- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SPCB

SuperCom's (NASDAQ:SPCB) Returns On Capital Are Heading Higher

There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at SuperCom (NASDAQ:SPCB) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for SuperCom:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.012 = US$517k ÷ (US$50m - US$6.4m) (Based on the trailing twelve months to June 2024).

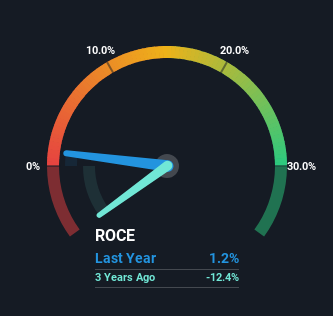

So, SuperCom has an ROCE of 1.2%. Ultimately, that's a low return and it under-performs the Electronic industry average of 10%.

See our latest analysis for SuperCom

Above you can see how the current ROCE for SuperCom compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for SuperCom .

How Are Returns Trending?

Shareholders will be relieved that SuperCom has broken into profitability. While the business was unprofitable in the past, it's now turned things around and is earning 1.2% on its capital. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. With no noticeable increase in capital employed, it's worth knowing what the company plans on doing going forward in regards to reinvesting and growing the business. Because in the end, a business can only get so efficient.

One more thing to note, SuperCom has decreased current liabilities to 13% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.

The Bottom Line On SuperCom's ROCE

To sum it up, SuperCom is collecting higher returns from the same amount of capital, and that's impressive. And since the stock has dived 97% over the last five years, there may be other factors affecting the company's prospects. In any case, we believe the economic trends of this company are positive and looking into the stock further could prove rewarding.

One more thing: We've identified 6 warning signs with SuperCom (at least 4 which are significant) , and understanding these would certainly be useful.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPCB

SuperCom

Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks