- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Shareholders 39% loss in Viavi Solutions (NASDAQ:VIAV) partly attributable to the company's decline in earnings over past three years

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Viavi Solutions Inc. (NASDAQ:VIAV) shareholders, since the share price is down 39% in the last three years, falling well short of the market return of around 17%. The more recent news is of little comfort, with the share price down 22% in a year. The falls have accelerated recently, with the share price down 17% in the last three months.

On a more encouraging note the company has added US$80m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Viavi Solutions

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

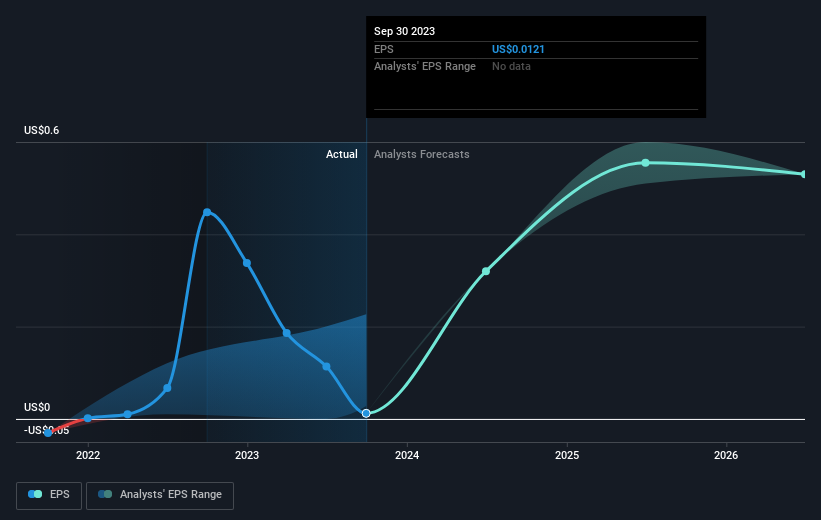

During the three years that the share price fell, Viavi Solutions' earnings per share (EPS) dropped by 59% each year. In comparison the 15% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. This positive sentiment is also reflected in the generous P/E ratio of 685.30.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Viavi Solutions' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 17% in the last year, Viavi Solutions shareholders lost 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Viavi Solutions better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Viavi Solutions , and understanding them should be part of your investment process.

But note: Viavi Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for communications service providers, hyperscalers, network equipment manufacturers, original equipment manufacturers, government, and avionics customers in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives