- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Is Seagate Still a Good Bet After 192% Rally and New AI Storage Demand?

Reviewed by Bailey Pemberton

If you have been watching Seagate Technology Holdings, you are definitely not alone. With a jaw-dropping 192.6% gain so far this year and a five-year return of 488.3%, the stock has caught the attention of investors questioning if they have already missed the party or if there may be more gains ahead. Seagate’s recent 16.2% jump just in the last week, and a 34.3% surge over the last month, point to a company riding a powerful wave fueled by shifts in tech demand, breakthroughs in data storage, or changing market optimism about its long-term potential.

But even with these staggering numbers, valuation remains top of mind for savvy investors. Is Seagate Technology worth its current price, or are we looking at a case of enthusiasm outpacing the company’s fundamentals? According to our value score, where 0 means not undervalued across six valuation checks and 6 signals deep value, Seagate currently scores a 0. That means, by these traditional metrics, the stock is not undervalued right now.

This sets the stage for a deeper dive into what those valuation methods actually reveal and why, for long-term investors, there might be a smarter way to gauge whether Seagate Technology is a buy, hold, or sell from here.

Seagate Technology Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Seagate Technology Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting them back to today's dollars. For Seagate Technology Holdings, this approach uses current and forecasted Free Cash Flows (FCF) to provide a longer-term perspective on the stock's intrinsic worth.

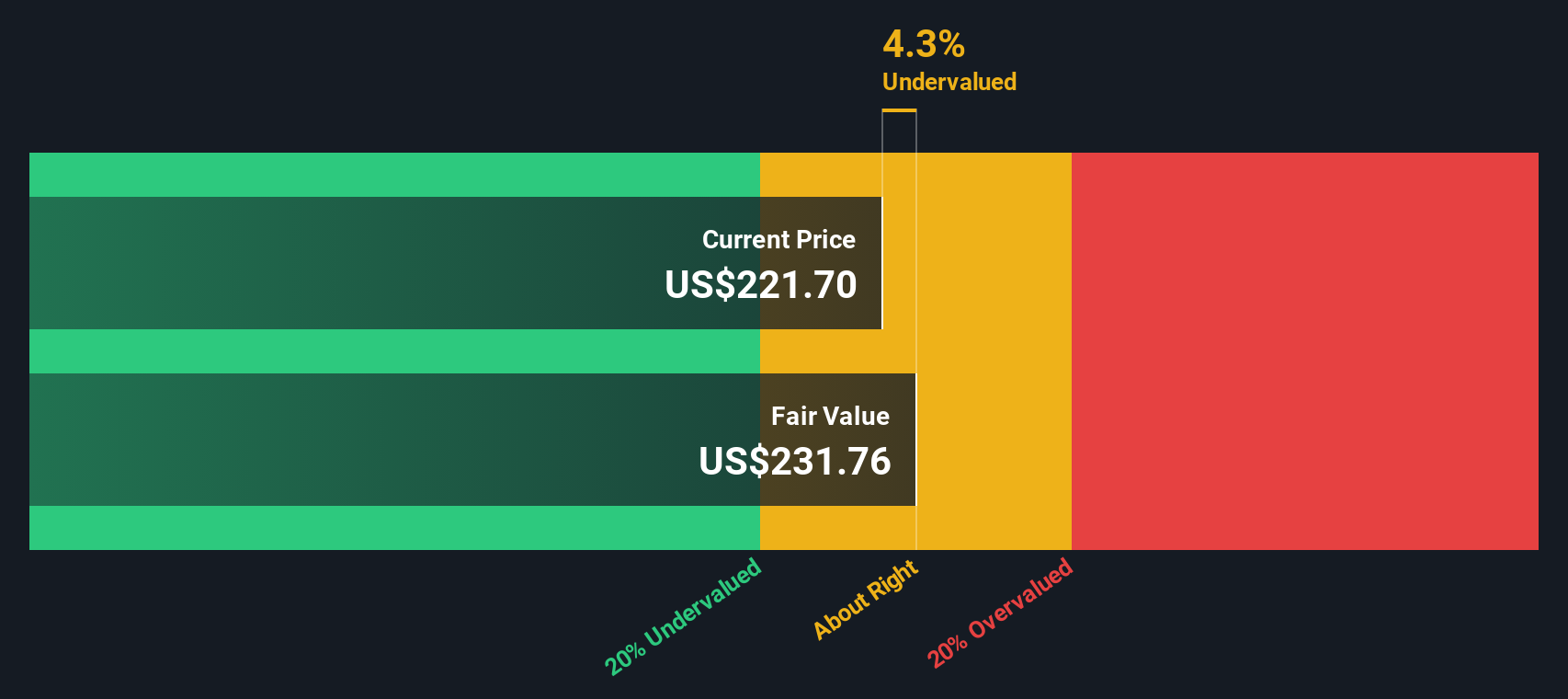

Seagate's most recent trailing twelve month Free Cash Flow stands at $753.4 million. According to analysts, FCF is expected to grow rapidly over the next five years, reaching $2.70 billion by 2030. Since analysts only provide estimates for up to five years, projections beyond that are extrapolated by Simply Wall St. The use of a "2 Stage Free Cash Flow to Equity" approach is designed to reflect both near-term growth and a more stable, mature phase.

After calculating all future cash flows and discounting them back, the intrinsic value for Seagate Technology Holdings comes out to $233.29 per share. Compared to the current share price, this suggests the stock is approximately 8.4% overvalued based on its long-term cash generation potential.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Seagate Technology Holdings's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Seagate Technology Holdings Price vs Earnings (PE)

For profitable companies like Seagate Technology Holdings, the Price-to-Earnings (PE) ratio is widely considered a relevant yardstick for valuation. PE multiples are useful because they relate a company's share price directly to its earnings, giving investors an instant snapshot of how much they are paying for every dollar of profit.

What determines a "normal" or "fair" PE ratio often comes down to a mix of market expectations for future earnings growth and overall risk. Higher growth prospects or lower perceived risk tend to justify a higher PE. In contrast, slower growth or higher perceived risk usually lead investors to demand a lower price relative to earnings.

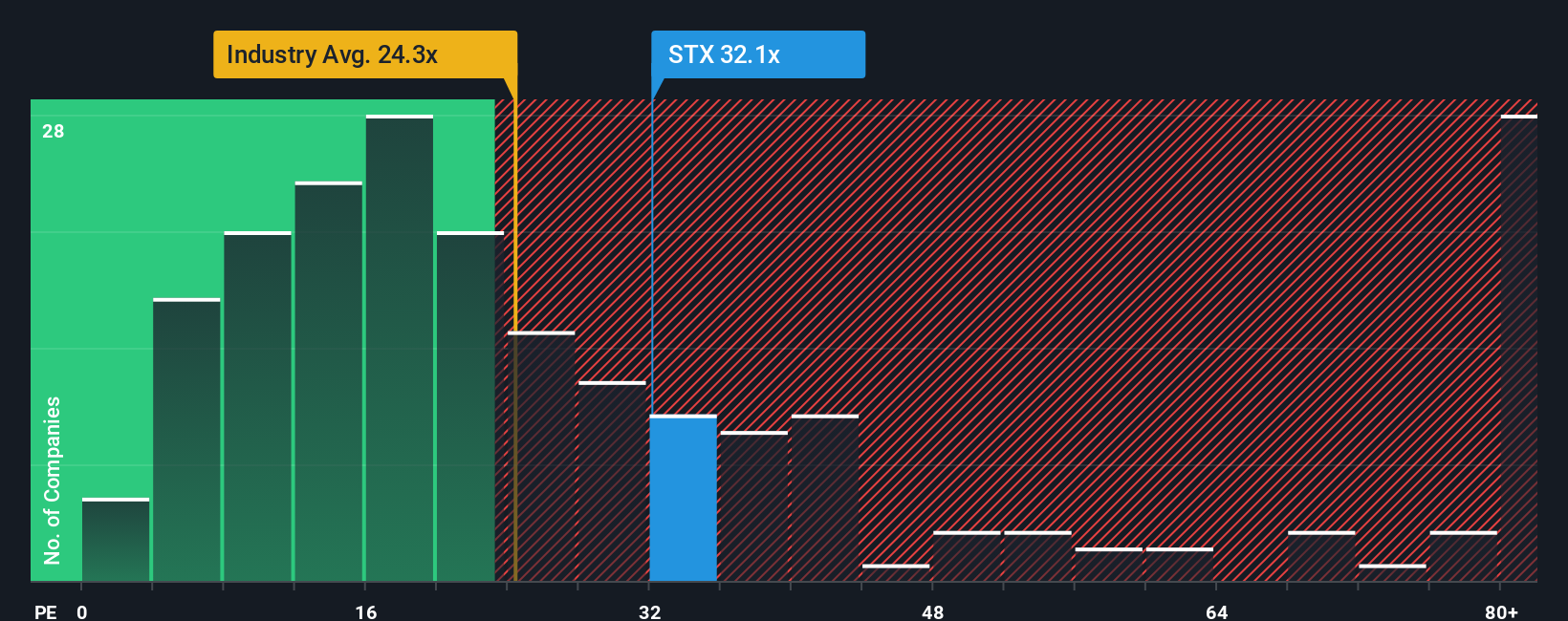

Currently, Seagate Technology trades at a PE ratio of 36.6x, which is much higher than the broader Tech industry average of 24x and above its peer group at 21.5x. However, these simple comparisons do not account for company-specific factors. That is why Simply Wall St’s proprietary “Fair Ratio” is crucial here. This metric takes a holistic view, adjusting for earnings growth, profit margins, the company’s risks, market cap, and its particular industry characteristics. The aim is to capture what Seagate’s true PE “should” be at this time.

Seagate’s Fair Ratio is 35.2x, which is almost identical to its actual PE of 36.6x. This alignment suggests the market price is broadly in line with what these fundamentals support. Based on this metric, the stock appears fairly valued relative to its earnings power and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Seagate Technology Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful method used by investors to tell the story behind a company's numbers, articulating your own expectations for Seagate’s future revenue growth, earnings, and profit margins, and anchoring them to a fair value estimate.

This approach bridges the gap between financial forecasts and valuation by allowing you to easily map Seagate's business outlook, whether optimistic or cautious, directly to what you believe the stock is worth. Narratives are readily accessible on Simply Wall St’s platform within the Community page, making it effortless for millions of investors to share and compare perspectives on when to buy, hold, or sell a stock by contrasting their own fair value estimates with the current market price.

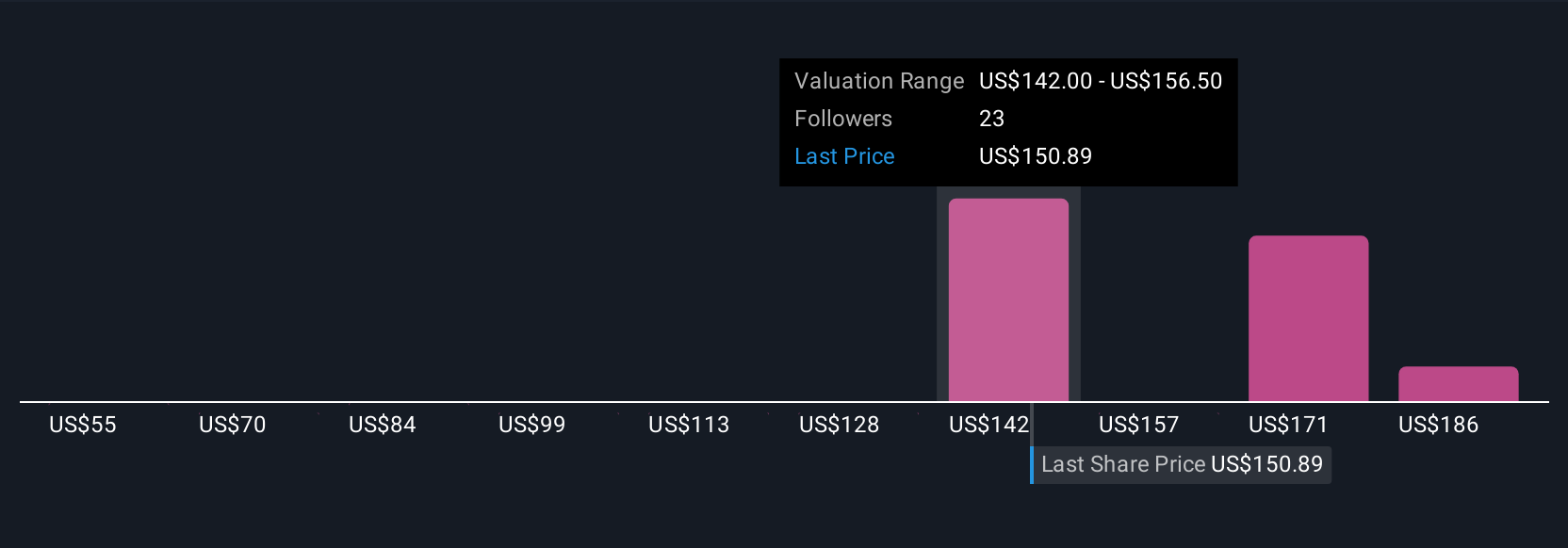

Unlike static models, Narratives are dynamically updated whenever new information arrives, such as earnings reports or news headlines, so your investment thesis can evolve alongside the company’s real-world performance. For example, some Seagate investors are targeting a fair value as high as $200 based on bullish views around AI-driven storage demand, while others are more cautious with a price target as low as $80, reflecting concerns about competition and future growth risks.

Do you think there's more to the story for Seagate Technology Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives