- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:TAIT

Is Now The Time To Put Taitron Components (NASDAQ:TAIT) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Taitron Components (NASDAQ:TAIT). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Taitron Components

How Fast Is Taitron Components Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Taitron Components has grown EPS by 23% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

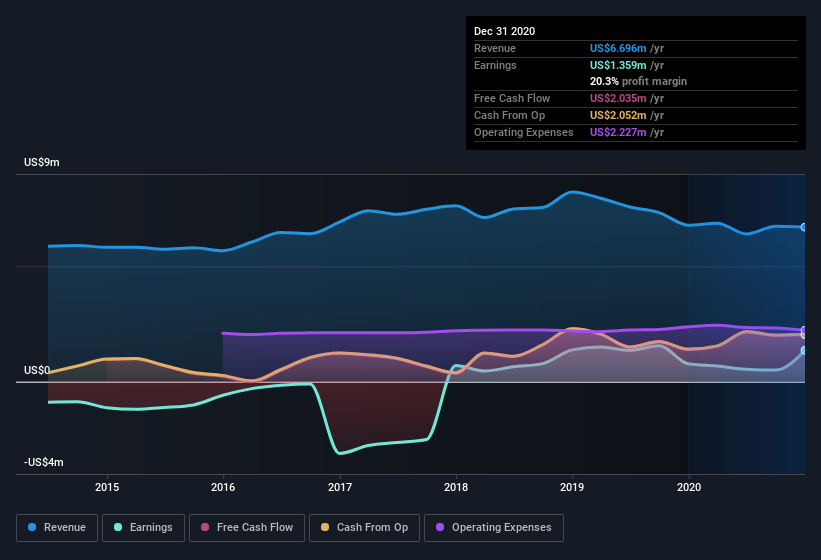

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 5.4 percentage points to 16%, in the last twelve months. That's something to smile about.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Taitron Components is no giant, with a market capitalization of US$25m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Taitron Components Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Taitron Components insiders own a meaningful share of the business. In fact, they own 48% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Taitron Components is a very small company, with a market cap of only US$25m. That means insiders only have US$12m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Taitron Components with market caps under US$200m is about US$533k.

The CEO of Taitron Components only received US$233k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Taitron Components To Your Watchlist?

You can't deny that Taitron Components has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes Taitron Components look rather interesting indeed. You should always think about risks though. Case in point, we've spotted 3 warning signs for Taitron Components you should be aware of.

Although Taitron Components certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Taitron Components, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taitron Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:TAIT

Taitron Components

Engages in the supply of original designed and manufactured (ODM) electronic components, and distribution of brand name electronic components.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)