- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Trimble (TRMB): Evaluating Valuation After Major Software Upgrades and Raised Guidance Spark Investor Interest

Reviewed by Simply Wall St

Trimble (TRMB) caught the spotlight after rolling out major software updates and integrations at its annual user conference. In addition to these launches, the company delivered strong Q3 results and raised its full-year guidance.

See our latest analysis for Trimble.

Trimble’s year has been marked by momentum, with its latest earnings beat and raised guidance following high-profile software rollouts and key industry partnerships. The stock’s 11.26% year-to-date share price return is a solid improvement, and its 1-year total shareholder return of nearly 11% shows investors are taking notice. Longer-term performance remains robust, highlighted by a 36% total shareholder return over three years, even as near-term price action remains sensitive to market swings and fresh innovation news.

If Trimble’s rapid progress has you wondering what other opportunities are out there, consider expanding your search and discover fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst targets despite raised guidance and strong product momentum, is this where future growth could still offer upside, or has the market already priced it all in?

Most Popular Narrative: 21.5% Undervalued

Trimble’s widely tracked narrative points to a fair value significantly above the last close of $77.56, setting expectations for solid fundamental growth to drive the price higher over time.

The migration from hardware-focused, CapEx models to bundled, subscription-based offerings, even in traditionally hardware-oriented segments, expands the addressable market, improves revenue visibility, and increases recurring revenue mix. This drives greater predictability and enhances long-term earnings.

Want to know what’s fueling this ambitious price target? The narrative hinges on bold moves into software and a total transformation of future earnings power. Forecasts factor in rapid margin expansion and a significant upward shift in recurring revenue. Curious how all these strategic shifts stack up to support such a premium valuation? Dive in to find out what underpins this big upside.

Result: Fair Value of $98.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic headwinds or a slower transition to recurring software streams could still present challenges to Trimble’s ambitious growth outlook.

Find out about the key risks to this Trimble narrative.

Another View: Upside, But Mind the Price Tag

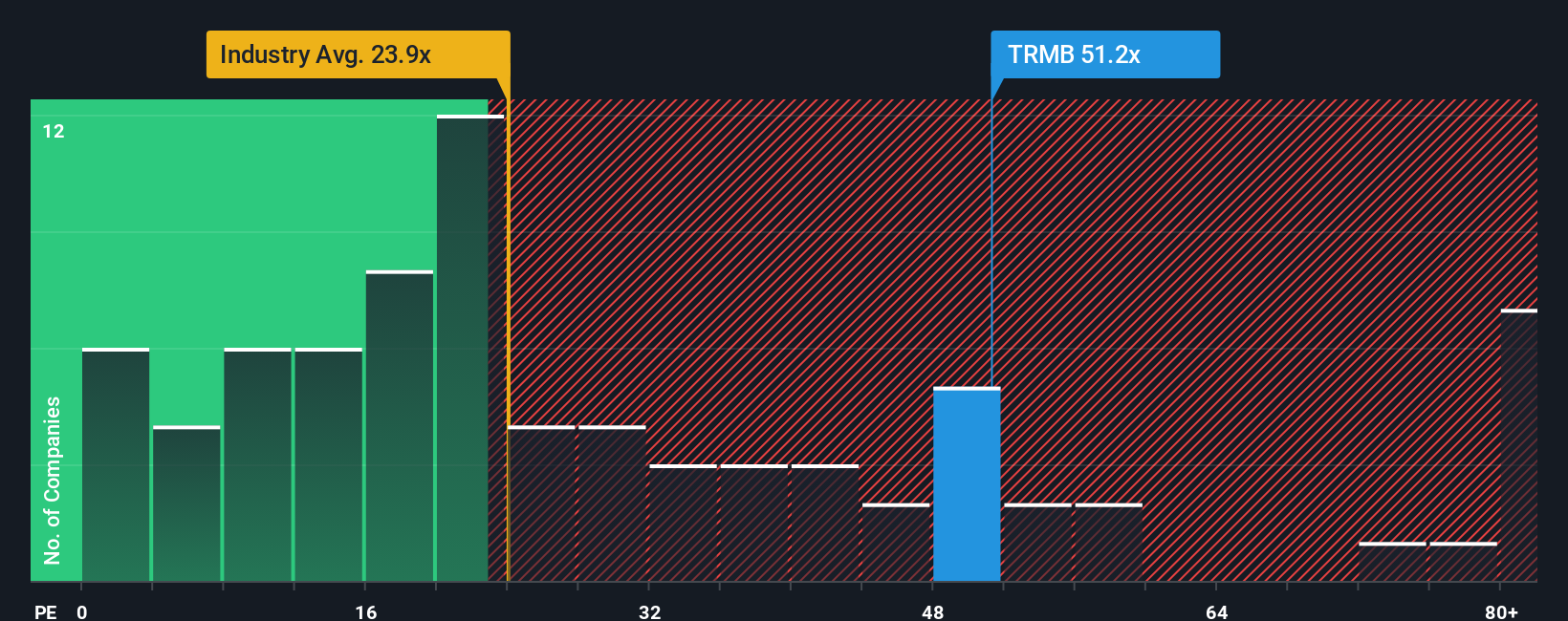

Looking at how Trimble is valued relative to its earnings, the numbers flash a caution sign. Its price-to-earnings ratio stands at 51.6x, which is much higher than both the industry average of 23.7x and its peer average of 40.4x. Even compared to the fair ratio of 33.4x, Trimble looks expensive. This suggests there may be less margin for error if growth falls short. Could the market be overestimating just how fast this shift to software will pay off?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trimble Narrative

If you’d rather take a hands-on approach and shape your own view of Trimble, you can easily build your own story in under three minutes. Do it your way

A great starting point for your Trimble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don't let great investments escape your radar. Simply Wall St’s powerful screener helps you take action on fresh ideas and uncover your next portfolio win in minutes.

- Tap into growth with these 901 undervalued stocks based on cash flows, which are trading at compelling prices based on their future cash flows and potential returns.

- Capture high yields as you review these 16 dividend stocks with yields > 3%, offering strong dividend payouts above the market average and ideal for boosting your passive income.

- Seize the future by checking out these 25 AI penny stocks, accelerating breakthroughs in AI, automation, and digital transformation for tomorrow’s leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives