- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:SANM

Sanmina (SANM): Assessing Valuation Following Recent Share Price Stability

Reviewed by Kshitija Bhandaru

See our latest analysis for Sanmina.

Sanmina’s stock has seen a modest climb, with momentum gradually building as investors weigh its fundamentals and recent market shifts. Its latest 1-year total shareholder return is 0.75%, and longer-term holders have enjoyed steady gains. This reflects growing confidence in the company’s prospects.

If you’re curious which stocks could be gaining momentum next, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares holding near their recent highs and trading just below analyst targets, the key question is whether Sanmina is still undervalued, or if the market has already fully priced in expectations for future growth.

Most Popular Narrative: Fairly Valued

Sanmina closed at $116.74, almost matching the consensus fair value estimate of $119.50. This tight gap suggests the narrative aligns closely with the market’s current outlook.

Strategic investments in automation, digital transformation, and the shift toward full system integration (highlighted by the buildout of end-to-end solutions for data center AI, liquid cooling, advanced circuit boards, etc.) are already showing benefits in operational efficiencies and gross margin expansion. These improvements could compound over time and lift net margins.

Wondering what’s driving analysts to peg Sanmina’s valuation with laser precision? The narrative hinges on advanced tech adoption and a projected financial leap few expect. Uncover which forward-looking metrics and whose ambitions could make this price more than justified.

Result: Fair Value of $119.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Sanmina’s reliance on a handful of major customers, along with the execution challenges posed by its ambitious expansion, could quickly alter this fair value outlook.

Find out about the key risks to this Sanmina narrative.

Another View: Discounted Cash Flow Perspective

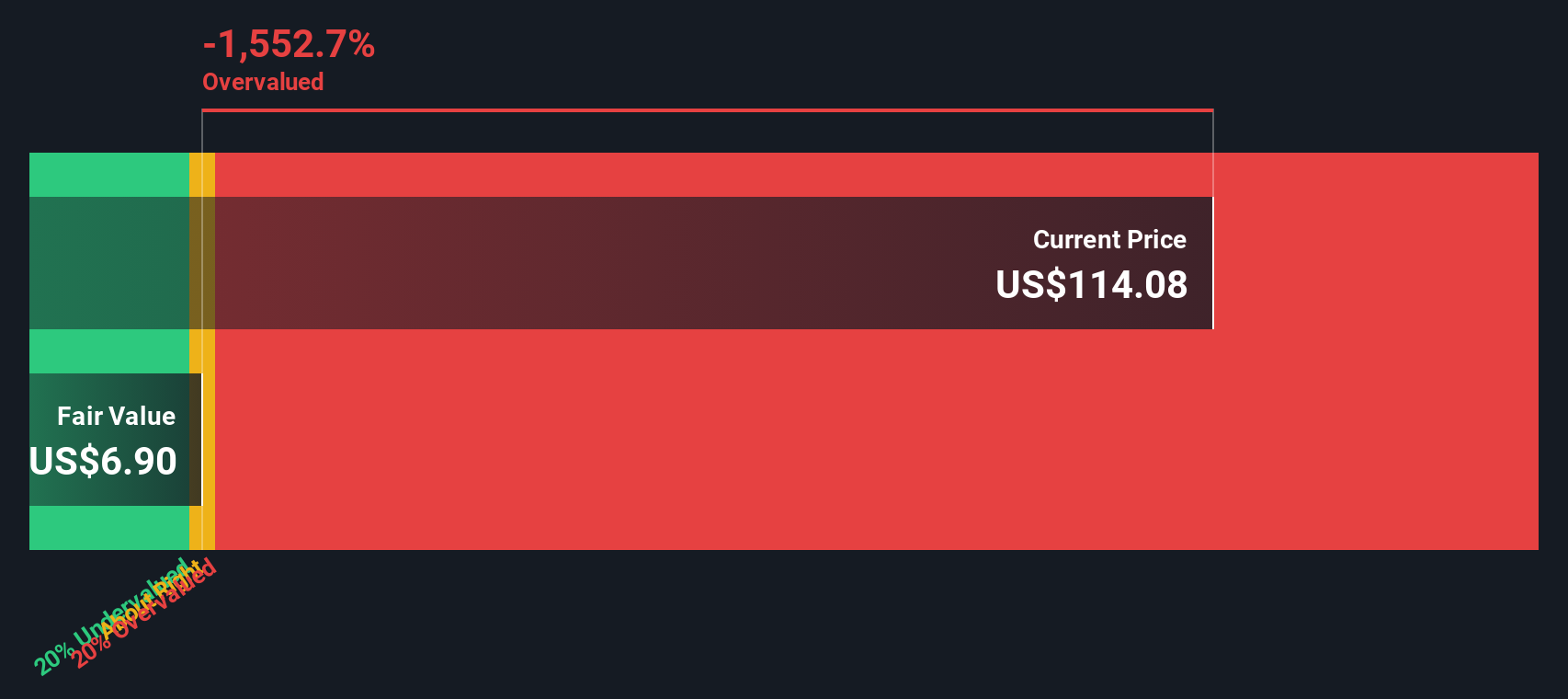

Looking at Sanmina through the SWS DCF model, a different story emerges. This approach suggests the shares are actually trading above their calculated fair value, which could signal potential overvaluation if future cash flows do not measure up. How confident should investors be that growth will keep justifying the current price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sanmina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sanmina Narrative

If you want to chart your own course, take a look at the numbers yourself and shape a unique perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sanmina.

Looking for more investment ideas?

Smart investors know the real edge comes from staying a step ahead. Get inspired by these opportunities and don’t let your next big winner pass you by.

- Tap into market innovation by uncovering these 24 AI penny stocks that are poised to benefit from the AI revolution and rapid advances in intelligent technology.

- Secure your portfolio with income potential by spotting these 19 dividend stocks with yields > 3% known for consistent payouts and yields above 3 percent.

- Ride the momentum in future finance and identify trends early by checking out these 78 cryptocurrency and blockchain stocks to capitalize on blockchain breakthroughs and digital assets growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANM

Sanmina

Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives