- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

What Seagate Technology Holdings (STX)'s Appointment of Finance Leader Szlosek Means for Shareholders

Reviewed by Simply Wall St

- On August 23, 2025, Seagate Technology Holdings announced the appointment of Thomas Szlosek, an experienced financial leader with a background spanning technology, automotive, and manufacturing, to its Board of Directors and Audit and Finance Committee.

- Szlosek’s current leadership role as CFO at AutoNation and board experience in transportation and storage solutions add depth to Seagate’s financial and governance expertise.

- We’ll explore how Szlosek’s appointment and the surge in cloud-driven storage demand are shaping Seagate’s investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Seagate Technology Holdings Investment Narrative Recap

If you’re considering Seagate Technology Holdings, it’s important to focus on the ongoing surge in cloud-driven storage demand that is fueling the company’s outlook and supporting earnings. The recent appointment of Thomas Szlosek to the Board and Audit and Finance Committee is not expected to materially change near-term business catalysts or address the primary headwind, the significant increase in corporate tax rates forecast for fiscal 2026, which could pressure future profitability.

The most relevant recent company update remains Seagate’s strong June quarter, highlighted by record Nearline drive shipments that coincided with robust cloud infrastructure spending. This performance points directly to the very catalyst underpinning Seagate’s current narrative: cloud-related storage growth and its impact on the company’s revenue trajectory.

However, investors should be aware that despite these tailwinds, Seagate faces a substantial tax rate hike in 2026 that could...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings is projected to reach $12.0 billion in revenue and $2.5 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 9.5% and a $1.0 billion increase in earnings from the current $1.5 billion.

Uncover how Seagate Technology Holdings' forecasts yield a $163.53 fair value, in line with its current price.

Exploring Other Perspectives

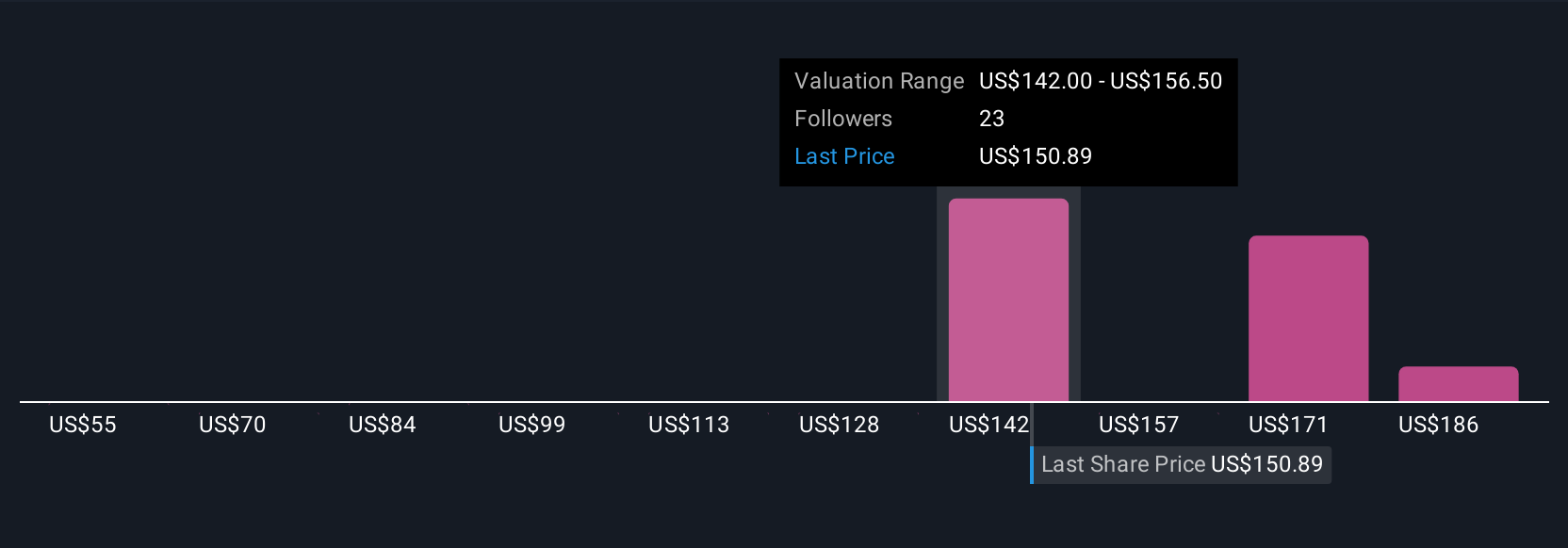

Five community contributors on Simply Wall St put fair value between US$55 and US$222, showing a broad range of expectations. This wide spread of estimates sits against the backdrop of regulatory headwinds like the global minimum tax, reinforcing the importance of comparing multiple viewpoints.

Explore 5 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as 35% more than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Established dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives