- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Richardson Electronics (NASDAQ:RELL) Has Affirmed Its Dividend Of $0.06

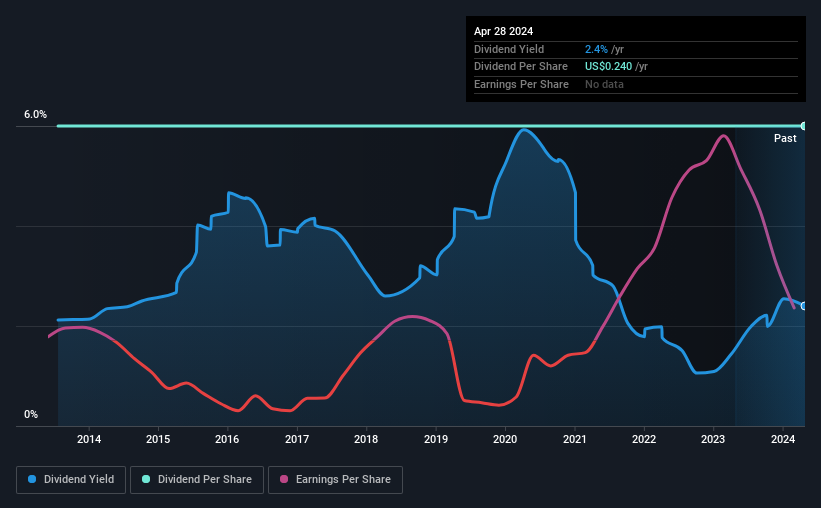

The board of Richardson Electronics, Ltd. (NASDAQ:RELL) has announced that it will pay a dividend on the 29th of May, with investors receiving $0.06 per share. The dividend yield will be 2.4% based on this payment which is still above the industry average.

Check out our latest analysis for Richardson Electronics

Richardson Electronics' Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, Richardson Electronics' dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. We think that this practice can make the dividend quite risky in the future.

Looking forward, earnings per share is forecast to rise by 71.0% over the next year. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 47% which would be quite comfortable going to take the dividend forward.

Richardson Electronics Has A Solid Track Record

The company has an extended history of paying stable dividends. The last annual payment of $0.24 was flat on the annual payment from10 years ago. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Richardson Electronics Might Find It Hard To Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. Richardson Electronics has impressed us by growing EPS at 38% per year over the past five years. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which Richardson Electronics hasn't been doing.

Our Thoughts On Richardson Electronics' Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Richardson Electronics' payments, as there could be some issues with sustaining them into the future. Although they have been consistent in the past, we think the payments are a little high to be sustained. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Richardson Electronics that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks