- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SPCB

SuperCom Ltd.'s (NASDAQ:SPCB) Price Is Right But Growth Is Lacking After Shares Rocket 32%

SuperCom Ltd. (NASDAQ:SPCB) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 108% in the last year.

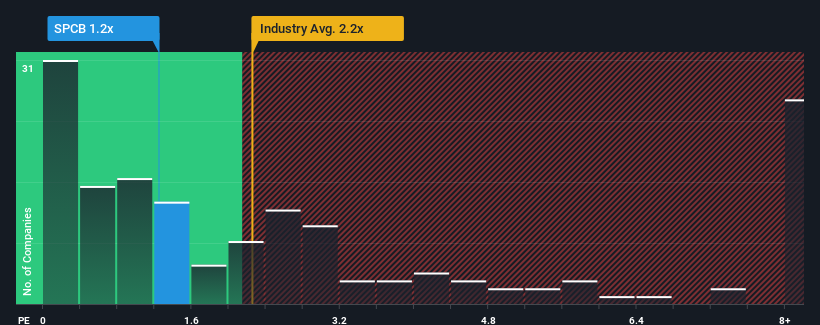

Even after such a large jump in price, SuperCom's price-to-sales (or "P/S") ratio of 1.2x might still make it look like a buy right now compared to the Electronic industry in the United States, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Our free stock report includes 4 warning signs investors should be aware of before investing in SuperCom. Read for free now.See our latest analysis for SuperCom

How Has SuperCom Performed Recently?

Recent times haven't been great for SuperCom as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think SuperCom's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For SuperCom?

SuperCom's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 2.9% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 127% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.6% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 16% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that SuperCom's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does SuperCom's P/S Mean For Investors?

SuperCom's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of SuperCom's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with SuperCom (including 2 which are a bit concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPCB

SuperCom

Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026