- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

Will TTM Technologies' (TTMI) New RF Components Strengthen Its Position in High-Growth Sectors?

Reviewed by Sasha Jovanovic

- In September 2025, TTM Technologies introduced new ultra small RF crossover and splitter components designed for applications in Telecom, Test and Measurement, and Commercial Off-the-Shelf Mil-Aero sectors, featuring high-frequency performance in compact, surface-mount formats.

- This product expansion, along with rigorous quality testing, highlights TTM's focus on advancing mmWave and broadband analog/digital solutions to meet evolving industry needs.

- We'll examine how TTM's release of advanced RF components for key high-growth sectors shapes the company's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

TTM Technologies Investment Narrative Recap

At its core, the TTM Technologies story is about capitalizing on growth in advanced electronics for high-demand sectors like AI data centers and defense. Although the recent launch of ultra-small RF components showcases TTM's innovation and potential to address customer needs in these areas, it does not directly resolve the short-term risk around operational challenges and margin pressures in the new Penang, Malaysia facility, which remains a key area to watch in the near term. Of TTM’s recent announcements, the acquisition of the 750,000-square-foot facility in Eau Claire, Wisconsin stands out as highly relevant. This investment supports the push into advanced PCB and interconnect solutions for 5G and data centers, aligning with the same end markets targeted by their new RF products, emphasizing a consistent focus on high-growth opportunities, though it also brings the risk of higher operating expenses if customer demand falls short. Yet, as investors consider the opportunity, it's important not to overlook the ongoing operational hurdles in Malaysia that could...

Read the full narrative on TTM Technologies (it's free!)

TTM Technologies' narrative projects $3.2 billion revenue and $251.1 million earnings by 2028. This requires 6.4% yearly revenue growth and a $157.9 million earnings increase from $93.2 million.

Uncover how TTM Technologies' forecasts yield a $59.00 fair value, in line with its current price.

Exploring Other Perspectives

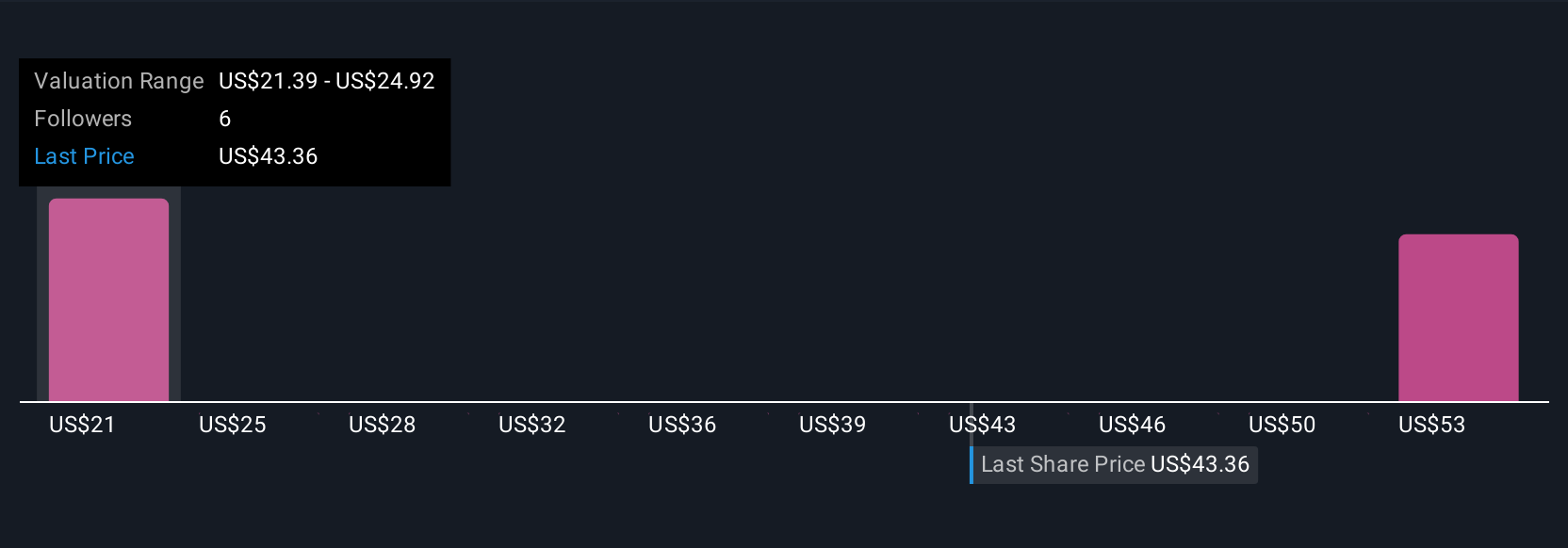

With only two estimates, the Simply Wall St Community values TTM Technologies as low as US$21.41 and as high as US$59. While some expect margin expansion from new product launches, the slow revenue ramp in Malaysia remains a crucial watchpoint shaping future outcomes. Explore more opinions and see where you stand.

Explore 2 other fair value estimates on TTM Technologies - why the stock might be worth less than half the current price!

Build Your Own TTM Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TTM Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TTM Technologies' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives