- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate Technology Holdings (NasdaqGS:STX) Soars 40% Over Last Month

Reviewed by Simply Wall St

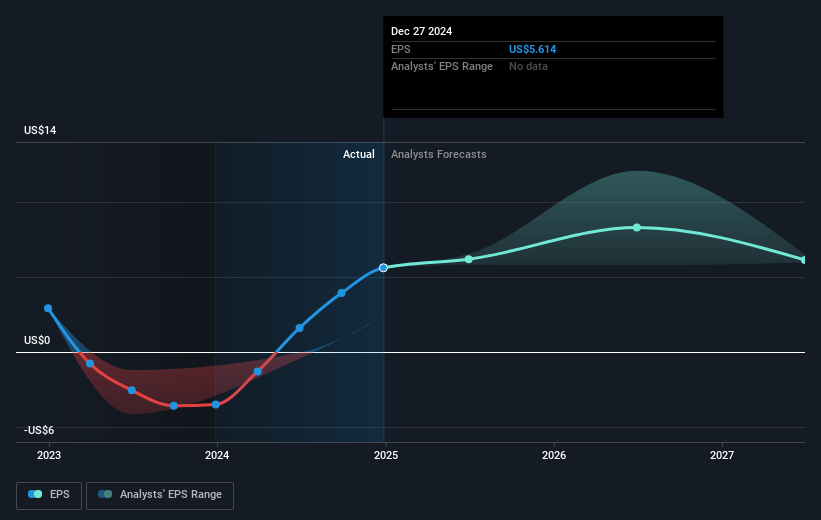

Seagate Technology Holdings (NasdaqGS:STX) witnessed a remarkable 40% increase in its share price over the past month, driven in part by its impressive Q3 earnings. The company reported sales of $2,160 million, a significant rise from $1,655 million year-over-year, and net income of $340 million, up from $25 million. The declaration of a $0.72 per share dividend and optimistic guidance for fiscal Q4 2025 further bolstered investor confidence. In contrast, the broader market faced some volatility due to trade policy uncertainties, making Seagate's robust performance stand out amidst these broader economic conditions.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The recent 40% boost in Seagate Technology Holdings' share price, driven by strong Q3 earnings and robust guidance, aligns well with the company's strengthening demand for data storage solutions. This momentum is likely to influence the projected revenue growth and could enhance earnings forecasts, supported by the company's ongoing innovation in Mozaic drives and strategic pricing initiatives. The declared dividend also indicates a commitment to returning value to shareholders, potentially reinforcing investor confidence.

Over the past five years, Seagate’s total shareholder return, including dividends, was 126.66%, reflecting substantial long-term growth. This growth contrasts with its performance over the past year, where it underperformed the US Tech industry, which saw an 11% return. The recent share price increase narrows the gap with the consensus analyst price target of $107.83, making it 22.9% higher than the current price of $81.6, suggesting room for further appreciation. However, it's essential to consider market volatility and competitive pressures that might impact future valuations and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Seagate Technology Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives