- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:SCSC

Examining ScanSource, Inc.’s (NASDAQ:SCSC) Weak Return On Capital Employed

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

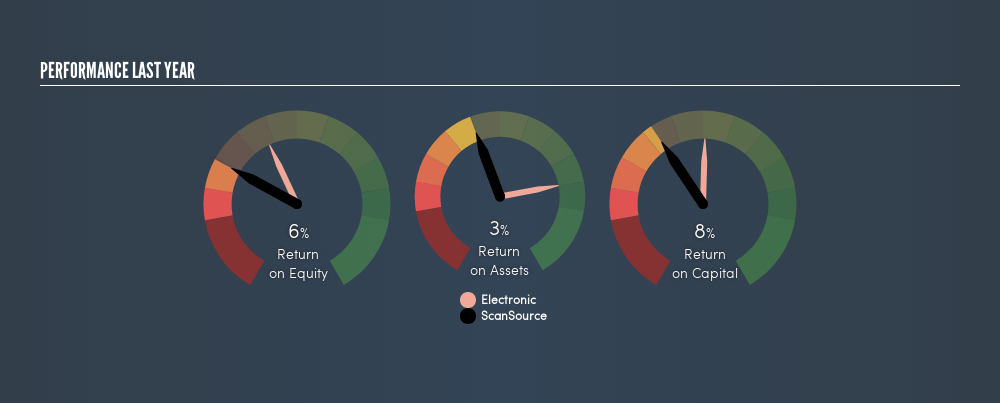

Today we'll evaluate ScanSource, Inc. (NASDAQ:SCSC) to determine whether it could have potential as an investment idea. Specifically, we'll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

First, we'll go over how we calculate ROCE. Then we'll compare its ROCE to similar companies. Finally, we'll look at how its current liabilities affect its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. In general, businesses with a higher ROCE are usually better quality. Ultimately, it is a useful but imperfect metric. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.'

So, How Do We Calculate ROCE?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for ScanSource:

0.08 = US$107m ÷ (US$2.1b - US$713m) (Based on the trailing twelve months to March 2019.)

Therefore, ScanSource has an ROCE of 8.0%.

See our latest analysis for ScanSource

Does ScanSource Have A Good ROCE?

When making comparisons between similar businesses, investors may find ROCE useful. We can see ScanSource's ROCE is meaningfully below the Electronic industry average of 12%. This performance is not ideal, as it suggests the company may not be deploying its capital as effectively as some competitors. Setting aside the industry comparison for now, ScanSource's ROCE is mediocre in absolute terms, considering the risk of investing in stocks versus the safety of a bank account. Readers may find more attractive investment prospects elsewhere.

We can see that , ScanSource currently has an ROCE of 8.0%, less than the 12% it reported 3 years ago. So investors might consider if it has had issues recently.

It is important to remember that ROCE shows past performance, and is not necessarily predictive. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. ROCE is, after all, simply a snap shot of a single year. What happens in the future is pretty important for investors, so we have prepared a free report on analyst forecasts for ScanSource.

How ScanSource's Current Liabilities Impact Its ROCE

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. Due to the way ROCE is calculated, a high level of current liabilities makes a company look as though it has less capital employed, and thus can (sometimes unfairly) boost the ROCE. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

ScanSource has total liabilities of US$713m and total assets of US$2.1b. As a result, its current liabilities are equal to approximately 35% of its total assets. ScanSource has a medium level of current liabilities, which would boost its ROCE somewhat.

Our Take On ScanSource's ROCE

With this level of liabilities and a mediocre ROCE, there are potentially better investments out there. You might be able to find a better investment than ScanSource. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SCSC

ScanSource

Engages in the distribution of technology products and solutions in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion