- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:TAIT

Should Shareholders Worry About Taitron Components Incorporated's (NASDAQ:TAIT) CEO Compensation Package?

Key Insights

- Taitron Components to hold its Annual General Meeting on 29th of May

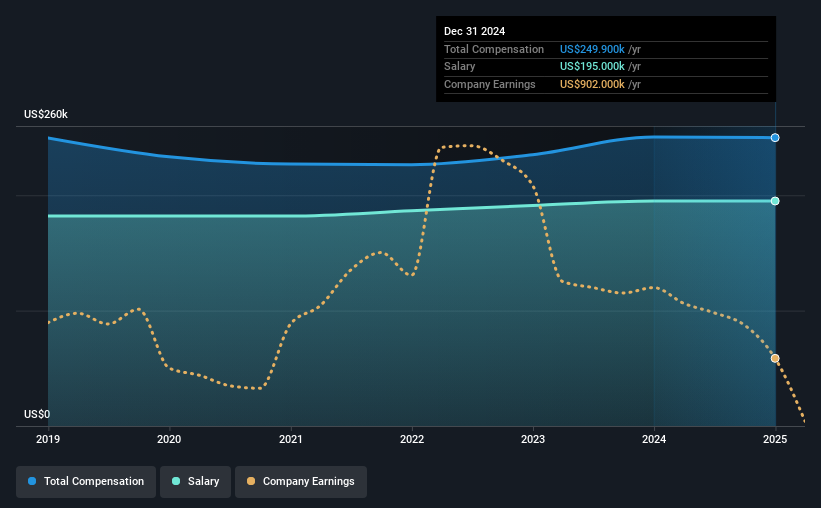

- Total pay for CEO Stewart Wang includes US$195.0k salary

- The total compensation is 46% less than the average for the industry

- Taitron Components' EPS declined by 74% over the past three years while total shareholder loss over the past three years was 17%

The underwhelming performance at Taitron Components Incorporated (NASDAQ:TAIT) recently has probably not pleased shareholders. The next AGM coming up on 29th of May will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for Taitron Components

Comparing Taitron Components Incorporated's CEO Compensation With The Industry

According to our data, Taitron Components Incorporated has a market capitalization of US$13m, and paid its CEO total annual compensation worth US$250k over the year to December 2024. That's mostly flat as compared to the prior year's compensation. In particular, the salary of US$195.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the American Electronic industry with market capitalizations under US$200m, the reported median total CEO compensation was US$462k. Accordingly, Taitron Components pays its CEO under the industry median. Moreover, Stewart Wang also holds US$3.1m worth of Taitron Components stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$195k | US$195k | 78% |

| Other | US$55k | US$55k | 22% |

| Total Compensation | US$250k | US$250k | 100% |

On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. Taitron Components is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Taitron Components Incorporated's Growth Numbers

Over the last three years, Taitron Components Incorporated has shrunk its earnings per share by 74% per year. In the last year, its revenue is down 15%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Taitron Components Incorporated Been A Good Investment?

Since shareholders would have lost about 17% over three years, some Taitron Components Incorporated investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 6 warning signs for Taitron Components you should be aware of, and 2 of them can't be ignored.

Important note: Taitron Components is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Taitron Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:TAIT

Taitron Components

Engages in the supply of original designed and manufactured (ODM) electronic components, and distribution of brand name electronic components.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026