- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer Q2 2026 Margin Compression Tests Bullish Earnings Growth Narrative

Super Micro Computer's Q2 2026 Earnings Snapshot

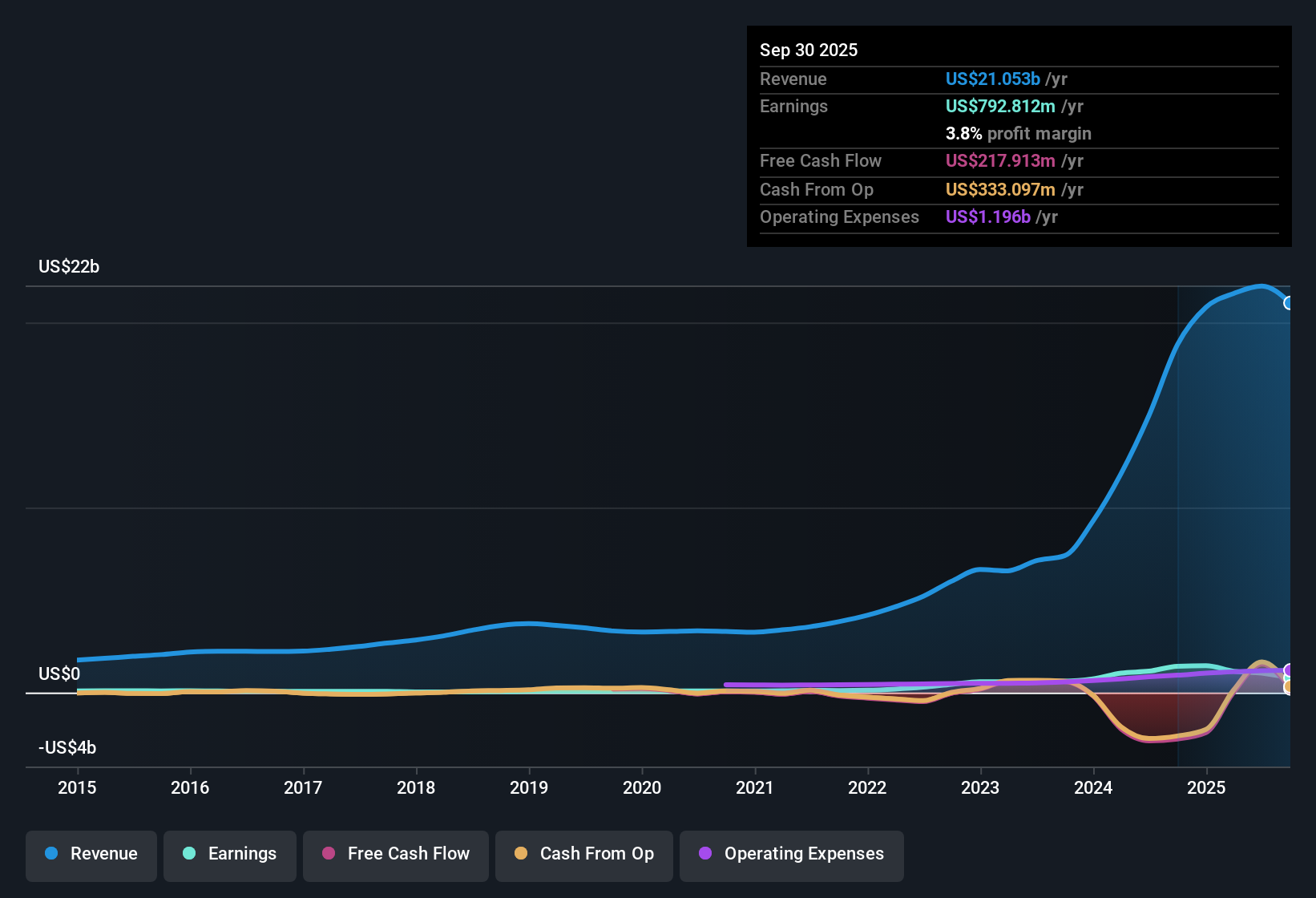

Super Micro Computer (SMCI) has put up another big quarter, with Q2 2026 revenue of about US$12.7b and basic EPS of US$0.67, alongside net income of US$400.6m. The company has seen revenue move from US$5.7b in Q2 2025 to US$12.7b in Q2 2026, while basic EPS shifted from US$0.54 to US$0.67 over the same period. This sets the stage for investors to weigh that top line expansion against a thinner net profit margin profile. With revenue growth expectations around 18.6% a year and earnings growth forecasts near 33% annually, the latest print provides a view of how much the current margin compression is shaping the risk reward trade off.

See our full analysis for Super Micro Computer.With the headline numbers on the table, the next step is to see how they line up with the strongest market narratives around Super Micro Computer, including the growth story, margin pressures, and what investors have been expecting going into this earnings season.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing Margins Compressed To 3.1%

- Over the last 12 months, Super Micro Computer converted US$28.1b of revenue into US$872.8m of net income, which equates to a 3.1% net profit margin compared with 6.9% a year earlier.

- Critics highlight that a 3.1% trailing margin leaves less room for error, and the data lines up with that concern by showing that, even as trailing 12 month basic EPS sits at US$1.46, profitability has been slimmer than the earlier 6.9% margin. As a result, any future cost pressure or pricing change would have a more visible impact on earnings.

Revenue Scale Jumps Above US$12b

- In Q2 2026, revenue was US$12.7b with net income of US$400.6m, compared with Q1 2026 revenue of US$5.0b and net income of US$168.3m. This highlights how much more volume is now flowing through the business at current margin levels.

- Supporters of a more optimistic view note that this higher revenue base sits alongside trailing 12 month revenue forecasts of 18.6% annual growth and about 33% expected annual earnings growth. If margins were to move closer to the earlier 6.9% level instead of the current 3.1%, that would provide additional support for the case that scale can translate into stronger earnings power over time.

P/E Of 23.6x And DCF Gap

- The shares trade on a P/E of 23.6x at a price of US$34.38, modestly above the Global Tech average of 21.8x but well below the 63x peer average, while a DCF fair value of US$42.17 sits roughly 18.5% above the current share price.

- From a positive valuation perspective, some investors point to the combination of strong historical earnings growth of about 39.3% per year over five years and modelled earnings growth around 33% annually. This growth track record, together with the P/E discount to peers and the DCF fair value sitting above the US$34.38 price, can be interpreted as linking the current valuation to a lower 3.1% margin in a business that has previously converted growth into earnings more efficiently.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Super Micro Computer's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SMCI's strong revenue base currently sits on relatively thin 3.1% margins, leaving less room for error if costs rise or pricing weakens.

If that tight margin profile makes you want more cushion in your portfolio, check out 82 resilient stocks with low risk scores to find companies where risk scores look more resilient.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion