- United States

- /

- Tech Hardware

- /

- NasdaqGM:TACT

Is TransAct Technologies (NASDAQ:TACT) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies TransAct Technologies Incorporated (NASDAQ:TACT) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for TransAct Technologies

What Is TransAct Technologies's Debt?

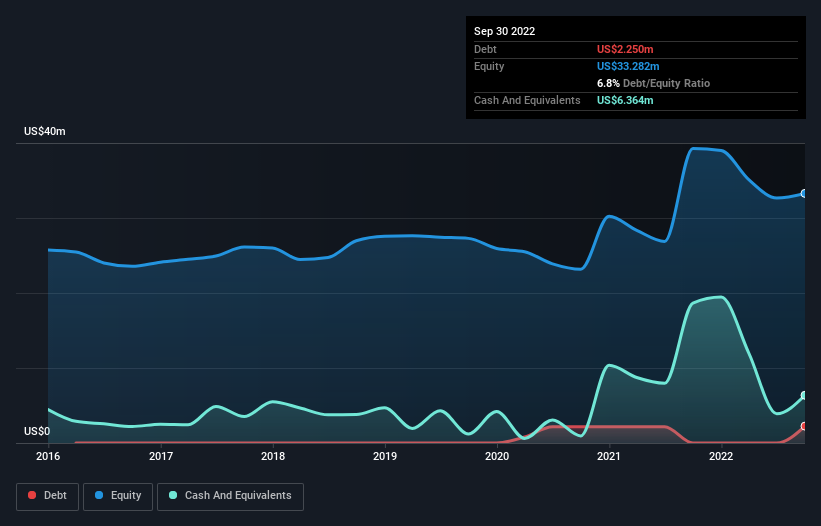

You can click the graphic below for the historical numbers, but it shows that as of September 2022 TransAct Technologies had US$2.25m of debt, an increase on none, over one year. However, its balance sheet shows it holds US$6.36m in cash, so it actually has US$4.11m net cash.

How Strong Is TransAct Technologies' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that TransAct Technologies had liabilities of US$14.4m due within 12 months and liabilities of US$2.27m due beyond that. Offsetting these obligations, it had cash of US$6.36m as well as receivables valued at US$15.1m due within 12 months. So it can boast US$4.85m more liquid assets than total liabilities.

This surplus suggests that TransAct Technologies has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, TransAct Technologies boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if TransAct Technologies can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year TransAct Technologies wasn't profitable at an EBIT level, but managed to grow its revenue by 42%, to US$51m. With any luck the company will be able to grow its way to profitability.

So How Risky Is TransAct Technologies?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year TransAct Technologies had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$15m and booked a US$7.1m accounting loss. With only US$4.11m on the balance sheet, it would appear that its going to need to raise capital again soon. With very solid revenue growth in the last year, TransAct Technologies may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with TransAct Technologies .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if TransAct Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TACT

TransAct Technologies

Designs, develops, and markets transaction-based and specialty printers and terminals in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026