanning these 896 undervalued stocks based on cash flows, which highlights companies that might be trading below their true worth based on underlying cash flow strength.

- Boost your portfolio's income potential by targeting these 19 dividend stocks with yields > 3%, a list packed with stocks delivering yields over 3% for investors who appreciate steady returns.

- Seize the next tech breakout with these 24 AI penny stocks, where emerging artificial intelligence leaders are transforming entire industries and redefining growth opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives