- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Trimble (NasdaqGS:TRMB) Partners With STMicroelectronics For High-Precision GNSS Solutions

Reviewed by Simply Wall St

Trimble (NasdaqGS:TRMB) saw its stock price rise by 1.48% over the past week. This increase occurred during a time when the broader market was experiencing a decline, with indexes like the Nasdaq Composite dropping 1.3% due to lingering economic concerns. A catalyst for Trimble's positive performance was its collaboration with STMicroelectronics, enhancing automotive and IoT positioning systems with the ProPoint Go and Teseo VI chips. This technology development supports diverse applications such as automotive navigation, boosting market expectations for Trimble's innovation capabilities. Additionally, the company's recent enhancements to its SketchUp software, which now offers improved visualization and interoperability, may further position Trimble as a leader in its field. Despite general market trepidation, fueled by issues such as weaker manufacturing data and inflation fears, Trimble's focus on high-accuracy solutions appears to align with robust demand, providing some insulation against broader market declines.

Dig deeper into the specifics of Trimble here with our thorough analysis report.

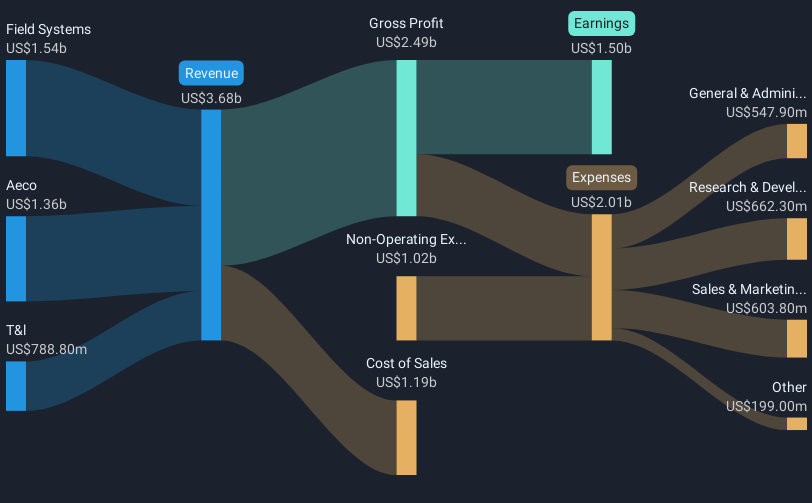

Trimble's total shareholder return of 99.17% over the last five years underscores a period of significant growth for the company. Among the key drivers was its earnings growth, which significantly outpaced the broader electronic industry by a very large margin last year alone. This was supported by a high return on equity of 26.2%, indicating effective management of equity to generate profits. Furthermore, an emphasis on enhancing existing technologies, such as the integration of grade control technology with John Deere's SmartGrade platform, and the launch of the Trimble Marketplace, has bolstered the company’s position within its industry.

Trimble's decision to authorize a US$1 billion share repurchase program also reflects the company's focus on enhancing shareholder value over the long term. Notably, these financial strategies are complemented by robust product advancements, such as the partnership with Qualcomm, marking Trimble's commitment to innovation in positioning systems. Additionally, although there were compliance concerns regarding timely financial filings that threatened its listing status in late 2024, Trimble effectively navigated these challenges, maintaining compliance with Nasdaq regulations.

- Analyze Trimble's fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Trimble's market positioning with our detailed risk analysis report.

- Got skin in the game with Trimble? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives