- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

How 30TB HAMR Drive Launch at Seagate (STX) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Seagate Technology Holdings recently announced the global availability of its new 30TB Exos M and IronWolf Pro hard drives, utilizing Mozaic 3+™ and HAMR technology to address surging enterprise and AI-driven storage demands.

- This launch not only marks an industry milestone in high-density hard drives but also highlights Seagate’s role in shaping scalable, energy-efficient solutions as data center needs accelerate alongside AI adoption.

- We’ll explore how the industry’s highest-density HAMR-based drive could shape Seagate’s evolving outlook for growth in large-scale AI storage infrastructure.

Find companies with promising cash flow potential yet trading below their fair value.

Seagate Technology Holdings Investment Narrative Recap

To be a Seagate shareholder today, you need to believe that enterprise and AI-led demand for mass-capacity storage will keep accelerating, and that breakthroughs like the new 30TB HAMR drives will underpin meaningful revenue expansion. While this news strengthens Seagate’s case for benefiting from the AI storage build-out, the biggest short-term catalyst remains the pace of customer adoption of next-generation drives; conversely, advances in competing SSD and NAND technologies continue to pose the most notable risk. If those substitution risks accelerate, the news may not be as material to near-term growth as it appears.

Of Seagate’s recent moves, the 30TB Exos M and IronWolf Pro drive launch is most relevant, as it offers the industry’s highest-density HAMR-based storage to address surging AI and data center needs. This launch builds directly on earlier announcements about extending Mozaic 3+ capacity points, further positioning Seagate around the most important growth catalysts in mass-capacity AI infrastructure, just as market adoption rates become crucial.

Yet, in sharp contrast, investors should pay close attention to the risk that rapid improvements in SSD and QLC NAND technologies could challenge Seagate’s hard drive demand, especially as...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings is projected to reach $10.7 billion in revenue and $1.7 billion in earnings by 2028. This forecast assumes a 7.8% annual revenue growth rate and a $0.2 billion increase in earnings from current earnings of $1.5 billion.

Exploring Other Perspectives

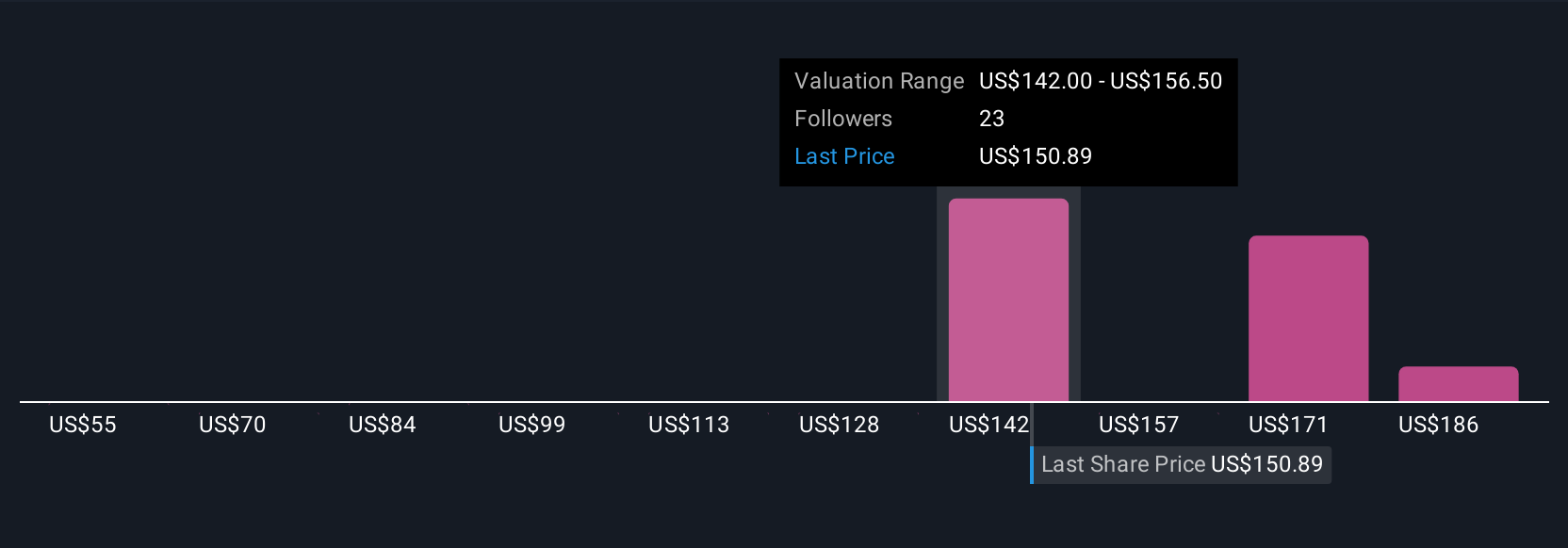

Five Simply Wall St Community fair value estimates for Seagate range from US$55 to US$198, offering a spectrum of views on its upside. As competing SSD and NAND technologies advance, consider how different perspectives may frame this critical risk to Seagate’s performance.

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives