- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

Assessing TTM Technologies (TTMI) Valuation After Strong Share Price Gains

Reviewed by Simply Wall St

TTM Technologies (TTMI) has seen some intriguing moves in its stock price recently, catching the attention of investors focused on the tech manufacturing sector. The company’s shares reflect shifting sentiment after several weeks of steady gains.

See our latest analysis for TTM Technologies.

After an impressive run, TTM Technologies is riding high with its share price up 177.83% year-to-date and a three-year total shareholder return of 326.28%. The recent burst of momentum suggests renewed confidence and possibly fresh growth prospects, with the latest week’s moves adding to its strong long-term narrative.

If you’re interested in what’s powering other tech manufacturers, now’s a great time to discover the full range with See the full list for free.

With these impressive returns and upbeat momentum, the big question for investors now is whether TTM Technologies' stock is actually undervalued, or if the recent rally has already priced in all its future growth. Could there still be a real buying opportunity here, or has the market already accounted for what’s ahead?

Most Popular Narrative: 10% Undervalued

Compared to the latest close at $68.29, the most widely followed narrative estimates fair value at $76.00 per share. This suggests meaningful upside and strong investor interest in the underlying growth drivers.

Large-scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure. This directly supports revenue growth and long-term customer relationships.

Curious which unexpected growth levers are behind this ambitious price target? The narrative's formula rests on bold forecasts for profitability and margins, hinting at numbers typically reserved for industry leaders. It is a future-oriented story shaped by aggressive assumptions. Get the full breakdown before the next move.

Result: Fair Value of $76.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high operating costs and growing pains in new facilities could quickly challenge the optimistic outlook for TTM Technologies' future earnings and margins.

Find out about the key risks to this TTM Technologies narrative.

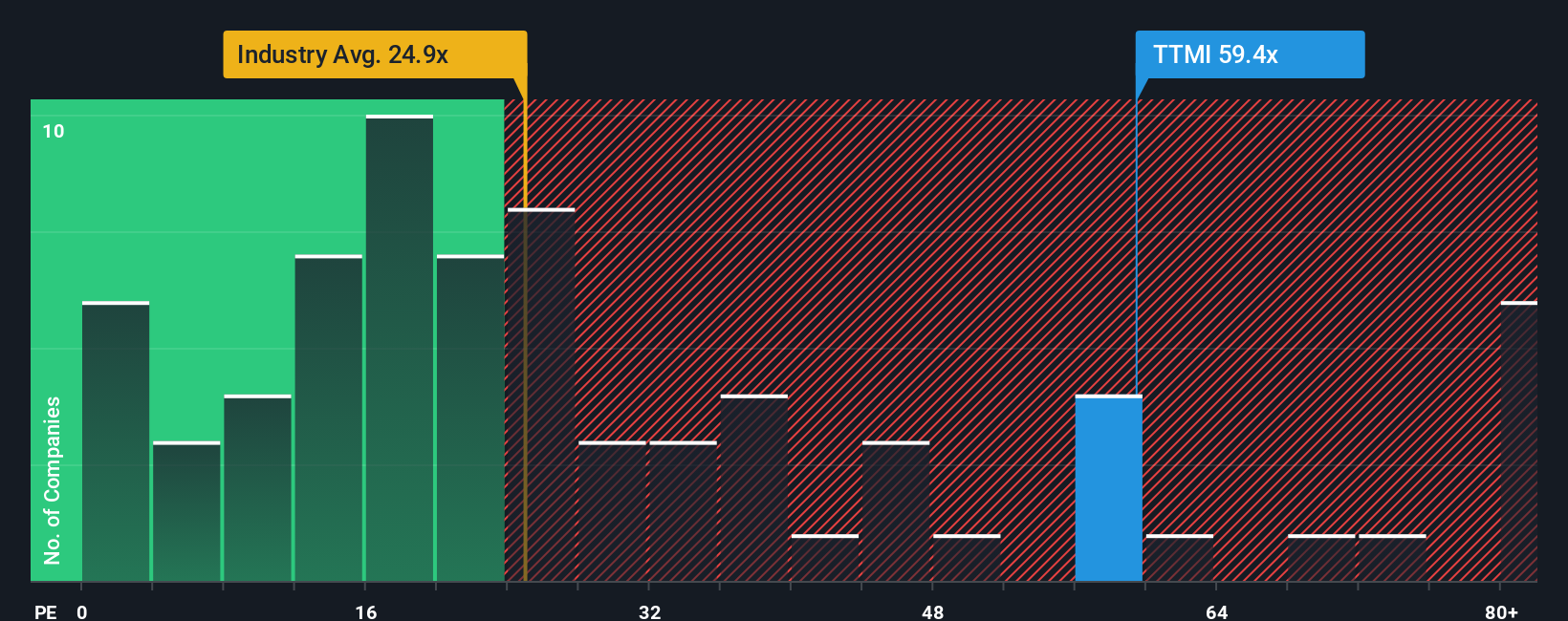

Another View: Price Ratios Raise Questions

While fair value estimates show TTMI as undervalued, the company's price-to-earnings ratio stands at 53.5x. This is notably higher than the US Electronic industry average of 24.7x and its fair ratio of 37.3x. This premium highlights valuation risk for investors and prompts a deeper look at what is truly priced in. Could recent excitement be overestimating the company’s immediate prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TTM Technologies Narrative

If you see the story differently or value your own research, you can dive in and shape your own perspective in just minutes with Do it your way.

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make sure you are not missing out on promising opportunities. Leverage these handpicked shortcuts to find your next great investment with confidence and ease.

- Unlock the potential of future-changing technology by checking out these 25 AI penny stocks, where innovation meets momentum in the artificial intelligence sector.

- Target steady income streams with these 15 dividend stocks with yields > 3%, showcasing companies with impressive yields that can enhance your portfolio's reliability.

- Get ahead of the curve by exploring these 82 cryptocurrency and blockchain stocks, offering unique access to the fast-moving world of cryptocurrency and blockchain pioneers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.