- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar (NASDAQ:SATS) Shareholders Booked A 15% Gain In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Low-cost index funds make it easy to achieve average market returns. But if you invest in individual stocks, some are likely to underperform. That's what has happened with the EchoStar Corporation (NASDAQ:SATS) share price. It's up 15% over three years, but that is below the market return. Disappointingly, the share price is down 3.2% in the last year.

See our latest analysis for EchoStar

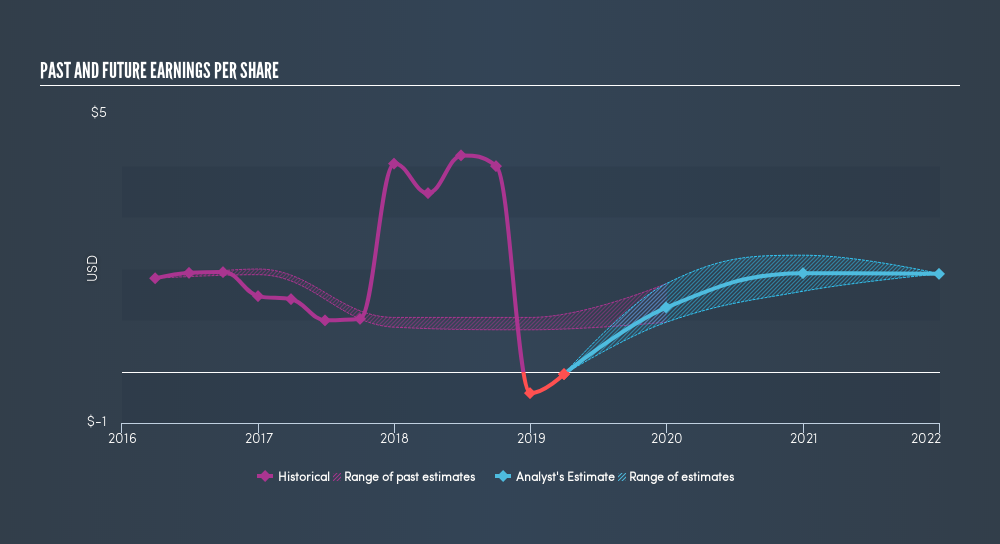

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

EchoStar was able to grow its EPS at 0.8% per year over three years, sending the share price higher. We note, however, that extraordinary items have impacted earnings. This EPS growth is lower than the 4.9% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of EchoStar's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 6.4% in the last year, EchoStar shareholders lost 3.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2.7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of EchoStar's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: EchoStar may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value low.

Similar Companies

Market Insights

Community Narratives