- United States

- /

- Tech Hardware

- /

- NasdaqCM:SONM

Lacklustre Performance Is Driving Sonim Technologies, Inc.'s (NASDAQ:SONM) 47% Price Drop

Sonim Technologies, Inc. (NASDAQ:SONM) shareholders that were waiting for something to happen have been dealt a blow with a 47% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

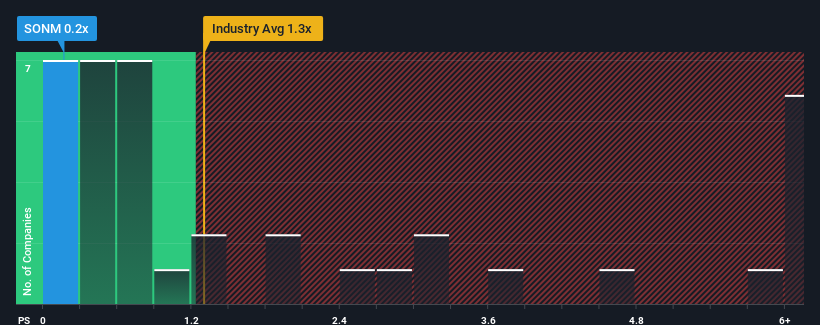

Since its price has dipped substantially, Sonim Technologies may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Tech industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Sonim Technologies

What Does Sonim Technologies' Recent Performance Look Like?

Sonim Technologies' revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sonim Technologies.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Sonim Technologies' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. The latest three year period has also seen an excellent 33% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 8.9% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to expand by 7.8%, which paints a poor picture.

With this information, we are not surprised that Sonim Technologies is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Sonim Technologies' P/S

Sonim Technologies' recently weak share price has pulled its P/S back below other Tech companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Sonim Technologies' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Sonim Technologies (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SONM

Sonim Technologies

Provides enterprise 5G solutions in the United States, Canada, Europe, the Middle East, and the Asia Pacific.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success