- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

What Super Micro Computer (SMCI)'s Turnkey Data Center Launch Means for Shareholders

- Earlier this month, Super Micro Computer, Inc. announced the launch of its Data Center Building Block Solutions® (DCBBS), a comprehensive new offering allowing organizations to design and order entire data centers, including AI servers, storage, networking, liquid cooling, and management software, from a single vendor. The company also expanded key partnerships, including with Hitachi Vantara, to further integrate advanced storage and AI compute capabilities for enterprise customers.

- This move positions Supermicro as a one-stop solution for high-density, energy-efficient AI infrastructure, aiming to simplify and accelerate data center deployments as demand for AI and analytics surges globally.

- We'll examine how Supermicro's expansion into turnkey data center solutions may reshape its investment narrative and growth opportunities.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Super Micro Computer Investment Narrative Recap

To be a Super Micro Computer shareholder, you need to believe the company can capture long-term growth from AI infrastructure buildouts and successfully scale its new data center platform, while managing competition and customer concentration risks. The recent launch of DCBBS makes Supermicro a more complete solutions provider, but the primary short-term catalyst remains delivery of next-generation AI server systems for major hyperscalers. This news does not materially alleviate the biggest risk, revenue and margin pressure should key customers pause spending or turn to rivals.

Among recent developments, the partnership with Hitachi Vantara stands out as especially relevant, aiming to strengthen Supermicro's reach and capabilities for enterprise AI workloads. This collaboration adds scale and diversification to Supermicro’s customer base, and could help offset segments where hardware commoditization and price competition remain intense.

However, before getting too confident, it’s worth understanding the risks if one or more top customers reduce orders...

Read the full narrative on Super Micro Computer (it's free!)

Super Micro Computer's outlook points to $48.2 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes a 29.9% annual revenue growth and a $1.4 billion increase in earnings from the current $1.0 billion level.

Uncover how Super Micro Computer's forecasts yield a $50.06 fair value, a 4% downside to its current price.

Exploring Other Perspectives

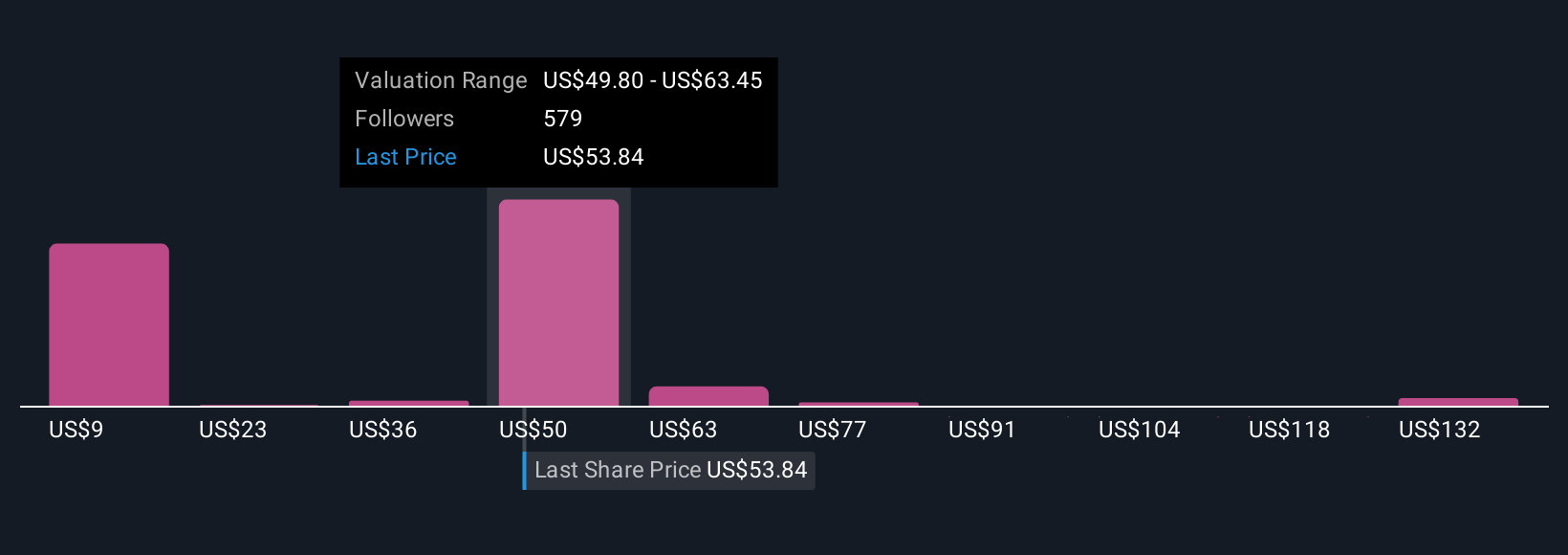

Simply Wall St Community members submitted 52 fair value estimates for Super Micro Computer ranging from US$26 to US$101.05 per share. While optimism about AI demand supports the company’s future, the risk of revenue volatility from customer concentration remains a key factor investors cannot ignore, see how several viewpoints address this in detail.

Explore 52 other fair value estimates on Super Micro Computer - why the stock might be worth as much as 94% more than the current price!

Build Your Own Super Micro Computer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Super Micro Computer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Micro Computer's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion