- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate Technology (STX): Unpacking the Valuation Story After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Seagate Technology Holdings.

While Seagate’s share price experienced a sharp pullback this week, the bigger story is its remarkable momentum. The stock has delivered a 148.2% year-to-date share price return and an impressive 99.97% total shareholder return over the past year, showing strong long-term performance even with some near-term volatility.

If you’re interested in expanding your tech watchlist beyond storage leaders, now’s the perfect opportunity to discover See the full list for free.

With Seagate near its all-time highs and trading above most analyst price targets, is this continued rally a sign investors are overlooking hidden value, or is the future growth story already fully priced in?

Most Popular Narrative: 11.7% Overvalued

Seagate Technology Holdings is pegged by the most watched narrative as trading well above its fair value, with a fair value estimate of $192 and a recent close of $214.38. The narrative highlights the disconnect between current price momentum and the outlook behind the numbers, setting the stage for a deeper look at what is fueling this premium.

Several analysts see the storage industry in the early stages of a multi-year profit cycle, with structurally improved industry profitability and the potential for further "beat/raise" quarters as demand for exabyte shipments outpaces supply growth. Bearish analysts acknowledge recent strong execution and cloud demand but caution that EPS and margin growth may decelerate after 2H 2025, highlighting potential risks of growth peaking and monitoring for signs that quarterly shipment growth could slow.

Want to know what fuels this heady valuation? Massive gains are not just about hype. The narrative hinges on critical earnings jumps and ambitious profit margin targets. These details might surprise you. Find out what assumptions power this high-stakes outlook by reading on.

Result: Fair Value of $192 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including trade policy uncertainty and persistent supply constraints. These factors could disrupt revenue momentum and test the narrative’s resilience.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: Looking at Price Ratios

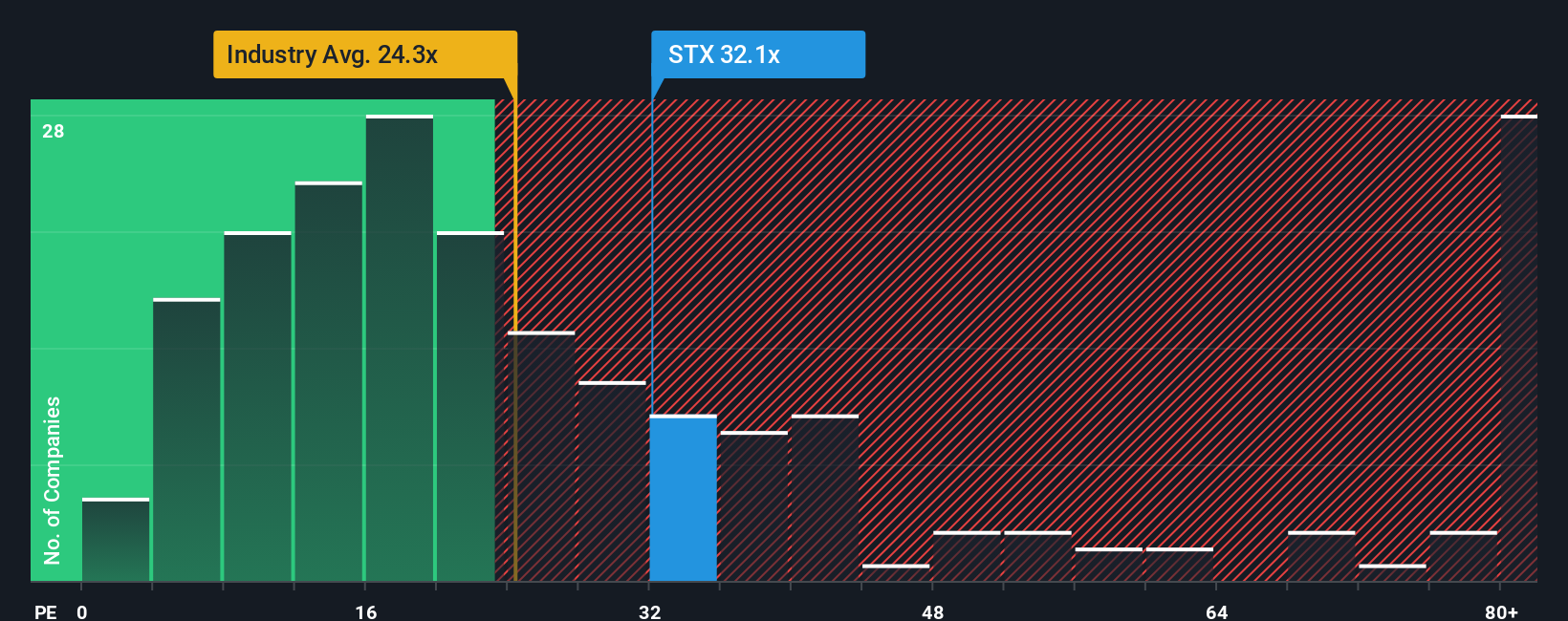

An alternative perspective comes from looking at Seagate’s price-to-earnings ratio. At 31x earnings, the stock is noticeably more expensive than both its global technology peers, which average 24.3x, and its closest competitors at 20.8x. The fair ratio, based on market trends, is estimated at 35.1x. This suggests there might be more room to run, but the premium price increases the risk if future growth disappoints. Could valuation optimism be running too far ahead of the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seagate Technology Holdings Narrative

If you see the numbers differently or want to dig into the details yourself, you can craft your own Seagate narrative from scratch in just minutes with Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Now is the time to get ahead of the crowd with fresh stock opportunities uniquely matched to your investment goals, all at your fingertips with the Simply Wall Street Screener.

- Pinpoint future winners by unlocking access to these 898 undervalued stocks based on cash flows packed with stocks trading below their true worth, giving you an advantage in the hunt for growth.

- Capitalize on transformative medical advances with these 33 healthcare AI stocks and follow companies harnessing artificial intelligence to reshape the industry.

- Take charge of your financial future and boost your portfolio’s income stream with these 19 dividend stocks with yields > 3% featuring stocks offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.