- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

This Analyst Just Downgraded Their Richardson Electronics, Ltd. (NASDAQ:RELL) EPS Forecasts

The analyst covering Richardson Electronics, Ltd. (NASDAQ:RELL) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

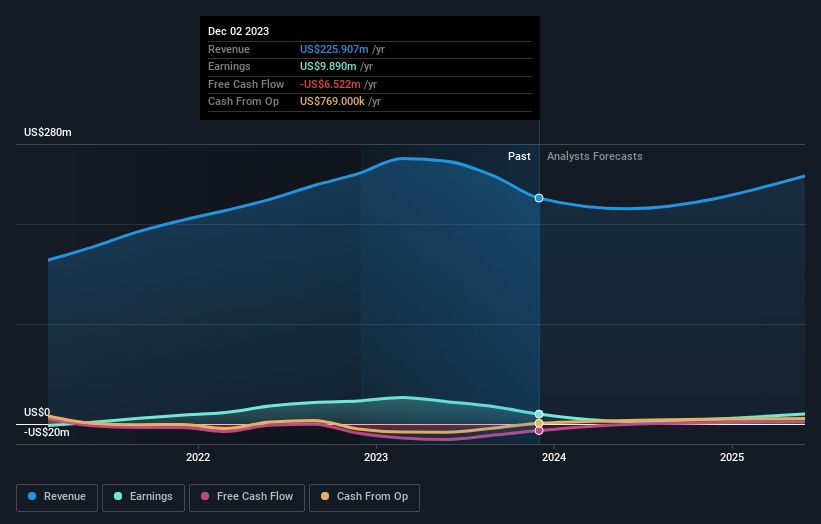

Following the downgrade, the consensus from single analyst covering Richardson Electronics is for revenues of US$215m in 2024, implying a measurable 4.7% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to dive 74% to US$0.18 in the same period. Previously, the analyst had been modelling revenues of US$240m and earnings per share (EPS) of US$0.31 in 2024. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a large cut to earnings per share numbers as well.

View our latest analysis for Richardson Electronics

The consensus price target fell 62% to US$10.00, with the weaker earnings outlook clearly leading analyst valuation estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 9.3% by the end of 2024. This indicates a significant reduction from annual growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.2% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Richardson Electronics is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Richardson Electronics.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Richardson Electronics going out as far as 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The NVIDIA Phenomenon

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion