- United States

- /

- Tech Hardware

- /

- NasdaqCM:SONM

We're Keeping An Eye On Sonim Technologies' (NASDAQ:SONM) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Sonim Technologies (NASDAQ:SONM) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Sonim Technologies

Does Sonim Technologies Have A Long Cash Runway?

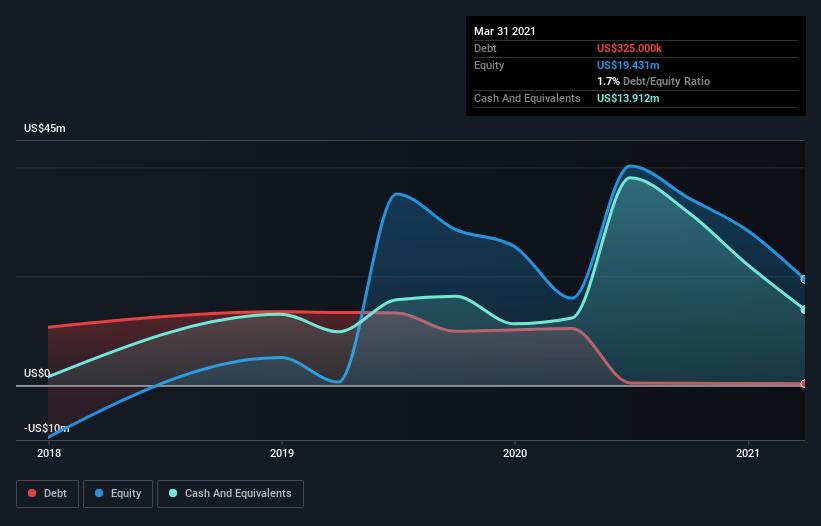

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2021, Sonim Technologies had cash of US$14m and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through US$20m. Therefore, from March 2021 it had roughly 8 months of cash runway. Importantly, analysts think that Sonim Technologies will reach cashflow breakeven in 2 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Sonim Technologies Growing?

We reckon the fact that Sonim Technologies managed to shrink its cash burn by 33% over the last year is rather encouraging. Unfortunately, however, operating revenue declined by 38% during the period. Considering both these factors, we're not particularly excited by its growth profile. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Sonim Technologies To Raise More Cash For Growth?

Given Sonim Technologies' revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$34m, Sonim Technologies' US$20m in cash burn equates to about 59% of its market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

Is Sonim Technologies' Cash Burn A Worry?

On this analysis of Sonim Technologies' cash burn, we think its cash burn reduction was reassuring, while its cash burn relative to its market cap has us a bit worried. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Summing up, we think the Sonim Technologies' cash burn is a risk, based on the factors we mentioned in this article. Taking an in-depth view of risks, we've identified 4 warning signs for Sonim Technologies that you should be aware of before investing.

Of course Sonim Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Sonim Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SONM

Sonim Technologies

Provides enterprise 5G solutions in the United States, Canada, Europe, the Middle East, and the Asia Pacific.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives