- United States

- /

- Tech Hardware

- /

- NasdaqCM:SONM

Sonim Technologies (NASDAQ:SONM) Might Be Having Difficulty Using Its Capital Effectively

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Sonim Technologies (NASDAQ:SONM), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Sonim Technologies is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.017 = US$409k ÷ (US$59m - US$34m) (Based on the trailing twelve months to September 2023).

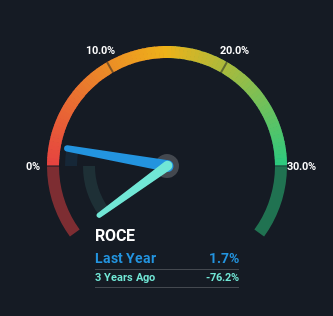

So, Sonim Technologies has an ROCE of 1.7%. In absolute terms, that's a low return and it also under-performs the Tech industry average of 7.5%.

See our latest analysis for Sonim Technologies

In the above chart we have measured Sonim Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Sonim Technologies.

The Trend Of ROCE

When we looked at the ROCE trend at Sonim Technologies, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 1.7% from 16% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

On a side note, Sonim Technologies has done well to pay down its current liabilities to 58% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE. Either way, they're still at a pretty high level, so we'd like to see them fall further if possible.

The Bottom Line On Sonim Technologies' ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Sonim Technologies is reinvesting for growth and has higher sales as a result. But since the stock has dived 94% in the last three years, there could be other drivers that are influencing the business' outlook. Regardless, reinvestment can pay off in the long run, so we think astute investors may want to look further into this stock.

Sonim Technologies does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable...

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SONM

DNA X

Provides enterprise 5G solutions in the United States, Canada, Europe, the Middle East, and the Asia Pacific.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Alphabet will shine

Tesla's Revenue to Soar 16% as Fair Value Hits 391.81 in Five Years

The $200 Billion Gamble: Can AWS Outrun the AI Capex Monster?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion