- United States

- /

- Tech Hardware

- /

- NasdaqCM:SONM

Sonim Technologies, Inc. (NASDAQ:SONM) Shares Fly 27% But Investors Aren't Buying For Growth

Sonim Technologies, Inc. (NASDAQ:SONM) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

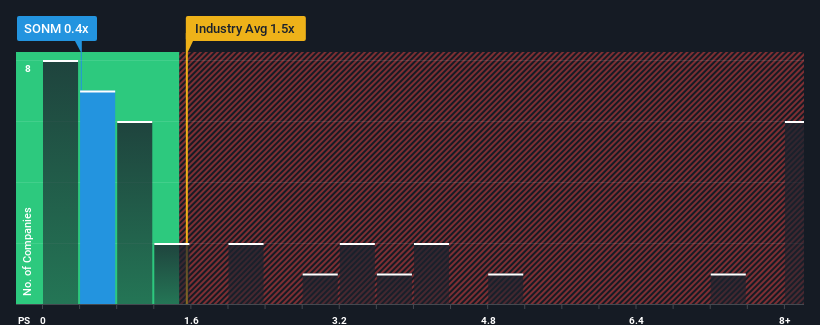

Even after such a large jump in price, Sonim Technologies may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Tech industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sonim Technologies

What Does Sonim Technologies' P/S Mean For Shareholders?

Recent times have been advantageous for Sonim Technologies as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Sonim Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Sonim Technologies would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. The latest three year period has also seen an excellent 33% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 8.9% as estimated by the only analyst watching the company. That's not great when the rest of the industry is expected to grow by 6.1%.

In light of this, it's understandable that Sonim Technologies' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Sonim Technologies' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Sonim Technologies maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Sonim Technologies' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Sonim Technologies you should know about.

If these risks are making you reconsider your opinion on Sonim Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SONM

Sonim Technologies

Provides enterprise 5G solutions in the United States, Canada, Europe, the Middle East, and the Asia Pacific.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives