- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate Technology Holdings (NasdaqGS:STX) Reports Strong Q3 Earnings

Reviewed by Simply Wall St

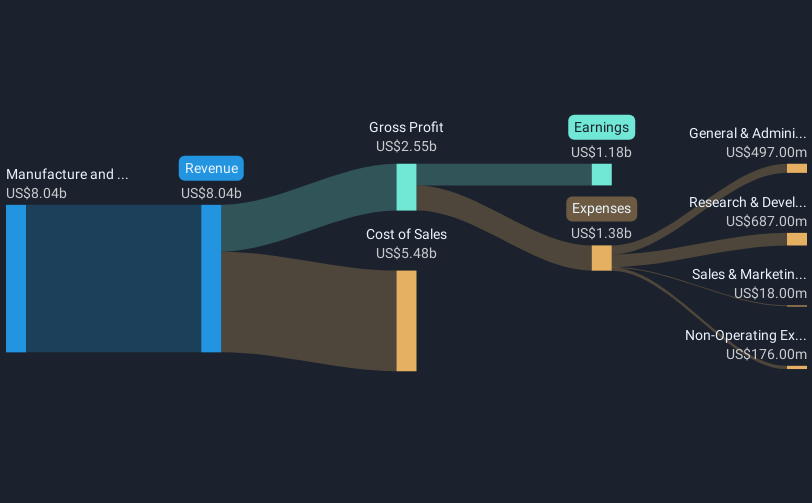

Seagate Technology Holdings (NasdaqGS:STX) recently reported strong third-quarter earnings, showcasing significant year-over-year growth in sales and net income. Additionally, the company raised its equity buyback authorization by $5 billion, highlighting a commitment to enhancing shareholder value. These developments may align with Seagate's notable 43% share price surge in the past month. The broader Nasdaq Composite's gains, partly fueled by the tech sector's rally following Nvidia's earnings, provided a favorable backdrop for Seagate's rise, while changes in the executive board and announced dividends possibly added further support to the overall positive sentiment.

Find companies with promising cash flow potential yet trading below their fair value.

The recent news of Seagate Technology Holdings boosting its equity buyback program could bolster investor confidence, potentially influencing future share value. The buyback might reduce the number of shares outstanding, which could positively affect earnings per share. However, the long-term financial gains will heavily rely on how well the company manages factors like competition and manufacturing efficiencies, as outlined in the company's narrative. Despite these challenges, Seagate remains focused on capitalizing on technological advancements and expanding demand for mass capacity storage solutions to enhance revenue streams.

Over the past five years, Seagate has seen a total shareholder return of 166.77%, illustrating substantial long-term growth. When compared to the broader U.S. market return of 11.3% in the past year, Seagate's 1-year performance has outpaced these returns, indicating a stronger recent performance relative to the market. However, growth forecasts suggest more modest future increases in earnings and revenue.

Seagate's recent share price surge places it in close proximity to the consensus price target of US$116.08, reflecting a slight discount that suggests room for potential appreciation. The earnings growth forecast and Seagate's strategic initiatives are critical elements that could further influence its trajectory toward this target. The alignment of Seagate's strategic goals with the capital market's performance metrics will be crucial in sustaining investor interest and achieving projected revenue growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion