- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Not Many Are Piling Into Richardson Electronics, Ltd. (NASDAQ:RELL) Stock Yet As It Plummets 26%

Unfortunately for some shareholders, the Richardson Electronics, Ltd. (NASDAQ:RELL) share price has dived 26% in the last thirty days, prolonging recent pain. The last month has meant the stock is now only up 2.6% during the last year.

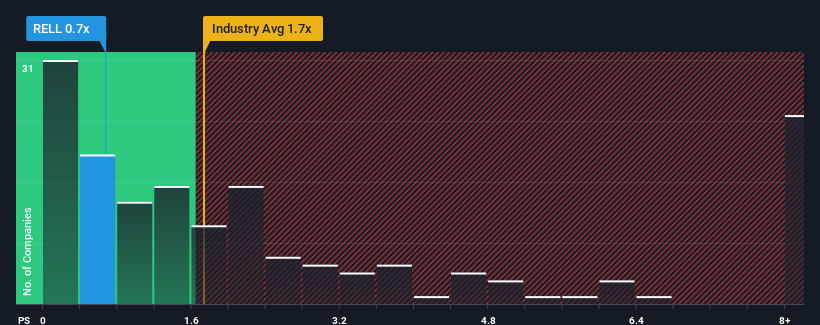

Even after such a large drop in price, Richardson Electronics' price-to-sales (or "P/S") ratio of 0.7x might still make it look like a buy right now compared to the Electronic industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Richardson Electronics

What Does Richardson Electronics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Richardson Electronics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Richardson Electronics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Richardson Electronics would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the two analysts following the company. With the industry predicted to deliver 11% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Richardson Electronics is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Richardson Electronics' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Richardson Electronics currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Richardson Electronics has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion