- United States

- /

- Tech Hardware

- /

- NasdaqGM:TACT

Downgrade: Here's How Analysts See TransAct Technologies Incorporated (NASDAQ:TACT) Performing In The Near Term

Market forces rained on the parade of TransAct Technologies Incorporated (NASDAQ:TACT) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

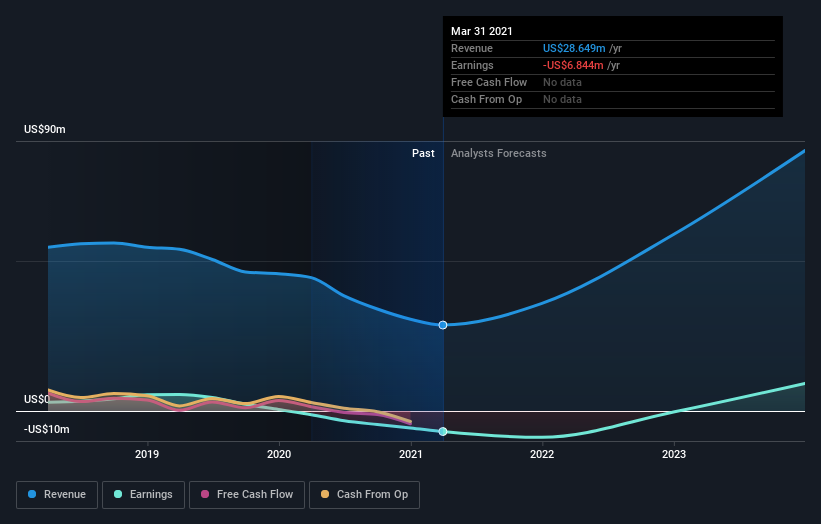

Following the downgrade, the current consensus from TransAct Technologies' two analysts is for revenues of US$36m in 2021 which - if met - would reflect a major 25% increase on its sales over the past 12 months. Per-share losses are expected to see a sharp uptick, reaching US$0.97. However, before this estimates update, the consensus had been expecting revenues of US$41m and US$0.71 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for TransAct Technologies

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that TransAct Technologies' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 35% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 11% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 4.6% annually. Not only are TransAct Technologies' revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at TransAct Technologies. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on TransAct Technologies, and their negativity could be grounds for caution.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for TransAct Technologies going out as far as 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade TransAct Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TransAct Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:TACT

TransAct Technologies

Designs, develops, and markets transaction-based and specialty printers and terminals in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.